MO 1040A SingleMarried Income from One Spouse Short Form Dor Mo 2019

What is the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

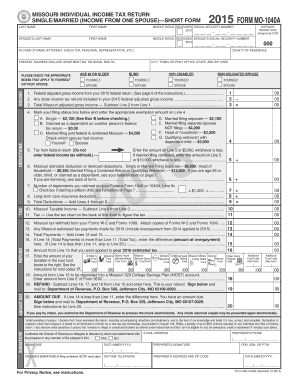

The MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo is a simplified tax form used by residents of Missouri. This form is designed for individuals who are filing their state income tax return as single or married, but only one spouse is reporting income. It streamlines the filing process, allowing taxpayers to report income, claim deductions, and calculate their tax liability in a more efficient manner. This form is particularly beneficial for those with straightforward tax situations, as it reduces the complexity often associated with longer forms.

Steps to complete the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

Completing the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Input your total income from all sources, ensuring accuracy in reporting.

- Claim deductions: Identify and claim any applicable deductions to reduce your taxable income.

- Calculate tax liability: Use the provided tax tables or formulas to determine your total tax owed.

- Sign and date the form: Ensure that you sign and date the form to validate your submission.

Legal use of the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

The MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo is legally recognized for filing state income taxes in Missouri. To ensure its legal validity, the form must be completed accurately and submitted within the designated filing period. Adhering to state tax laws and regulations is crucial, as any discrepancies or errors could lead to penalties or delays in processing. Additionally, using a secure method for submission, such as eSigning through a trusted platform, enhances the legal standing of the document.

How to obtain the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

The MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo can be obtained through multiple channels. Taxpayers can download the form directly from the Missouri Department of Revenue's website. Alternatively, physical copies may be available at local tax offices or libraries. For those who prefer digital solutions, online tax preparation software often includes this form, simplifying the process of filling it out electronically.

Filing Deadlines / Important Dates

Filing deadlines for the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo typically align with federal tax deadlines. Generally, the form must be submitted by April 15 of the following year. However, taxpayers should be aware of potential extensions or changes to deadlines, especially during extraordinary circumstances. It is advisable to check the Missouri Department of Revenue's website for the most current information regarding filing dates.

Examples of using the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

There are various scenarios in which the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo is applicable. For instance, a single individual with a straightforward income source, such as a full-time job, can use this form to report their earnings. Similarly, a married couple where only one spouse is employed may choose this form to simplify their tax filing process. These examples illustrate how the form serves a broad audience, particularly those with uncomplicated financial situations.

Quick guide on how to complete mo 1040a singlemarried income from one spouse short form dor mo

Effortlessly Prepare MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without any hindrances. Handle MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo on any device using airSlate SignNow apps for Android or iOS, and simplify your document-related tasks today.

How to Edit and eSign MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo with Ease

- Obtain MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new document duplicates. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Edit and eSign MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo, and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 1040a singlemarried income from one spouse short form dor mo

Create this form in 5 minutes!

How to create an eSignature for the mo 1040a singlemarried income from one spouse short form dor mo

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

The MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo is a simplified tax form used in Missouri for filing individual income taxes. This form is designed for taxpayers who meet specific criteria, typically single or married individuals with straightforward tax situations. It allows for easier filing and can help expedite the tax return process.

-

How can airSlate SignNow help with the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

airSlate SignNow offers an efficient platform to electronically sign and send the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo. This digital solution ensures that you can manage your documents effortlessly while complying with legal requirements for electronic signatures. You can streamline your tax filing process and reduce paperwork.

-

What are the pricing options for using airSlate SignNow with the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

airSlate SignNow provides various pricing plans to suit different business needs. Each plan includes a set number of documents that can be signed per month, along with additional features for document management. Choosing the right plan can enhance your experience when dealing with the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo.

-

What features does airSlate SignNow provide for the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

With airSlate SignNow, you can access features such as document templates, automatic reminders, and real-time tracking for your MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo. These features simplify the process of sending and signing documents, ensuring that all parties are informed and engaged throughout the transaction.

-

Are there integrations available for using airSlate SignNow with other software when filing the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

Yes, airSlate SignNow offers various integrations with popular applications and services, enhancing the utility of your MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo. These integrations allow you to connect with tools like CRMs and cloud storage solutions, facilitating a smoother workflow. This interconnectedness helps streamline your tax filing and document management.

-

What are the benefits of using airSlate SignNow for my MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

Using airSlate SignNow provides numerous benefits for managing your MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo. It saves time with quick and easy electronic signatures, reduces errors with clear document tracking, and increases security for sensitive information. Overall, it modernizes your tax filing experience.

-

How secure is airSlate SignNow when signing the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo?

airSlate SignNow employs robust security measures to protect your documents, including the MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo. All data is encrypted, and user access is controlled to ensure confidentiality. You can trust that your sensitive tax information remains secure throughout the signing process.

Get more for MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

Find out other MO 1040A SingleMarried Income From One Spouse Short Form Dor Mo

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document