Form 40, Full Year Resident Individual Income Tax Return Oregon Gov 2019

What is the Form 40, Full Year Resident Individual Income Tax Return Oregon gov

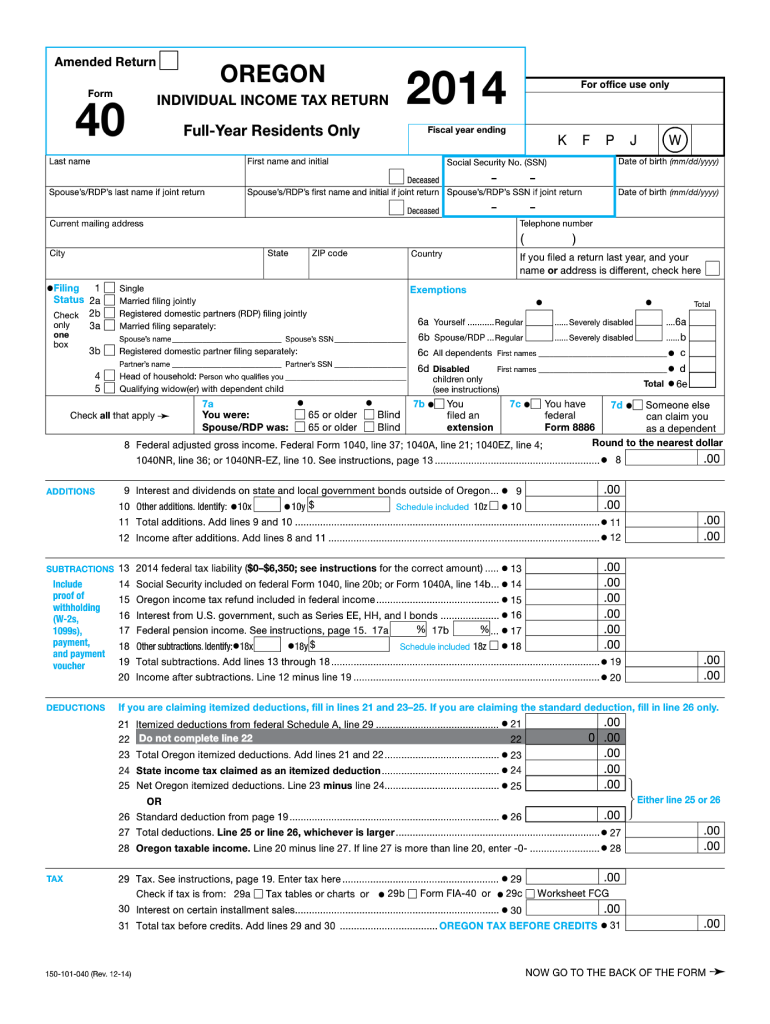

The Form 40, Full Year Resident Individual Income Tax Return, is a tax document used by residents of Oregon to report their income and calculate their state income tax liability. This form is specifically designed for individuals who have lived in Oregon for the entire tax year and need to disclose their earnings, deductions, and credits to the Oregon Department of Revenue. Completing this form accurately is essential for ensuring compliance with state tax laws and for determining any tax refund or amount owed.

How to obtain the Form 40, Full Year Resident Individual Income Tax Return Oregon gov

To obtain the Form 40, Full Year Resident Individual Income Tax Return, individuals can visit the official Oregon Department of Revenue website. The form is available for download in PDF format, allowing taxpayers to print it for completion. Additionally, the form may be available at local tax offices or libraries. It is advisable to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to complete the Form 40, Full Year Resident Individual Income Tax Return Oregon gov

Completing the Form 40 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any deductions and credits for which you qualify, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy before submitting it.

Legal use of the Form 40, Full Year Resident Individual Income Tax Return Oregon gov

The Form 40 is legally binding when completed and submitted according to Oregon state tax laws. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. It is crucial to retain a copy of the submitted form for personal records and potential future reference.

