Il 941 X Form 2020

What is the Il 941 X Form

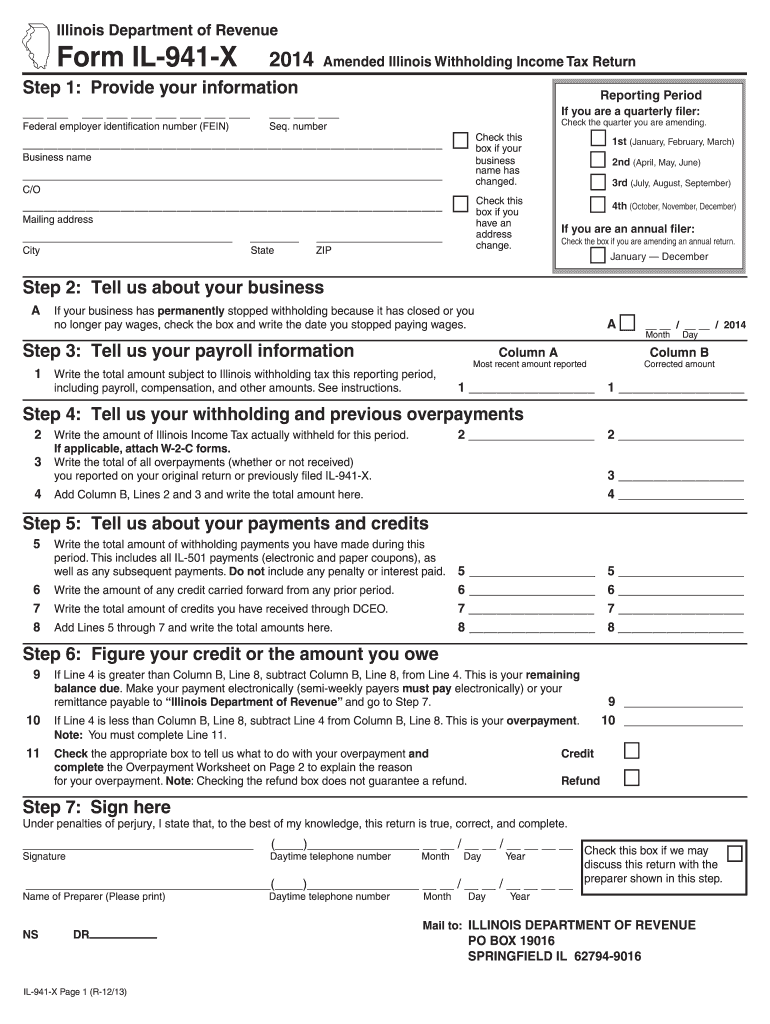

The Il 941 X Form is a tax form used by employers in the United States to amend previously filed quarterly payroll tax returns. Specifically, it allows employers to correct errors related to the IRS Form 941, which reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring accurate reporting and compliance with federal tax obligations.

How to use the Il 941 X Form

To use the Il 941 X Form, employers must first identify the specific errors in their previously submitted Form 941. Once identified, they can fill out the Il 941 X Form by providing the necessary corrections. It is crucial to include detailed explanations for each correction to avoid complications with the IRS. After completing the form, employers should submit it according to IRS guidelines, ensuring that all relevant information is accurate and complete.

Steps to complete the Il 941 X Form

Completing the Il 941 X Form involves several key steps:

- Review the original Form 941 to identify errors.

- Obtain the Il 941 X Form from the IRS website or authorized sources.

- Fill out the form, specifying the corrections needed, including any adjustments to wages, taxes withheld, and credits.

- Provide a clear explanation for each correction in the designated section.

- Sign and date the form to validate it.

- Submit the completed form to the IRS, either electronically or via mail, as per the guidelines.

Legal use of the Il 941 X Form

The Il 941 X Form is legally binding when completed and submitted according to IRS regulations. It must be signed by an authorized representative of the business, ensuring that the corrections made are truthful and accurate. Compliance with the legal requirements surrounding this form is essential to avoid penalties and ensure proper tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Il 941 X Form align with the regular deadlines for Form 941. Employers should file the Il 941 X Form as soon as they discover an error, ideally within three years of the original filing date. Timely submission helps minimize potential penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Il 941 X Form can be submitted to the IRS through various methods. Employers may choose to file electronically using approved e-filing software or submit a paper version by mail. It is important to follow the specific submission guidelines provided by the IRS, which may vary based on the employer's location and the method chosen.

Quick guide on how to complete 2014 il 941 x form

Effortlessly Prepare Il 941 X Form on Any Device

The management of online documents has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, enabling you to find the right form and store it securely online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without delay. Manage Il 941 X Form on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven process today.

How to Edit and Electronically Sign Il 941 X Form with Ease

- Locate Il 941 X Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

No more worries about lost or misplaced documents, endless form searches, or errors that necessitate printing new document copies. airSlate SignNow efficiently meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Il 941 X Form and ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 il 941 x form

Create this form in 5 minutes!

How to create an eSignature for the 2014 il 941 x form

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the Il 941 X Form?

The Il 941 X Form is a corrected version of the Illinois 941 form used for reporting state income taxes withheld from employee wages. It is essential for businesses to accurately report and amend any mistakes found in previous filings. Using the Il 941 X Form ensures compliance with state regulations and helps maintain up-to-date tax records.

-

How can airSlate SignNow help me with the Il 941 X Form?

airSlate SignNow enables businesses to easily eSign and send the Il 941 X Form digitally, streamlining the correction process. With our user-friendly interface, you can quickly fill out and submit the form without delays. Our platform ensures your documents are securely signed and ready for submission.

-

Is there a cost associated with using airSlate SignNow for the Il 941 X Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that can assist with completing and eSigning documents like the Il 941 X Form. Our cost-effective solutions are designed to benefit businesses of all sizes.

-

What features does airSlate SignNow offer for managing the Il 941 X Form?

airSlate SignNow offers features such as easy document creation, eSigning, and secure sharing that are perfect for managing the Il 941 X Form. Additionally, the platform allows users to track document status and integrate with other applications for seamless workflow management. These tools help simplify the filing process.

-

Can I integrate airSlate SignNow with other software for the Il 941 X Form?

Yes, airSlate SignNow supports integration with various software applications, making it easier to manage the Il 941 X Form. This allows users to connect with popular tools such as CRM systems, accounting software, and more. Such integrations enhance workflow efficiency and facilitate the correction process.

-

What are the benefits of using airSlate SignNow for the Il 941 X Form?

Using airSlate SignNow for the Il 941 X Form simplifies the process of eSigning and submitting your tax corrections. The platform not only saves time but also improves accuracy, reducing the likelihood of errors. Additionally, it provides secure storage for your documents, ensuring easy access when needed.

-

How long does it take to complete the Il 941 X Form using airSlate SignNow?

Completing the Il 941 X Form using airSlate SignNow is quick and efficient, often taking just a few minutes. With our intuitive interface, businesses can easily fill out the necessary information and add electronic signatures. This rapid turnaround helps meet deadlines without the hassle of manual paperwork.

Get more for Il 941 X Form

- How to print on pre printed checks form

- Nevada durable power of attorney effective immediately form

- Astm 2488 form

- Mutual of omaha living promise application form

- Wisconsin iid exemption form

- Lic 9163 form

- Nebraska birth certificate application pdf 5595904 form

- Form it 249claim for long term care insurance credit

Find out other Il 941 X Form

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure