Kentucky Form 720s 2019

What is the Kentucky Form 720s

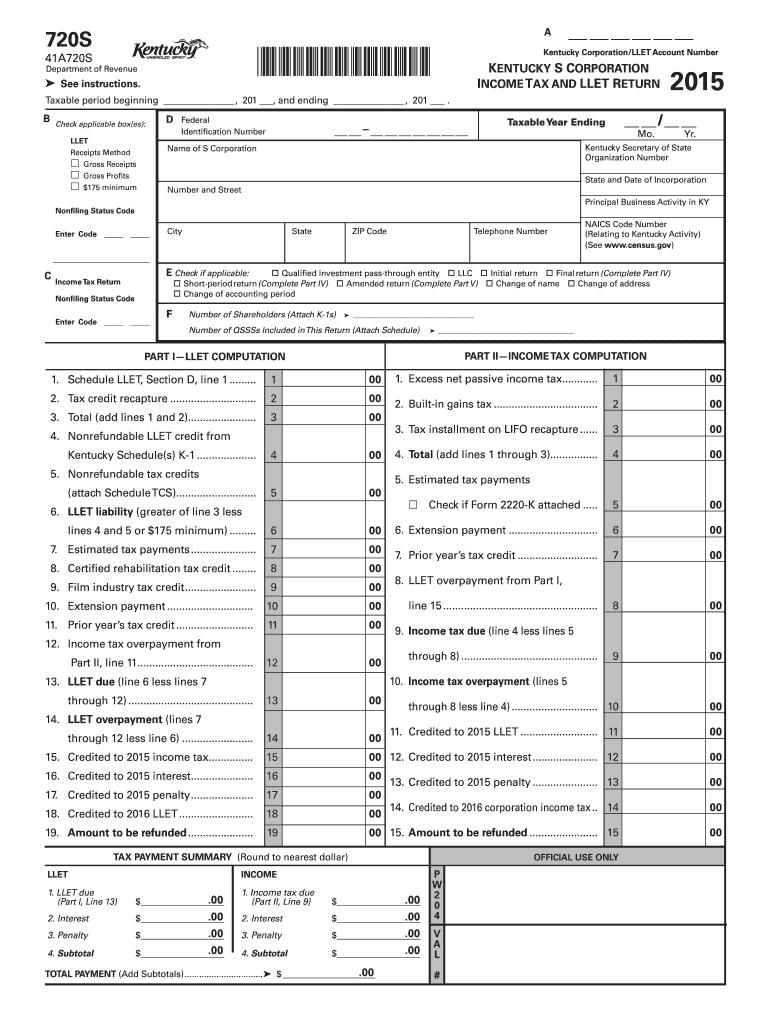

The Kentucky Form 720s is a state-specific tax form used by corporations and limited liability companies (LLCs) to report their income and calculate their tax liability in Kentucky. This form is essential for businesses operating within the state, as it helps ensure compliance with state tax laws. The form collects information about the entity's income, deductions, and credits, which are crucial for determining the amount of tax owed to the state. Understanding the purpose and requirements of the Kentucky Form 720s is vital for any business entity looking to fulfill its tax obligations accurately.

How to use the Kentucky Form 720s

Using the Kentucky Form 720s involves several key steps that ensure accurate reporting of your business's financial activities. First, gather all necessary financial documents, including income statements and records of deductions. Next, fill out the form by entering the required information in the designated sections, such as total income, deductions, and credits. It is important to review the completed form for accuracy before submission. Finally, submit the form to the Kentucky Department of Revenue by the specified deadline, ensuring that all required signatures are included. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form electronically.

Steps to complete the Kentucky Form 720s

Completing the Kentucky Form 720s requires careful attention to detail. Here are the essential steps:

- Collect financial records, including income statements, expense reports, and previous tax returns.

- Download the Kentucky Form 720s from the official state website or access it through a digital platform.

