PA Tax Return 2019

What is the PA Tax Return

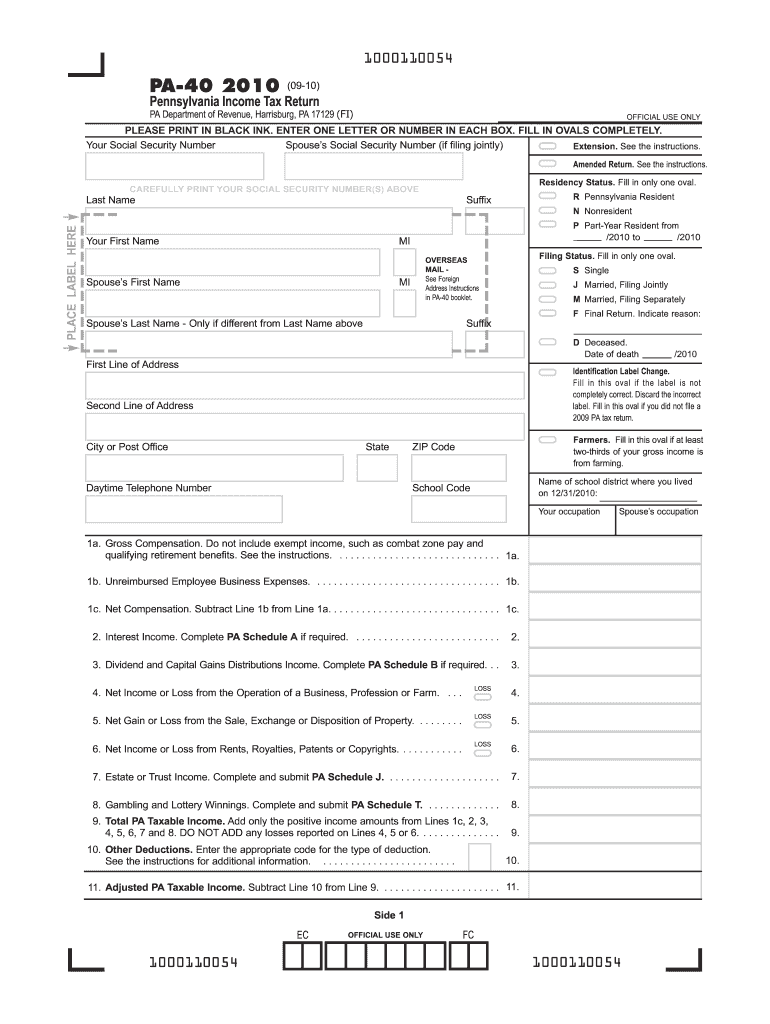

The Pennsylvania Tax Return, commonly referred to as the PA Tax Return, is a document that residents of Pennsylvania must file to report their income and calculate their state tax obligations. This form is essential for individuals, businesses, and other entities operating within the state. The PA Tax Return includes details about income, deductions, and credits that can affect the overall tax liability. Understanding this form is crucial for compliance with state tax laws and ensuring that taxpayers fulfill their financial responsibilities accurately.

How to use the PA Tax Return

Using the PA Tax Return involves several steps that ensure accurate reporting of income and tax calculations. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Once the required information is collected, individuals can fill out the form, either electronically or on paper. After completing the form, it must be reviewed for accuracy before submission. Utilizing digital tools can streamline this process, allowing for easy e-signature and secure submission.

Steps to complete the PA Tax Return

Completing the PA Tax Return involves a systematic approach:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Choose the correct version of the PA Tax Return based on your filing status.

- Fill out the form, ensuring all income, deductions, and credits are accurately reported.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, ensuring it is sent by the filing deadline.

Legal use of the PA Tax Return

The PA Tax Return is a legally binding document that must be completed in accordance with Pennsylvania tax laws. It is important to ensure that all information provided is accurate and truthful to avoid potential legal repercussions. Filing the form electronically through a compliant platform can enhance its legal standing, as these platforms often provide features such as secure e-signatures and audit trails that confirm the authenticity of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the PA Tax Return are crucial for compliance. Typically, the deadline for filing individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, as well as specific deadlines for estimated tax payments. Keeping track of these dates helps avoid penalties and ensures timely compliance with state tax regulations.

Required Documents

To successfully complete the PA Tax Return, several documents are typically required:

- W-2 forms from employers to report wages.

- 1099 forms for other income sources, such as freelance work or interest.

- Records of any deductions or credits claimed, such as receipts for charitable donations.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the PA Tax Return. The most efficient method is electronic filing, which allows for immediate processing and confirmation. Alternatively, individuals can mail their completed forms to the appropriate state tax office. In-person submissions may also be possible at designated tax offices, providing an opportunity for direct assistance. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete 2009 pa tax return

Manage PA Tax Return effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any delays. Handle PA Tax Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign PA Tax Return with ease

- Locate PA Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device of your choice. Alter and eSign PA Tax Return while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 pa tax return

Create this form in 5 minutes!

How to create an eSignature for the 2009 pa tax return

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the PA Tax Return process using airSlate SignNow?

The PA Tax Return process with airSlate SignNow is simplified with our intuitive eSigning platform. You can easily send your tax documents for signature and receive them back in a secure, compliant manner. This streamlines the submission process, ensuring that your PA Tax Return is filed accurately and on time.

-

How much does it cost to use airSlate SignNow for PA Tax Return?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. Our plans are designed to be cost-effective, especially useful for managing your PA Tax Return efficiently. You can choose a subscription that fits your budget while benefiting from our premium features.

-

What features does airSlate SignNow provide for PA Tax Return?

airSlate SignNow includes key features like document templates, audit trails, and real-time tracking that are especially beneficial for your PA Tax Return. These features ensure transparency and compliance while saving you time in collecting signatures. You can also integrate other tools for a seamless experience.

-

Can I integrate airSlate SignNow with other software for my PA Tax Return?

Absolutely! airSlate SignNow integrates with various software applications, enhancing your workflow for managing PA Tax Return. Whether it's accounting software or other business tools, our integrations help streamline document management and signature collection, saving you from manual processes.

-

Is airSlate SignNow secure for sending PA Tax Return documents?

Yes, airSlate SignNow prioritizes security, making it a reliable choice for sending your PA Tax Return documents. Our platform uses advanced encryption techniques and complies with industry standards to safeguard your sensitive information throughout the signing process.

-

How does airSlate SignNow improve the efficiency of my PA Tax Return filing?

Using airSlate SignNow signNowly enhances the efficiency of your PA Tax Return filing. With automated reminders, document routing, and eSigning capabilities, you can expedite the entire process. This means less time spent on paperwork and more focus on your core business activities.

-

What are the benefits of using airSlate SignNow for PA Tax Return?

The main benefits of using airSlate SignNow for your PA Tax Return include reduced paperwork, faster turnaround times, and enhanced compliance. Our platform helps eliminate the hassles of traditional document handling, allowing you to submit your tax returns effortlessly and meet deadlines with confidence.

Get more for PA Tax Return

- Subpoena to a witness ontario form 16

- To be completed by mgp lab staff solid tumor test form

- Salzmann index form

- Pe strada mantuleasa pdf form

- Bihar minority loan form pdf

- California form 3588fill out and use this pdf formspal

- Form tmt 334818application for duplicate andor

- Personal training client package form

Find out other PA Tax Return

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament