OTC 901 Oklahoma Tax Commission State of Oklahoma 2020

What is the OTC 901 Oklahoma Tax Commission State Of Oklahoma

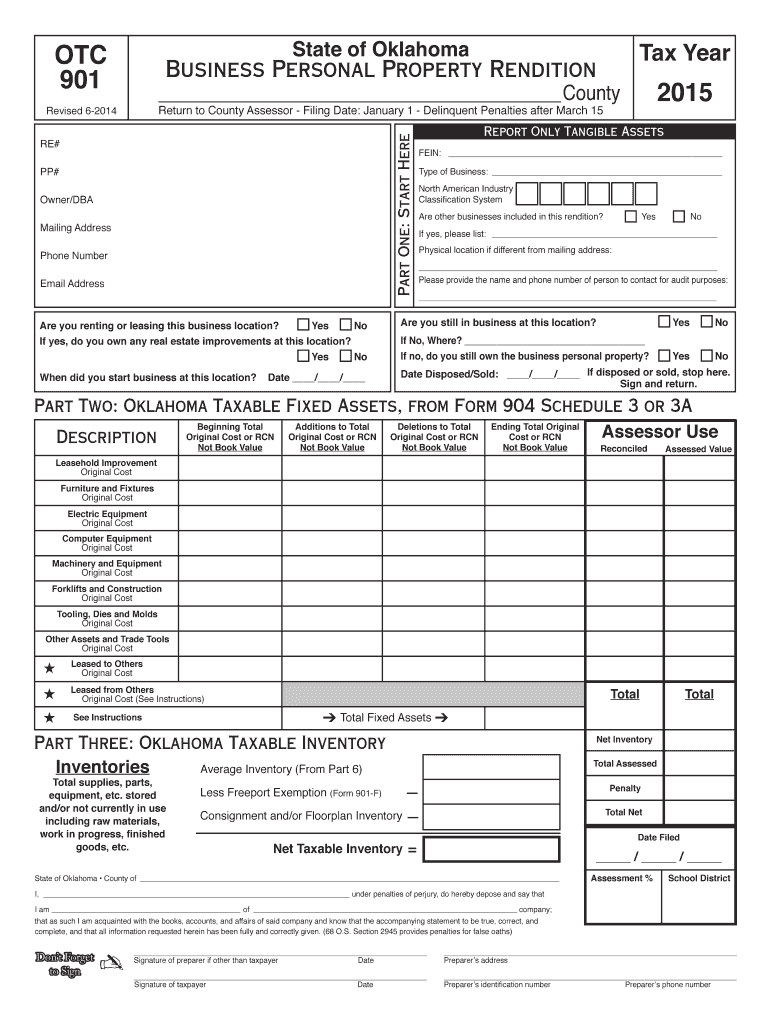

The OTC 901 form is a specific document issued by the Oklahoma Tax Commission. It is primarily used for tax-related purposes within the state of Oklahoma. This form is essential for individuals and businesses to report certain tax information accurately. Understanding the purpose and requirements of the OTC 901 is crucial for compliance with state tax laws.

Steps to complete the OTC 901 Oklahoma Tax Commission State Of Oklahoma

Completing the OTC 901 form requires attention to detail and adherence to specific guidelines. Here are the general steps to follow:

- Gather necessary information, including personal details and financial data relevant to your tax situation.

- Download the OTC 901 form from the Oklahoma Tax Commission website or access it through a trusted digital platform.

- Fill out the form carefully, ensuring all required fields are completed accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the OTC 901 Oklahoma Tax Commission State Of Oklahoma

The OTC 901 form is legally binding when filled out and submitted according to Oklahoma tax laws. To ensure its legal validity, it is important to comply with all relevant regulations. This includes providing accurate information and adhering to deadlines. Using a reliable digital signing solution can enhance the legitimacy of the form, ensuring that it meets the necessary legal standards.

How to obtain the OTC 901 Oklahoma Tax Commission State Of Oklahoma

Obtaining the OTC 901 form is straightforward. You can access it through the Oklahoma Tax Commission's official website. Additionally, many tax preparation services and software platforms provide this form as part of their offerings. Ensure that you are using the most current version of the form to avoid any compliance issues.

