Form Ct3 Instructions 2020

What is the Form Ct3 Instructions

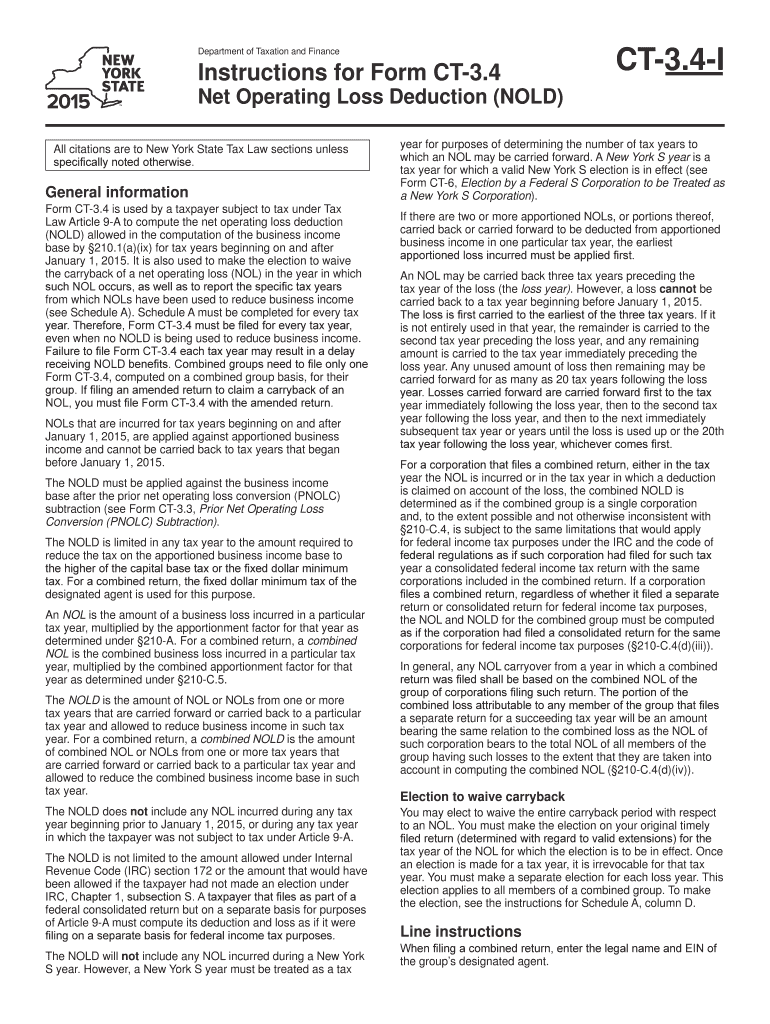

The Form Ct3 Instructions provide guidance for completing the New York City Corporate Tax Return. This form is essential for corporations operating within the city, as it outlines the necessary steps and requirements for accurate tax reporting. Understanding these instructions is crucial for compliance with local tax laws and regulations.

Steps to complete the Form Ct3 Instructions

Completing the Form Ct3 requires careful attention to detail. Here are the key steps to follow:

- Gather all necessary financial documents, including income statements and balance sheets.

- Review the specific sections of the Form Ct3 to understand what information is required.

- Fill out the form accurately, ensuring that all figures are correct and correspond to your financial records.

- Double-check for any required signatures and dates before submission.

- Submit the completed form by the deadline, either online or via mail, as per the guidelines.

How to obtain the Form Ct3 Instructions

The Form Ct3 Instructions can be obtained directly from the New York City Department of Finance website. It is available for download in PDF format, allowing businesses to access the latest version easily. Ensure that you are using the most current instructions to avoid any compliance issues.

Legal use of the Form Ct3 Instructions

Using the Form Ct3 Instructions legally involves adhering to the guidelines set forth by the New York City tax authorities. This includes accurately reporting income, deductions, and any applicable credits. Failure to comply with these instructions may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Timely filing of the Form Ct3 is crucial to avoid penalties. The standard deadline for submitting this form is typically the fifteenth day of the fourth month following the end of the corporation's fiscal year. However, corporations may apply for extensions if necessary, but they must still pay any taxes owed by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting the Form Ct3. The form can be filed online through the New York City Department of Finance's e-filing system, which is often the most efficient method. Alternatively, businesses may choose to mail the completed form to the appropriate address or submit it in person at designated tax offices. Each method has specific instructions that should be followed to ensure proper processing.

Quick guide on how to complete form ct3 instructions 2015

Complete Form Ct3 Instructions seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Form Ct3 Instructions on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form Ct3 Instructions effortlessly

- Locate Form Ct3 Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Ct3 Instructions and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct3 instructions 2015

Create this form in 5 minutes!

How to create an eSignature for the form ct3 instructions 2015

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What are the Form Ct3 Instructions provided by airSlate SignNow?

The Form Ct3 Instructions offered by airSlate SignNow simplify the process of completing and submitting your forms. Our platform provides detailed guidance tailored to ensure you meet all requirements specific to Form Ct3. Users can easily navigate the steps necessary for compliance, making their filing experience more efficient.

-

How can airSlate SignNow help me with Form Ct3 Instructions?

airSlate SignNow streamlines how you handle Form Ct3 Instructions by providing tools for electronic signatures and document management. You can confidently complete and sign the necessary documents while receiving step-by-step prompts throughout the process. This enhances the overall efficiency and accuracy of your submissions.

-

Is there a cost associated with accessing Form Ct3 Instructions on airSlate SignNow?

Accessing Form Ct3 Instructions on airSlate SignNow is cost-effective and provides great value for businesses. We offer flexible pricing plans that accommodate various needs and budgets, ensuring you get the most out of our features. Our competitive rates include comprehensive support for all your form-related queries.

-

What features are included with airSlate SignNow for Form Ct3 Instructions?

When using airSlate SignNow for Form Ct3 Instructions, you gain access to features such as document templates, eSignature capabilities, and real-time tracking. These tools are designed to simplify the completion and submission of your forms. Additionally, our user-friendly interface allows for easy collaboration with your team.

-

Are there any integrations available for working with Form Ct3 Instructions?

Yes, airSlate SignNow offers integrations with a variety of software solutions to help you manage your Form Ct3 Instructions seamlessly. You can connect with popular applications like Google Workspace, Microsoft Office, and more to enhance productivity. These integrations ensure your workflow remains uninterrupted while handling your form submissions.

-

What benefits does airSlate SignNow offer for users of Form Ct3 Instructions?

Users of airSlate SignNow for Form Ct3 Instructions benefit from increased efficiency and reduced errors in their form submissions. The platform provides a clear, guided process that eliminates confusion around compliance. Ultimately, this saves time and improves the overall management of important documents.

-

How secure is the process of using airSlate SignNow for Form Ct3 Instructions?

The security of your data when using airSlate SignNow for Form Ct3 Instructions is our top priority. We implement advanced encryption and security protocols to ensure your documents are safe. Additionally, our platform complies with industry standards to provide peace of mind when handling sensitive information.

Get more for Form Ct3 Instructions

- Z280 form

- Personal assets and liabilities statement sbi format download

- Motion to change venue form

- Eagle bscoutb rank application boy bscoutsb of america scouting form

- Skid steer inspection form

- Golf cart bill of sale form

- Shutterstock model release form pdf download 46590733

- Letter writing fill in the blanks form

Find out other Form Ct3 Instructions

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer