Nys Tax Form 2019

What is the Nys Tax Form

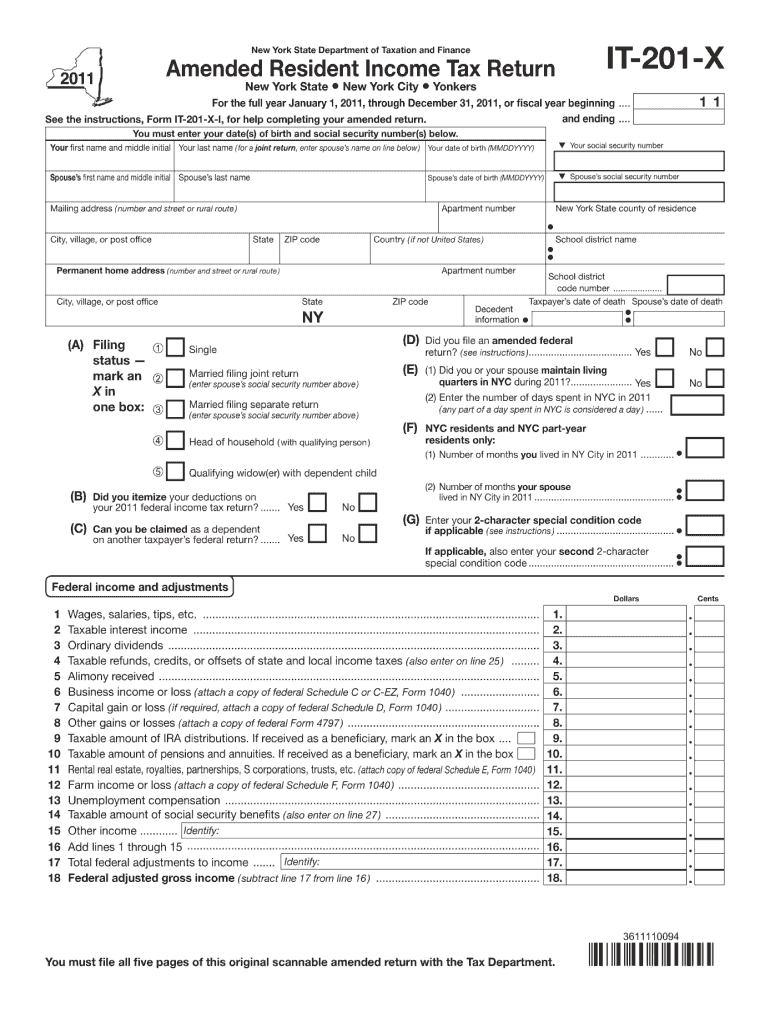

The Nys Tax Form is a critical document used by residents of New York State to report their income and calculate their tax obligations. This form is essential for individuals and businesses alike, as it ensures compliance with state tax laws. The form collects various financial details, including income sources, deductions, and credits, which ultimately determine the amount of tax owed or refunded. Understanding the purpose and components of the Nys Tax Form is vital for accurate filing and compliance with state regulations.

How to obtain the Nys Tax Form

Obtaining the Nys Tax Form is straightforward. Residents can access the form through the New York State Department of Taxation and Finance website, where it is available for download in PDF format. Additionally, physical copies can often be found at public libraries, post offices, and tax preparation offices across the state. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Steps to complete the Nys Tax Form

Completing the Nys Tax Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and records of deductions. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is crucial to double-check all entries for accuracy before submitting. Finally, review the completed form for any errors and ensure that all required signatures are included.

Legal use of the Nys Tax Form

The Nys Tax Form is legally binding when completed and submitted according to state regulations. To ensure its legal validity, filers must provide accurate information and adhere to the guidelines set forth by the New York State Department of Taxation and Finance. Electronic submissions are also accepted, provided they comply with the relevant eSignature laws and regulations. Proper completion and submission of the form protect taxpayers from potential legal issues and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Tax Form are crucial for compliance. Typically, individual tax returns are due by April fifteenth of each year, although extensions may be available. It is essential to stay informed about any changes to deadlines, especially in light of special circumstances such as natural disasters or public health emergencies, which may affect filing dates. Marking these important dates on your calendar can help avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nys Tax Form can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file online using the New York State Department of Taxation and Finance's e-filing system, which is secure and efficient. Alternatively, forms can be mailed to the appropriate processing center or submitted in person at designated offices. Each method has specific guidelines and requirements, so it is important to select the one that best suits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the Nys Tax Form can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action by the state. It is essential to file the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can motivate taxpayers to prioritize their filing obligations and seek assistance if needed.

Quick guide on how to complete 2011 nys tax form

Effortlessly Prepare Nys Tax Form on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to formulate, modify, and electronically sign your documents swiftly without holdups. Handle Nys Tax Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to Alter and Electronically Sign Nys Tax Form with Ease

- Obtain Nys Tax Form and then click Get Form to commence.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any preferred device. Edit and electronically sign Nys Tax Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 nys tax form

Create this form in 5 minutes!

How to create an eSignature for the 2011 nys tax form

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is a NYS Tax Form?

A NYS Tax Form is a document used to report income, deductions, and credits to the New York State Department of Taxation and Finance. These forms are essential for individuals and businesses to comply with state tax regulations and ensure accurate tax reporting. Understanding how to fill out and submit your NYS Tax Form is crucial for avoiding potential penalties.

-

How can airSlate SignNow help with NYS Tax Forms?

airSlate SignNow provides an easy-to-use solution for sending and eSigning NYS Tax Forms digitally. This platform simplifies the process of signing and submitting important tax documents, ensuring that you meet deadlines efficiently. With airSlate SignNow, businesses can streamline their tax form submissions without the hassle of physical paperwork.

-

What features does airSlate SignNow offer for managing NYS Tax Forms?

airSlate SignNow offers a range of features for managing NYS Tax Forms, including customizable templates, secure eSignature capabilities, and document tracking. These features enable users to create, send, and receive signed tax forms quickly and securely. Additionally, the user-friendly interface makes it easy to navigate through the process.

-

Is airSlate SignNow cost-effective for handling NYS Tax Forms?

Yes, airSlate SignNow is a cost-effective solution for managing NYS Tax Forms. With various pricing plans available, businesses can choose an option that fits their budget while still benefiting from a comprehensive eSigning platform. The savings in time and resources further enhance its affordability.

-

Can airSlate SignNow integrate with other tax software for NYS Tax Forms?

AirSlate SignNow seamlessly integrates with various tax software, making it easy to handle NYS Tax Forms alongside other financial tasks. These integrations allow for a smoother workflow, enabling users to manage tax-related documents within one platform. This connectivity enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for NYS Tax Form submissions?

Using airSlate SignNow for NYS Tax Form submissions offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. The digital solution ensures that your information is kept confidential while allowing for quick access and updates. This ultimately leads to a more efficient tax filing process.

-

Is there customer support available for questions about NYS Tax Forms?

Yes, airSlate SignNow offers comprehensive customer support for any questions regarding NYS Tax Forms. Users can access resources and get assistance through various channels, including live chat, email, and help documentation. This commitment to support ensures that you can resolve any issues quickly and efficiently.

Get more for Nys Tax Form

Find out other Nys Tax Form

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract