Ky Form Inheritance 2016-2026

What is the Ky Form Inheritance

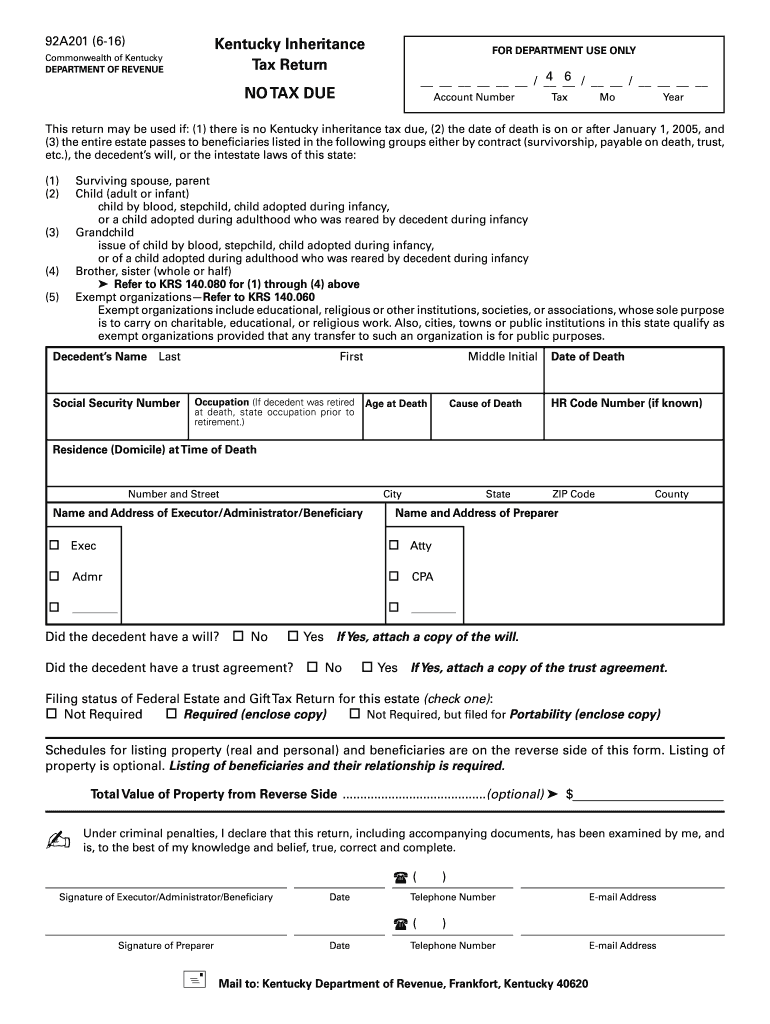

The Ky Form Inheritance is an essential document used in Kentucky to report and settle the estate of a deceased individual. This form, also known as the Kentucky inheritance tax return, is specifically designed for estate executors to declare the value of the estate and determine any applicable inheritance taxes. It is crucial for ensuring compliance with state tax laws and for the proper distribution of assets to heirs and beneficiaries.

Steps to Complete the Ky Form Inheritance

Completing the Ky Form Inheritance involves several important steps:

- Gather all necessary documentation related to the deceased's estate, including property deeds, bank statements, and any prior tax returns.

- Determine the total value of the estate by assessing all assets, including real estate, personal property, and financial accounts.

- Fill out the form accurately, ensuring that all information regarding the deceased and the estate is included.

- Calculate any inheritance tax owed based on the estate's value and applicable tax rates.

- Review the completed form for accuracy before submission.

- Submit the form to the Kentucky Department of Revenue either online or by mail, along with any required payment for taxes owed.

Legal Use of the Ky Form Inheritance

The legal use of the Ky Form Inheritance is critical for estate executors. It serves as an official declaration of the estate's value and ensures compliance with Kentucky inheritance tax laws. By accurately completing and submitting this form, estate executors fulfill their legal obligations and help prevent potential disputes among heirs. It is important to note that failure to file the form correctly or on time can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Ky Form Inheritance, several documents are required:

- Death certificate of the deceased.

- List of all assets and their valuations, including real estate and personal property.

- Documentation of any debts or liabilities owed by the deceased.

- Previous tax returns, if applicable, to provide context for the estate's financial history.

- Any relevant legal documents, such as wills or trusts, that outline the distribution of assets.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Ky Form Inheritance is essential for estate executors. The form must be filed within nine months of the date of death to avoid penalties. If additional time is needed, executors may request an extension, but this must be done before the initial deadline. Keeping track of these important dates helps ensure compliance and smooth processing of the estate.

Who Issues the Form

The Ky Form Inheritance is issued by the Kentucky Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring that estate taxes are properly assessed and collected. Executors should refer to the Department of Revenue for any updates or changes to the form and its requirements.

Quick guide on how to complete ky form inheritance

Effortlessly Prepare Ky Form Inheritance on Any Device

Digital document management has gained popularity among businesses and individuals alike. It presents a suitable eco-friendly substitute for traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Manage Ky Form Inheritance on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and eSign Ky Form Inheritance with Ease

- Obtain Ky Form Inheritance and then select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select your preferred method of delivery for your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Ky Form Inheritance and ensure outstanding communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ky form inheritance

Create this form in 5 minutes!

How to create an eSignature for the ky form inheritance

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is an estate executor and what are their responsibilities?

An estate executor is a person or entity appointed to manage the estate of a deceased individual. Their primary responsibilities include settling debts, distributing assets, and ensuring that the will is executed according to the deceased's wishes. Using tools like airSlate SignNow can simplify the signing and documentation process for estate executors, making their tasks more efficient.

-

How can airSlate SignNow assist estate executors?

airSlate SignNow provides an easy-to-use platform for estate executors to send, sign, and manage necessary documents. With electronic signatures and document templates, estate executors can streamline communication and ensure that all legal requirements are met without unnecessary delays. This makes their workflow more efficient and organized.

-

Is airSlate SignNow cost-effective for estate executors?

Yes, airSlate SignNow offers a cost-effective solution for estate executors managing multiple documents. With affordable pricing plans that cater to various needs, estate executors can access all the essential features without breaking the bank. This allows them to focus on more important aspects of estate management while saving on administrative costs.

-

What features does airSlate SignNow offer that are beneficial for estate executors?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and real-time tracking of document status. These tools are particularly beneficial for estate executors who deal with numerous legal documents, ensuring they meet deadlines and compliance. The intuitive interface also makes it easy for executors to navigate the platform efficiently.

-

Can estate executors integrate airSlate SignNow with other tools?

Absolutely, airSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and various CRM systems. This allows estate executors to synchronize their workflows and manage all documentation in one place. Such integrations enhance productivity, enabling executors to focus more on managing the estate effectively.

-

What are the benefits of using electronic signatures for estate executors?

Using electronic signatures provides estate executors with a faster and more secure way to obtain necessary approvals on documents. This method eliminates the need for printing, scanning, and mailing, thereby expediting the execution of estate-related responsibilities. Additionally, electronic signatures carry legal validity in most jurisdictions, providing peace of mind for estate executors.

-

How secure is airSlate SignNow for estate executors handling sensitive documents?

airSlate SignNow takes the security of sensitive documents seriously by offering features like encryption, secure access, and audit trails. Estate executors can confidently manage and sign documents without worrying about unauthorized access. This high level of security is crucial for executors dealing with personal and financial information.

Get more for Ky Form Inheritance

Find out other Ky Form Inheritance

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors