Ptax 342 R Form 2018

What is the Ptax 342 R Form

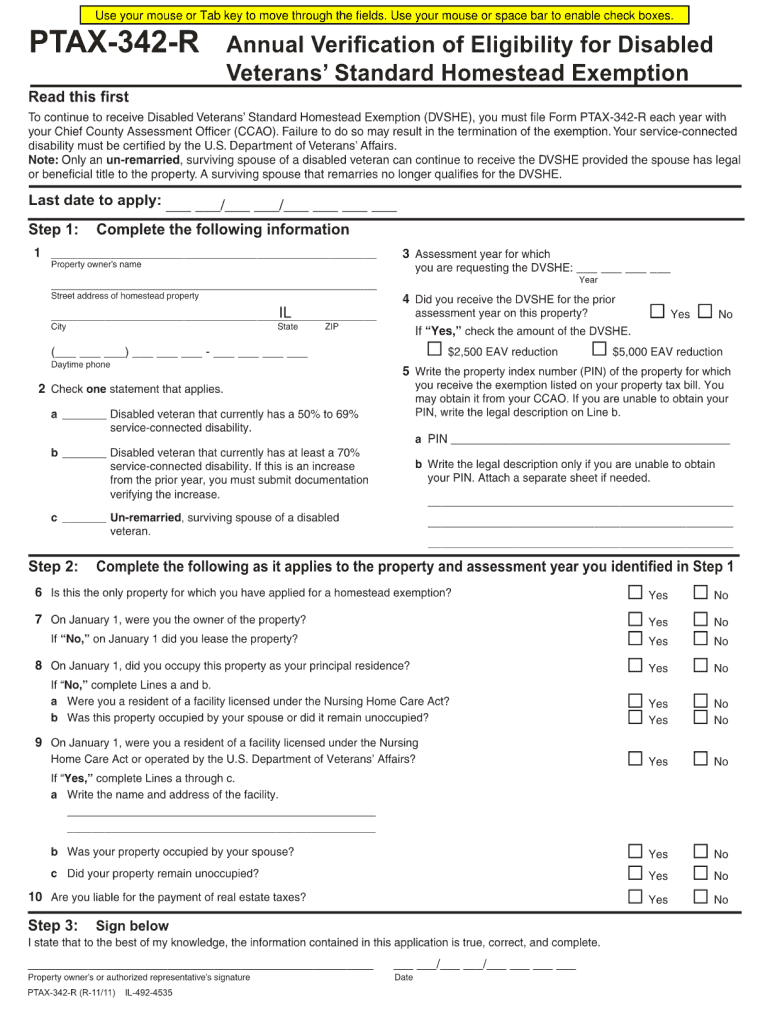

The Ptax 342 R Form is a specific document used in the state of Illinois for property tax assessment purposes. It is primarily utilized by property owners to report changes in property ownership or to claim exemptions. This form plays a crucial role in ensuring that property taxes are assessed accurately based on current ownership and property status. Understanding the Ptax 342 R Form is essential for homeowners and real estate professionals to navigate property tax obligations effectively.

How to use the Ptax 342 R Form

Using the Ptax 342 R Form involves several steps that ensure accurate completion and submission. First, gather all necessary information regarding the property, including ownership details and any applicable exemptions. Next, fill out the form with precise information, ensuring that all fields are completed. Once the form is filled out, review it for accuracy before submitting it to the appropriate local tax authority. This process helps to avoid delays and ensures compliance with local tax regulations.

Steps to complete the Ptax 342 R Form

Completing the Ptax 342 R Form requires careful attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the Ptax 342 R Form from the local tax authority or official website.

- Fill in property details, including the property address and owner information.

- Indicate any changes in ownership or exemptions that apply to the property.

- Review the completed form for any errors or omissions.

- Submit the form to the local tax office either online, by mail, or in person, as specified by local guidelines.

Legal use of the Ptax 342 R Form

The Ptax 342 R Form serves a legal purpose in the property tax assessment process. It is essential for property owners to use this form correctly to ensure compliance with state laws. Failure to submit the form or inaccuracies in the information provided can lead to penalties or issues with property tax assessments. Therefore, understanding the legal implications of the Ptax 342 R Form is vital for property owners to maintain their rights and responsibilities regarding property taxes.

Key elements of the Ptax 342 R Form

Several key elements must be included when filling out the Ptax 342 R Form. These elements typically include:

- Property identification details, such as the parcel number and address.

- Owner's name and contact information.

- Details of any changes in ownership, such as sale or transfer dates.

- Information regarding any exemptions being claimed.

Including all required information ensures that the form is processed efficiently and accurately by the local tax authority.

Form Submission Methods

The Ptax 342 R Form can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing the completed form to the designated tax office.

- Delivering the form in person to the local tax office during business hours.

Choosing the appropriate submission method is essential for ensuring timely processing of the form.

Quick guide on how to complete ptax 342 r 2011 form

Effortlessly prepare Ptax 342 R Form on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without complications. Manage Ptax 342 R Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and electronically sign Ptax 342 R Form with ease

- Obtain Ptax 342 R Form and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ptax 342 R Form and maintain excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 342 r 2011 form

Create this form in 5 minutes!

How to create an eSignature for the ptax 342 r 2011 form

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Ptax 342 R Form and why is it important?

The Ptax 342 R Form is a tax form required for property tax assessment in certain regions. Completing this form accurately is crucial as it affects your property tax obligations. Using airSlate SignNow ensures that you can eSign and submit the Ptax 342 R Form easily and securely.

-

How does airSlate SignNow simplify the process of completing the Ptax 342 R Form?

airSlate SignNow simplifies the Ptax 342 R Form process by providing an intuitive interface for document management and eSigning. With features like templates and real-time collaboration, users can streamline the completion and submission of the form. This efficiency reduces the chance of errors and ensures timely filing.

-

Is there a cost associated with using airSlate SignNow for the Ptax 342 R Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, ensuring a cost-effective solution for handling the Ptax 342 R Form. Users can choose plans based on their volume of documents and features desired. Additionally, the cost savings on printing and mailing can often offset the subscription fees.

-

Can I integrate airSlate SignNow with other applications while handling the Ptax 342 R Form?

Absolutely! airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office. This functionality allows you to efficiently manage and send the Ptax 342 R Form directly from your preferred platforms, enhancing your workflow.

-

What are the security features of airSlate SignNow when handling the Ptax 342 R Form?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Ptax 342 R Form. The platform utilizes advanced encryption protocols and offers secure cloud storage to protect your information. Additionally, user access controls ensure that only authorized personnel can view or complete the form.

-

How quickly can I get started with airSlate SignNow for the Ptax 342 R Form?

Getting started with airSlate SignNow for the Ptax 342 R Form is quick and easy. After signing up for an account, you can access templates and begin eSigning within minutes. The user-friendly interface makes it simple to get up and running without any technical expertise.

-

What features does airSlate SignNow offer for tracking the Ptax 342 R Form?

airSlate SignNow provides robust tracking features for the Ptax 342 R Form, allowing users to monitor the status of their submissions in real-time. You can receive notifications once the form is viewed, signed, or completed, ensuring that you remain updated on its progress. This feature improves accountability and reduces follow-up inquiries.

Get more for Ptax 342 R Form

Find out other Ptax 342 R Form

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online