Filing Deadlines / Important Dates

Taxpayers must be aware of key filing deadlines to avoid penalties. The deadline for submitting the Form 40 typically coincides with the federal tax deadline, which is usually April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any state-specific extensions or changes that may apply to the current tax year.

Form Submission Methods (Online / Mail / In-Person)

The Form 40 can be submitted in several ways. Taxpayers have the option to file electronically through the Oregon Department of Revenue's e-filing system, which is a convenient and efficient method. Alternatively, individuals can print the completed form and mail it to the appropriate tax office. In-person submissions may also be possible at designated tax offices, but it is advisable to check for any specific requirements or appointments needed for in-person filing.

Quick guide on how to complete form 40 full year resident individual income tax return oregongov

Easily prepare Form 40, Full Year Resident Individual Income Tax Return Oregon gov on any device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly option to conventional printed and signed documents, enabling you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Form 40, Full Year Resident Individual Income Tax Return Oregon gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The simplest way to edit and electronically sign Form 40, Full Year Resident Individual Income Tax Return Oregon gov with ease

- Obtain Form 40, Full Year Resident Individual Income Tax Return Oregon gov and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

No more lost or misfiled documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 40, Full Year Resident Individual Income Tax Return Oregon gov and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 40 full year resident individual income tax return oregongov

Create this form in 5 minutes!

How to create an eSignature for the form 40 full year resident individual income tax return oregongov

The best way to generate an eSignature for your PDF document online

The best way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

The Form 40, Full Year Resident Individual Income Tax Return Oregon gov is the official state tax form used by residents of Oregon to report their annual income and calculate their tax obligations. It is essential for anyone residing in Oregon throughout the tax year to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

airSlate SignNow allows users to easily create, send, and electronically sign documents, including the Form 40, Full Year Resident Individual Income Tax Return Oregon gov. This streamlines the tax filing process, making it quicker and more efficient for individuals to meet their state tax requirements.

-

Are there any costs associated with filing the Form 40, Full Year Resident Individual Income Tax Return Oregon gov using airSlate SignNow?

Yes, while airSlate SignNow offers various pricing plans, there may be a nominal fee for certain premium features. However, the cost is generally more affordable compared to traditional document signing services, making it a cost-effective solution for those filing the Form 40, Full Year Resident Individual Income Tax Return Oregon gov.

-

What features does airSlate SignNow provide for preparing the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

airSlate SignNow comes with features like customizable document templates, automated reminders, and real-time collaboration tools. These features simplify the preparation and submission of the Form 40, Full Year Resident Individual Income Tax Return Oregon gov, ensuring that all required information is included and deadlines are met.

-

Is airSlate SignNow secure for filing the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

Absolutely! airSlate SignNow emphasizes document security and employs advanced encryption protocols to protect your sensitive information. Users can confidently file their Form 40, Full Year Resident Individual Income Tax Return Oregon gov, knowing their data is secure throughout the process.

-

Can airSlate SignNow integrate with other software for the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax software. This allows users to easily import data and prepare their Form 40, Full Year Resident Individual Income Tax Return Oregon gov without lengthy manual data entry.

-

What benefits does airSlate SignNow offer for those filing the Form 40, Full Year Resident Individual Income Tax Return Oregon gov?

Using airSlate SignNow for your Form 40, Full Year Resident Individual Income Tax Return Oregon gov has numerous benefits, including increased efficiency, reduced paperwork, and the ability to track the status of your documents. This results in a smoother tax filing experience and peace of mind for individuals.

Get more for Form 40, Full Year Resident Individual Income Tax Return Oregon gov

- American red cross course record form

- Rubrics for seminar evaluation form

- Csi form 12 1a pdf

- Aramex authorization letter form

- Pay gov billing worksheet form

- Fee 15 00 department of agriculture and markets ny gov form

- Certified nursing assistant skills checklist lnt staffing llc form

- Vendor managed inventory materials storage agreement october 24 1docx form

Find out other Form 40, Full Year Resident Individual Income Tax Return Oregon gov

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form