Form Submission Methods (Online / Mail / In-Person)

The OTC 901 form can be submitted through several methods, providing flexibility for taxpayers. The available submission options include:

- Online: Many taxpayers prefer to submit the OTC 901 electronically through the Oklahoma Tax Commission's online portal.

- Mail: You can print the completed form and send it via postal service to the designated address provided by the Tax Commission.

- In-Person: For those who prefer personal interaction, submitting the form in person at a local Tax Commission office is an option.

Key elements of the OTC 901 Oklahoma Tax Commission State Of Oklahoma

Understanding the key elements of the OTC 901 form is essential for accurate completion. Important components typically include:

- Taxpayer Identification: This section requires personal or business identification details.

- Income Reporting: Accurate reporting of income is crucial for tax calculations.

- Deductions and Credits: Information regarding any applicable deductions or tax credits should be clearly stated.

Quick guide on how to complete otc 901 2015 oklahoma tax commission state of oklahoma

Effortlessly Prepare OTC 901 Oklahoma Tax Commission State Of Oklahoma on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to swiftly create, edit, and electronically sign your documents without any delays. Manage OTC 901 Oklahoma Tax Commission State Of Oklahoma on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Easily Modify and eSign OTC 901 Oklahoma Tax Commission State Of Oklahoma Without Stress

- Find OTC 901 Oklahoma Tax Commission State Of Oklahoma and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or hide sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign OTC 901 Oklahoma Tax Commission State Of Oklahoma and ensure superb communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct otc 901 2015 oklahoma tax commission state of oklahoma

Create this form in 5 minutes!

How to create an eSignature for the otc 901 2015 oklahoma tax commission state of oklahoma

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the OTC 901 form used for?

The OTC 901 form, provided by the Oklahoma Tax Commission, is used for submitting various tax-related documentation in the State of Oklahoma. This form is crucial for ensuring compliance with state tax regulations. airSlate SignNow simplifies the process of filling out and eSigning the OTC 901, making it an efficient choice for businesses.

-

How can airSlate SignNow help with the OTC 901 Oklahoma Tax Commission submission?

airSlate SignNow offers a streamlined eSigning solution for the OTC 901 Oklahoma Tax Commission form. With our platform, you'll be able to prepare, send, and receive signed documents easily. This saves time and helps ensure that your submissions are accurate and compliant with the State of Oklahoma's requirements.

-

Are there any costs associated with using airSlate SignNow for OTC 901 forms?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning documents, there may be subscription fees depending on your usage level. However, the convenience of managing your OTC 901 Oklahoma Tax Commission forms digitally often outweighs these costs, leading to signNow time and resource savings.

-

What features does airSlate SignNow offer for OTC 901 Oklahoma Tax Commission users?

With airSlate SignNow, users can take advantage of features such as customizable templates for the OTC 901, automated reminders for signers, and real-time tracking of document status. These features enhance efficiency and help ensure all submissions to the Oklahoma Tax Commission are handled seamlessly.

-

Can I integrate airSlate SignNow with other tools for managing OTC 901 forms?

Absolutely! airSlate SignNow supports integrations with various platforms such as CRM systems, project management tools, and cloud storage services. This makes it easier to manage your OTC 901 Oklahoma Tax Commission documents alongside other business processes, enhancing overall productivity.

-

How secure is the airSlate SignNow platform for OTC 901 documents?

Security is a priority for airSlate SignNow, especially when handling sensitive documents like the OTC 901 Oklahoma Tax Commission form. Our platform employs advanced encryption technologies and complies with legal standards for eSignatures to ensure that your data remains safe and secure throughout the signing process.

-

What benefits do I gain by using airSlate SignNow for my OTC 901 submissions?

By utilizing airSlate SignNow for your OTC 901 submissions, you gain a faster, more efficient process for managing your documents. This includes instant access to signed documents and the ability to track their status in real-time, which can lead to improved compliance and peace of mind regarding your state tax obligations.

Get more for OTC 901 Oklahoma Tax Commission State Of Oklahoma

Find out other OTC 901 Oklahoma Tax Commission State Of Oklahoma

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later