K 41 Form 2020

What is the K 41 Form

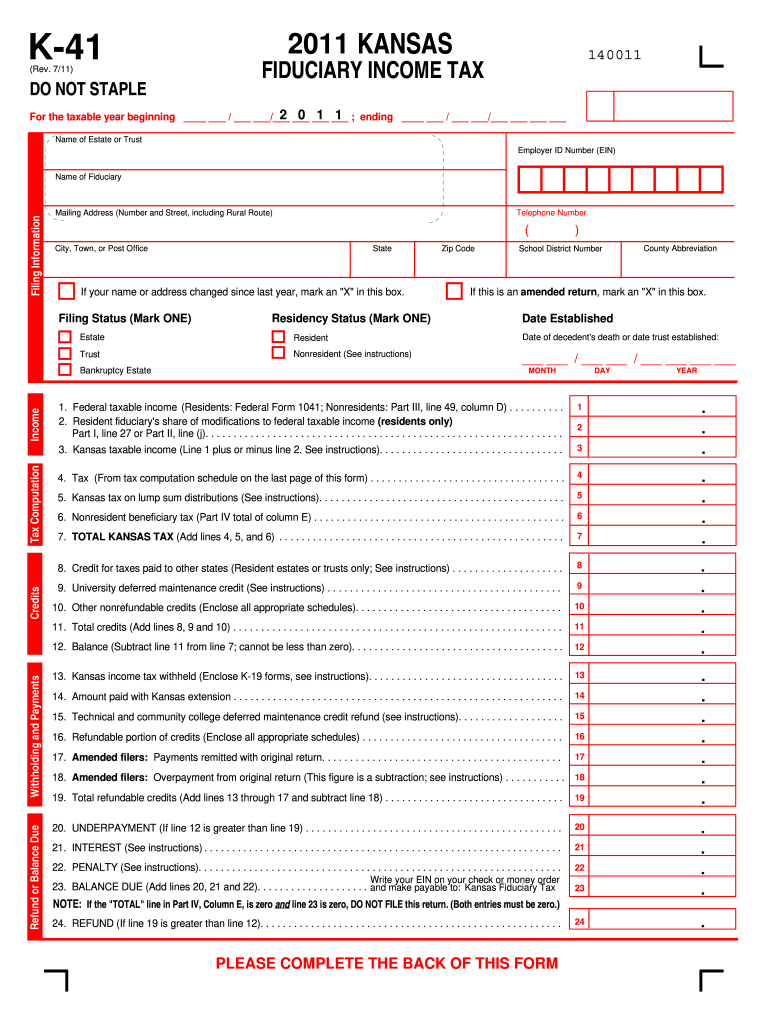

The K 41 Form is a specific tax-related document used primarily in the United States. It is often utilized for reporting certain types of income or deductions, depending on the context in which it is applied. This form is essential for individuals or businesses that need to comply with federal or state tax regulations. Understanding the purpose and requirements of the K 41 Form is crucial for accurate tax reporting and compliance.

How to use the K 41 Form

Using the K 41 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents and information relevant to your income or deductions. Next, fill out the form carefully, ensuring that all sections are completed according to the guidelines provided. Once completed, review the form for any errors or omissions. Finally, submit the form through the appropriate channels, whether online or via mail, to ensure it is received by the relevant tax authority.

Steps to complete the K 41 Form

Completing the K 41 Form requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents.

- Read the instructions carefully to understand each section of the form.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Input the required financial data, ensuring accuracy in reporting income and deductions.

- Review the form thoroughly for any mistakes or missing information.

- Sign and date the form before submission.

Legal use of the K 41 Form

The K 41 Form holds legal significance in tax reporting. To be considered valid, it must be completed accurately and submitted within the designated time frame. Compliance with federal and state tax laws is essential to avoid penalties. Additionally, the form may require specific signatures or certifications to ensure its legality. Understanding the legal implications of the K 41 Form is vital for individuals and businesses to maintain compliance and avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the K 41 Form can vary based on individual circumstances and tax regulations. It is crucial to be aware of these dates to avoid late penalties. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for individual taxpayers. However, specific deadlines may apply for businesses or different tax situations. Keeping track of these important dates ensures timely compliance with tax obligations.

Required Documents

To complete the K 41 Form accurately, certain documents are typically required. These may include:

- Previous year’s tax return for reference.

- W-2 forms or 1099 forms to report income.

- Receipts or documentation for any deductions claimed.

- Identification documents, such as a Social Security number or taxpayer identification number.

Having these documents ready will facilitate a smoother completion process for the K 41 Form.

Who Issues the Form

The K 41 Form is issued by the relevant tax authority, which may vary depending on the specific context in which the form is used. In most cases, this will be a state or federal tax agency responsible for tax collection and regulation. Understanding the issuing authority is important for ensuring that the form is completed and submitted correctly according to the applicable guidelines.

Quick guide on how to complete k 41 form 2011

Easily create K 41 Form on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without delays. Handle K 41 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign K 41 Form effortlessly

- Find K 41 Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or hide sensitive information with features offered specifically by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require reprinting document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign K 41 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 41 form 2011

Create this form in 5 minutes!

How to create an eSignature for the k 41 form 2011

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

The way to create an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the K 41 Form and how is it used?

The K 41 Form is a tax document used for reporting income and deductions for specific types of taxation. It facilitates compliance with tax regulations and ensures accurate reporting, making it essential for businesses managing their finances. Understanding how to correctly utilize the K 41 Form can signNowly impact your tax obligations and overall financial health.

-

How can airSlate SignNow help with the K 41 Form?

airSlate SignNow offers a seamless solution for electronically signing and sending the K 41 Form. With our intuitive interface, users can quickly complete and securely eSign the document without the hassle of physical paperwork. This boosts efficiency and ensures compliance with legal requirements for electronic signatures.

-

What features does airSlate SignNow offer for managing K 41 Forms?

airSlate SignNow includes features such as document templates, automated workflows, and real-time tracking for managing K 41 Forms. These functionalities allow users to streamline their document processes and customize forms for their specific business needs. Plus, the secure storage ensures your documents are safe and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the K 41 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business requirements. Each plan provides access to features necessary for managing the K 41 Form efficiently. By choosing the right plan, you can ensure cost-effectiveness while benefiting from advanced eSignature capabilities.

-

Can I integrate airSlate SignNow with other applications while handling the K 41 Form?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications such as CRM systems and document management tools. This allows users to efficiently manage their workflows related to the K 41 Form and enhances workflow automation across their existing software ecosystem.

-

What are the benefits of using airSlate SignNow for the K 41 Form?

Using airSlate SignNow for the K 41 Form provides numerous benefits, including speed, security, and ease of use. Businesses can quickly prepare, sign, and send documents, reducing turnaround time signNowly. Enhanced security measures also protect sensitive information, ensuring compliance with regulations.

-

How does electronic signing of the K 41 Form work?

Electronic signing of the K 41 Form with airSlate SignNow is simple and legal. Users can upload the form, add eSignature fields, and send it to recipients for signing. Once signed, the completed document is securely stored and can be easily shared or retrieved when needed.

Get more for K 41 Form

Find out other K 41 Form

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy