CASUAL MALE RETAIL GROUP INC 2016-2026

Understanding the FL Intangible Personal Extension File

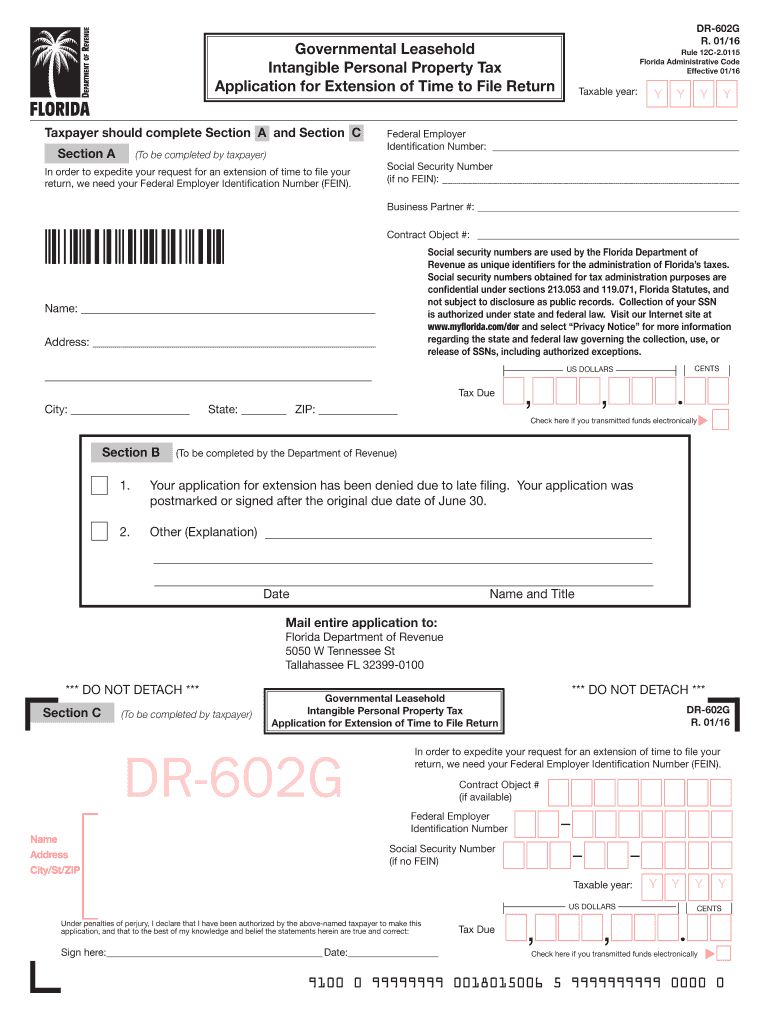

The FL intangible personal extension file is a critical document for individuals and businesses in Florida seeking to manage their intangible personal property taxes. This form allows taxpayers to apply for an extension on their tax filings, ensuring they meet their obligations without incurring penalties. Understanding its purpose and requirements is essential for compliance and effective tax management.

Steps to Complete the FL Intangible Personal Extension File Online

Completing the FL intangible personal extension file online involves several straightforward steps. First, gather all necessary information about your intangible personal property, including its value and any relevant documentation. Next, access the appropriate online platform, such as signNow, to fill out the form digitally. Ensure that all fields are accurately completed, as errors can lead to delays or rejections. Once filled, review the information for accuracy before submitting it electronically. This process not only saves time but also enhances the security of your sensitive data.

Legal Use of the FL Intangible Personal Extension File

The legal use of the FL intangible personal extension file is governed by state tax laws. To be considered valid, the form must be submitted within the designated time frame set by the Florida Department of Revenue. Adhering to these regulations ensures that the extension is recognized legally, preventing potential penalties for late filing. Utilizing a compliant eSignature solution, such as signNow, can further enhance the legal standing of your submission by providing a secure digital certificate.

Required Documents for the FL Intangible Personal Extension File

When preparing to submit the FL intangible personal extension file, certain documents are required to support your application. These may include proof of ownership of intangible assets, previous tax returns, and any correspondence from the tax authority. Having these documents readily available will streamline the process and help ensure that your application is complete and accurate.

Filing Deadlines for the FL Intangible Personal Extension File

Filing deadlines for the FL intangible personal extension file are crucial to avoid penalties. Typically, the extension request must be submitted by the original due date of the tax return. It is advisable to check the Florida Department of Revenue’s official guidelines for specific dates each tax year, as these can vary. Staying informed about these deadlines helps taxpayers manage their obligations effectively.

Form Submission Methods for the FL Intangible Personal Extension File

The FL intangible personal extension file can be submitted through various methods, including online, by mail, or in-person. Submitting online is often the most efficient option, allowing for quick processing and confirmation. If choosing to file by mail, ensure that the form is sent well before the deadline to allow for any potential delays in postal service. In-person submissions can be made at local tax offices, providing an opportunity to clarify any questions directly with tax officials.

Quick guide on how to complete casual male retail group inc

Effortlessly Prepare CASUAL MALE RETAIL GROUP INC on Any Device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, amend, and electronically sign your documents swiftly without delays. Manage CASUAL MALE RETAIL GROUP INC on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Amend and Electronically Sign CASUAL MALE RETAIL GROUP INC Easily

- Locate CASUAL MALE RETAIL GROUP INC and subsequently click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of missing or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign CASUAL MALE RETAIL GROUP INC and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct casual male retail group inc

Create this form in 5 minutes!

How to create an eSignature for the casual male retail group inc

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the FL tax application time file form used for?

The FL tax application time file form is essential for businesses filing taxes in Florida. It helps streamline your tax processing and ensures compliance with state regulations. By using airSlate SignNow, you can easily eSign and submit this form, saving time and reducing errors.

-

How does airSlate SignNow help with the FL tax application time file form?

airSlate SignNow provides an intuitive platform for preparing and signing your FL tax application time file form. The solution allows for easy document management and fast eSigning, which is crucial during tax season. This feature enhances productivity and ensures you meet your filing deadlines.

-

Is there a cost associated with using airSlate SignNow for the FL tax application time file form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing is competitive and varies based on your needs and volume. Investing in our service ensures you have the tools necessary for efficient form management and signing.

-

Can I integrate other applications with airSlate SignNow for my FL tax application time file form?

Absolutely! airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and CRM systems. This capability allows you to import and organize your FL tax application time file form seamlessly, enhancing your workflow and productivity.

-

What features does airSlate SignNow offer for managing the FL tax application time file form?

airSlate SignNow includes features such as customizable templates, eSigning, and document tracking specifically for the FL tax application time file form. Users can also collaborate in real time, ensuring that all necessary parties are involved in the signing process, which aids in timely filings.

-

How does airSlate SignNow improve the eSigning process for the FL tax application time file form?

With airSlate SignNow, the eSigning process for the FL tax application time file form is signNowly simplified. Our platform allows users to sign documents from any device, which is particularly helpful for keeping up with tax deadlines. The ease of use and the speed of transactions enhance overall user experience.

-

Is customer support available for using airSlate SignNow with the FL tax application time file form?

Yes, airSlate SignNow provides robust customer support to help you with any questions regarding the FL tax application time file form. Our team is available via chat, email, and phone to ensure you have the necessary assistance to navigate our platform. We aim to make your experience as smooth as possible.

Get more for CASUAL MALE RETAIL GROUP INC

Find out other CASUAL MALE RETAIL GROUP INC

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online