Form Estimated 2021

What is the Form Estimated

The Form Estimated is a crucial document used primarily for tax purposes in the United States. It allows taxpayers to report their estimated tax liabilities for the year. This form is particularly important for individuals who have income that is not subject to withholding, such as self-employed individuals, freelancers, and investors. By submitting this form, taxpayers can ensure they meet their tax obligations and avoid potential penalties for underpayment.

How to use the Form Estimated

Using the Form Estimated involves several key steps. First, gather all necessary financial information, including income sources and deductions. Next, calculate your estimated tax liability based on your expected income for the year. Once you have this information, fill out the form accurately, ensuring all sections are completed. Finally, submit the form according to the guidelines provided by the IRS, either online or via mail, to ensure timely processing.

Steps to complete the Form Estimated

Completing the Form Estimated requires careful attention to detail. Start by entering your personal information, including your name and Social Security number. Then, provide details about your expected income, including wages, dividends, and any other sources. Calculate your estimated tax based on the current tax rates, considering any applicable deductions or credits. Review your entries for accuracy before submitting the form to avoid delays or issues with the IRS.

Legal use of the Form Estimated

The legal use of the Form Estimated is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately. It is essential to adhere to the deadlines set by the IRS to avoid penalties. Additionally, the form must be signed and dated to confirm that the information provided is truthful and complete. Compliance with these legal requirements ensures that your estimated tax payments are recognized and processed by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form Estimated are critical for compliance. Generally, taxpayers must submit estimated tax payments quarterly, with specific due dates throughout the year. These dates typically fall on April 15, June 15, September 15, and January 15 of the following year. It is important to mark these dates on your calendar to ensure that you submit your payments on time and avoid any late fees or penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Form Estimated. These guidelines outline the eligibility criteria, required documentation, and calculation methods for estimated taxes. It is advisable to review these guidelines thoroughly to ensure compliance and accuracy. The IRS website offers resources and tools to assist taxpayers in understanding their obligations and completing the form correctly.

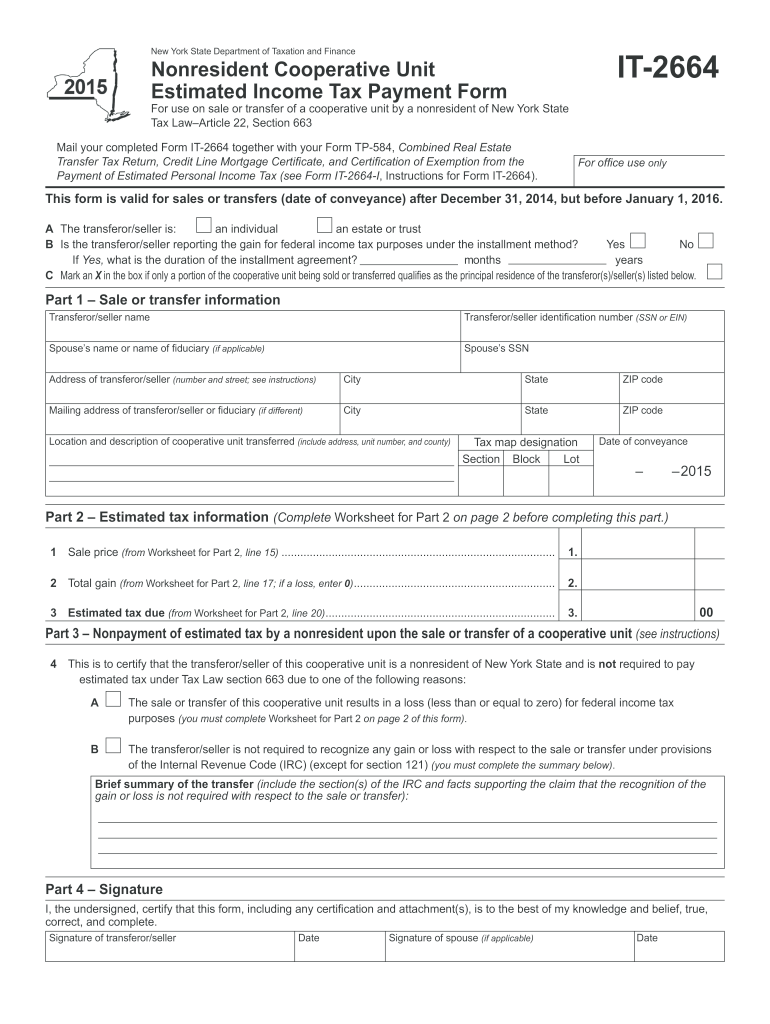

Quick guide on how to complete 2015 form estimated

Set up Form Estimated effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your files quickly without delays. Manage Form Estimated on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form Estimated with ease

- Locate Form Estimated and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choosing. Modify and eSign Form Estimated and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form estimated

Create this form in 5 minutes!

How to create an eSignature for the 2015 form estimated

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a Form Estimated in airSlate SignNow?

A Form Estimated in airSlate SignNow refers to the process of evaluating and completing forms electronically with streamlined eSignature capabilities. This allows businesses to save time and reduce errors by automating their document workflows.

-

How does airSlate SignNow handle pricing for Form Estimated services?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. Each plan provides access to features for managing Form Estimated documents, enabling users to choose a solution that fits their budget and requirements.

-

What features can I expect for Form Estimated applications?

Form Estimated applications in airSlate SignNow come with essential features like customizable templates, the ability to collect payments, automated reminders, and real-time status updates. These functionalities help businesses enhance their document management processes.

-

How can airSlate SignNow benefit my business with Form Estimated documents?

By using airSlate SignNow for Form Estimated documents, your business can improve efficiency and turnaround times. The platform minimizes the need for physical paperwork and accelerates the eSigning process, which enhances overall productivity.

-

Is airSlate SignNow compatible with other tools for handling Form Estimated documents?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, including CRMs and cloud storage services. This compatibility allows you to manage Form Estimated documents alongside your existing software ecosystem.

-

Can I customize my Form Estimated templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize Form Estimated templates to fit their specific needs. You can add branding elements, adjust fields, and create unique workflows that align with your organization's processes.

-

What security measures are in place for Form Estimated documents?

airSlate SignNow prioritizes the security of Form Estimated documents by employing advanced encryption protocols and compliance with industry standards. These measures ensure that your data remains protected during the eSigning process.

Get more for Form Estimated

Find out other Form Estimated

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation