Kentucky 740 Es Form 2020

What is the Kentucky 740 Es Form

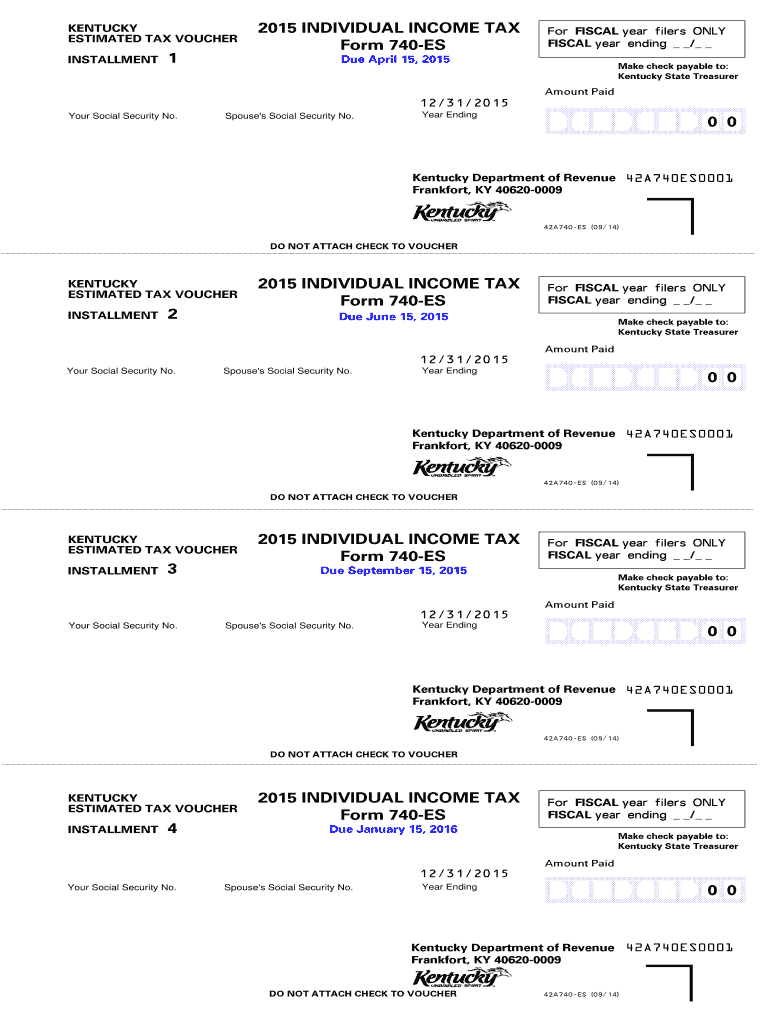

The Kentucky 740 Es Form is a state tax form used by individuals to make estimated income tax payments to the Kentucky Department of Revenue. This form is essential for taxpayers who expect to owe tax of $500 or more when filing their annual return. It allows individuals to pay their estimated tax in four installments throughout the year, helping to avoid penalties and interest for underpayment.

How to use the Kentucky 740 Es Form

To use the Kentucky 740 Es Form, taxpayers need to calculate their estimated tax liability based on their expected income for the year. This involves determining the total income, applicable deductions, and tax credits. Once the estimated tax amount is calculated, taxpayers can fill out the form with their personal information, including name, address, and Social Security number, and indicate the payment amounts for each quarter. It is important to keep track of payment deadlines to ensure compliance and avoid penalties.

Steps to complete the Kentucky 740 Es Form

Completing the Kentucky 740 Es Form involves several steps:

- Calculate your estimated tax: Use your previous year's tax return as a guide and adjust for any changes in income or deductions.

- Fill out the form: Provide your personal information and input the estimated tax amounts for each quarter.

- Review your calculations: Double-check your figures to ensure accuracy before submitting.

- Submit the form: Send the completed form along with your payment to the Kentucky Department of Revenue by the specified deadlines.

