Nys Sales Tax Forms St 330 2018

What is the Nys Sales Tax Forms St 330

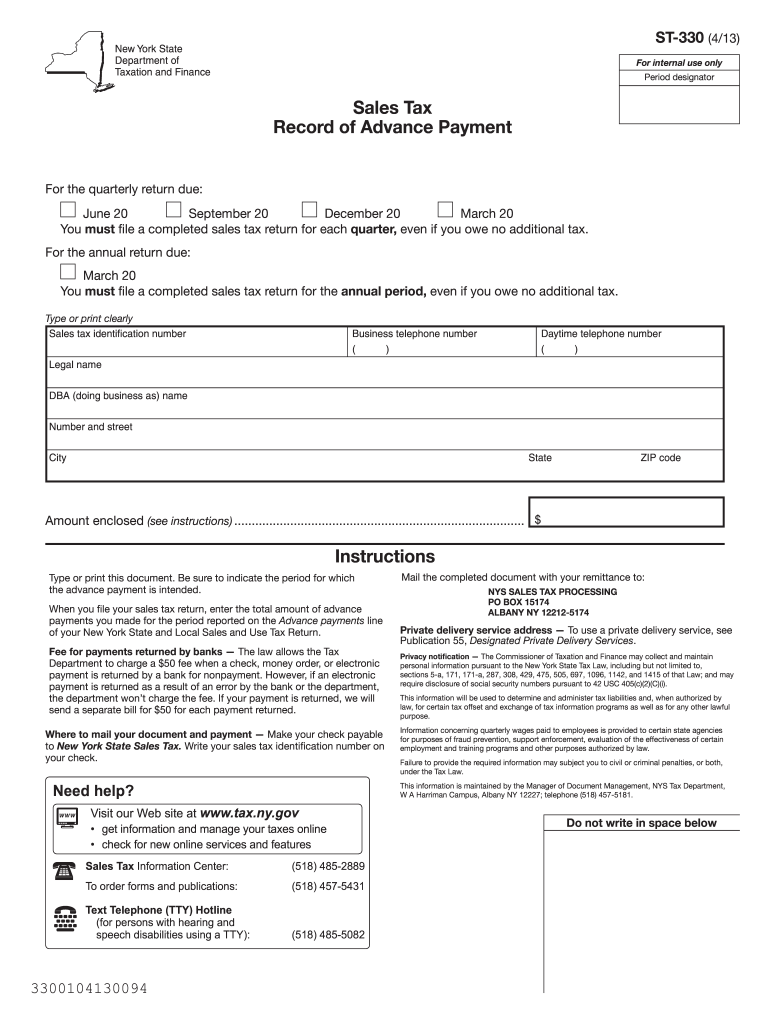

The Nys Sales Tax Forms St 330 is a crucial document used by businesses in New York State for reporting and remitting sales tax. This form specifically addresses the requirements for sales tax collection and provides a structured way for businesses to comply with state tax laws. It is essential for businesses that sell taxable goods or services within New York, ensuring they fulfill their tax obligations accurately and timely.

How to use the Nys Sales Tax Forms St 330

Using the Nys Sales Tax Forms St 330 involves several key steps. First, businesses need to gather all relevant sales data, including total sales, exempt sales, and any sales tax collected during the reporting period. Next, the form must be filled out accurately, reflecting these figures. Once completed, the form can be submitted electronically or via mail, depending on the preferred submission method. It is important to ensure that all information is correct to avoid any penalties or issues with the New York State Department of Taxation and Finance.

Steps to complete the Nys Sales Tax Forms St 330

Completing the Nys Sales Tax Forms St 330 requires careful attention to detail. Follow these steps:

- Collect all sales records for the reporting period.

- Calculate the total sales, including taxable and exempt sales.

- Determine the total sales tax collected.

- Fill out the form with accurate figures in the designated fields.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail to the appropriate tax authority.

Legal use of the Nys Sales Tax Forms St 330

The Nys Sales Tax Forms St 330 is legally binding when completed and submitted according to New York State tax regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes maintaining accurate records, filing on time, and ensuring all calculations are correct. Using a reliable electronic signature solution can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Sales Tax Forms St 330 vary based on the reporting period. Typically, businesses must file monthly, quarterly, or annually, depending on their sales volume. It is crucial for businesses to be aware of these deadlines to avoid penalties. The New York State Department of Taxation and Finance publishes a calendar detailing important dates for filing and payment, which should be consulted regularly.

Form Submission Methods (Online / Mail / In-Person)

The Nys Sales Tax Forms St 330 can be submitted through various methods. Businesses have the option to file online through the New York State Department of Taxation and Finance website, which is often the fastest and most efficient method. Alternatively, forms can be mailed to the designated address or submitted in person at local tax offices. Each method has specific guidelines and processing times, so businesses should choose the one that best fits their needs.

Quick guide on how to complete nys sales tax forms st 330 2013

Complete Nys Sales Tax Forms St 330 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and electronically sign your documents promptly without any interruptions. Manage Nys Sales Tax Forms St 330 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Nys Sales Tax Forms St 330 with ease

- Obtain Nys Sales Tax Forms St 330 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Alter and electronically sign Nys Sales Tax Forms St 330 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys sales tax forms st 330 2013

Create this form in 5 minutes!

How to create an eSignature for the nys sales tax forms st 330 2013

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are NYS Sales Tax Forms ST 330?

NYS Sales Tax Forms ST 330 are specific tax forms used for reporting and remitting sales tax in New York State. These forms are essential for businesses to comply with state tax regulations and to ensure accurate reporting of sales tax collected from customers.

-

How can airSlate SignNow help with NYS Sales Tax Forms ST 330?

airSlate SignNow simplifies the process of filling out and eSigning NYS Sales Tax Forms ST 330. With our user-friendly platform, you can quickly complete the necessary fields and send the forms electronically, ensuring compliance while saving time.

-

Is there a pricing plan for using airSlate SignNow for NYS Sales Tax Forms ST 330?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of different sizes. Our pricing is designed to provide an efficient and cost-effective solution for managing NYS Sales Tax Forms ST 330 and other document needs.

-

What features does airSlate SignNow offer for NYS Sales Tax Forms ST 330?

airSlate SignNow includes features such as eSignature capabilities, document templates, automated workflows, and integration with other software applications. These features make it easier to manage and submit NYS Sales Tax Forms ST 330 efficiently.

-

Are there any integrations available with airSlate SignNow for NYS Sales Tax Forms ST 330?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage NYS Sales Tax Forms ST 330. This interoperability ensures that your sales tax data flows seamlessly between platforms.

-

Can I track the status of my NYS Sales Tax Forms ST 330 submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your document submissions, including NYS Sales Tax Forms ST 330. You can easily monitor the status of your forms, know when they are signed, and keep a record of submissions.

-

What are the benefits of using airSlate SignNow for my NYS Sales Tax Forms ST 330?

Using airSlate SignNow for your NYS Sales Tax Forms ST 330 streamlines your tax filing process, increases compliance accuracy, and saves valuable time. Our platform allows you to focus on your business while we handle the complexities of document management.

Get more for Nys Sales Tax Forms St 330

Find out other Nys Sales Tax Forms St 330

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document