- Fill in the entity's name, address, and identification number at the top of the form.

- Report total income in the appropriate section, ensuring all sources of income are included.

- List any allowable deductions and credits, following the guidelines provided in the form instructions.

- Calculate the total tax liability based on the provided rates and tables.

- Review the completed form for accuracy and completeness before signing it.

- Submit the form electronically or by mail, adhering to the filing deadlines set by the state.

Legal use of the Kentucky Form 720s

The Kentucky Form 720s must be used in compliance with state tax laws to ensure its legal standing. This includes accurately reporting all income and deductions, as well as adhering to the filing deadlines established by the Kentucky Department of Revenue. Failure to comply with these regulations can result in penalties or interest on unpaid taxes. It is essential for businesses to maintain accurate records and utilize the form correctly to avoid legal complications. Additionally, utilizing a secure electronic signature solution can further enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Form 720s are crucial for maintaining compliance with state tax regulations. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Entities may also request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates helps ensure timely filing and payment.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky Form 720s can be submitted through various methods, providing flexibility for businesses. Electronic submission is encouraged as it allows for quicker processing and confirmation of receipt. Businesses can submit the form online through the Kentucky Department of Revenue's e-filing system. Alternatively, the form can be mailed to the appropriate address listed in the instructions, ensuring it is postmarked by the filing deadline. In-person submissions are also accepted at designated state offices, although this method may require more time and resources. Each submission method has its advantages, and businesses should choose the one that best fits their needs.

Quick guide on how to complete 2015 kentucky form 720s

Complete Kentucky Form 720s effortlessly on any gadget

Online document administration has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Kentucky Form 720s on any device with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The simplest method to alter and electronically sign Kentucky Form 720s with ease

- Locate Kentucky Form 720s and then click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes a matter of seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or the need to print new copies due to errors. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Kentucky Form 720s and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 kentucky form 720s

Create this form in 5 minutes!

How to create an eSignature for the 2015 kentucky form 720s

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is Kentucky Form 720s and why is it important?

Kentucky Form 720s is a crucial tax form designed for pass-through entities to report their income and determine tax liabilities in the state of Kentucky. Properly filing this form ensures compliance with state regulations and avoids potential penalties.

-

How can airSlate SignNow assist with Kentucky Form 720s?

airSlate SignNow provides an efficient platform to easily create, send, and eSign Kentucky Form 720s. Our user-friendly interface ensures that you can fill out and submit your forms accurately, helping streamline your tax filing process.

-

What are the costs associated with using airSlate SignNow for tax forms like Kentucky Form 720s?

airSlate SignNow offers cost-effective pricing plans that cater to different user needs, allowing businesses to manage forms such as Kentucky Form 720s without breaking the budget. Visit our pricing page for detailed information on available plans and features.

-

Are there any specific features in airSlate SignNow for preparing Kentucky Form 720s?

Yes, airSlate SignNow includes features specifically designed to simplify the preparation of Kentucky Form 720s, such as customizable templates, collaborative editing, and guided workflows. These features help ensure accuracy in your tax filing process.

-

Is it easy to eSign Kentucky Form 720s using airSlate SignNow?

Absolutely! airSlate SignNow makes it simple to eSign Kentucky Form 720s with just a few clicks. Our platform supports electronic signatures that are legally binding, ensuring your documents are signed quickly and securely.

-

Can I integrate airSlate SignNow with other software for filing Kentucky Form 720s?

Yes, airSlate SignNow seamlessly integrates with various software applications, enabling you to effortlessly manage your documents and filing processes for Kentucky Form 720s. Integrations with accounting software enhance efficiency and reduce the possibility of errors.

-

What benefits does airSlate SignNow provide for handling Kentucky Form 720s?

Using airSlate SignNow for handling Kentucky Form 720s offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing your document management, you can focus on your business rather than administrative tasks.

Get more for Kentucky Form 720s

Find out other Kentucky Form 720s

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free