Legal use of the Kentucky 740 Es Form

The Kentucky 740 Es Form is legally recognized as a valid method for making estimated tax payments. It is important to adhere to the guidelines set forth by the Kentucky Department of Revenue to ensure that the payments are credited appropriately. Failure to use this form correctly may result in penalties for underpayment, so understanding the legal implications is crucial for all taxpayers.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Kentucky 740 Es Form to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. Keeping a calendar of these dates can help ensure timely payments and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky 740 Es Form can be submitted through various methods. Taxpayers have the option to file online, which is often the most convenient and efficient method. Alternatively, the form can be mailed to the Kentucky Department of Revenue or submitted in person at designated offices. Each method has its own processing times, so it is advisable to choose the one that best fits your needs and timeline.

Key elements of the Kentucky 740 Es Form

Key elements of the Kentucky 740 Es Form include the taxpayer's personal information, estimated tax liability, and payment schedule. The form requires detailed calculations of expected income, deductions, and credits to arrive at an accurate estimated tax amount. Additionally, it includes sections for indicating the payment amounts for each quarter, ensuring that taxpayers can manage their tax obligations effectively throughout the year.

Quick guide on how to complete 2015 kentucky 740 es form

Complete Kentucky 740 Es Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, amend, and eSign your documents quickly without delays. Manage Kentucky 740 Es Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to adjust and eSign Kentucky 740 Es Form with ease

- Obtain Kentucky 740 Es Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or black out sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign Kentucky 740 Es Form while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 kentucky 740 es form

Create this form in 5 minutes!

How to create an eSignature for the 2015 kentucky 740 es form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the Kentucky 740 Es Form and why is it important?

The Kentucky 740 Es Form is a vital document used for making estimated income tax payments in the state of Kentucky. It allows taxpayers to report their estimated tax liability and ensure compliance with state tax regulations. Understanding this form is crucial for managing your tax obligations effectively.

-

How does airSlate SignNow streamline the process of submitting the Kentucky 740 Es Form?

airSlate SignNow simplifies the submission of the Kentucky 740 Es Form by providing an intuitive platform for eSigning and sending documents securely. With streamlined workflows, you can complete and submit your form quickly, which minimizes the risk of errors and delays in tax payments.

-

What are the pricing plans available for using airSlate SignNow for the Kentucky 740 Es Form?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including options for both individuals and enterprises. Each plan includes features that efficiently support the completion and submission of the Kentucky 740 Es Form. Exploring the pricing page will give you a detailed breakdown of all available options.

-

Can I integrate airSlate SignNow with other tools for managing the Kentucky 740 Es Form?

Yes, airSlate SignNow offers integrations with multiple tools and platforms that can enhance your experience with the Kentucky 740 Es Form. Whether you use accounting software or document management systems, these integrations will help you maintain an organized workflow and ensure seamless completion of your tax forms.

-

What are the key benefits of using airSlate SignNow for the Kentucky 740 Es Form?

Using airSlate SignNow for the Kentucky 740 Es Form provides several benefits, including enhanced efficiency, secure document transfers, and legally-binding eSignatures. The user-friendly interface allows you to complete tax forms quickly, helping you stay on top of your tax responsibilities with minimal hassle.

-

Is it safe to eSign the Kentucky 740 Es Form using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard security protocols to protect your sensitive information while eSigning the Kentucky 740 Es Form. With robust encryption and compliance with legal standards, you can trust that your data will remain secure throughout the entire signing process.

-

How can I ensure my Kentucky 740 Es Form submissions are accurate?

To ensure the accuracy of your Kentucky 740 Es Form submissions, it’s essential to double-check all entries before signing. airSlate SignNow allows you to review documents thoroughly, and its collaborative features enable you to work with tax professionals for additional support and verification, ensuring everything is in order.

Get more for Kentucky 740 Es Form

Find out other Kentucky 740 Es Form

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer