Form MO 1040A Forms and Manuals MO Gov 2020-2026

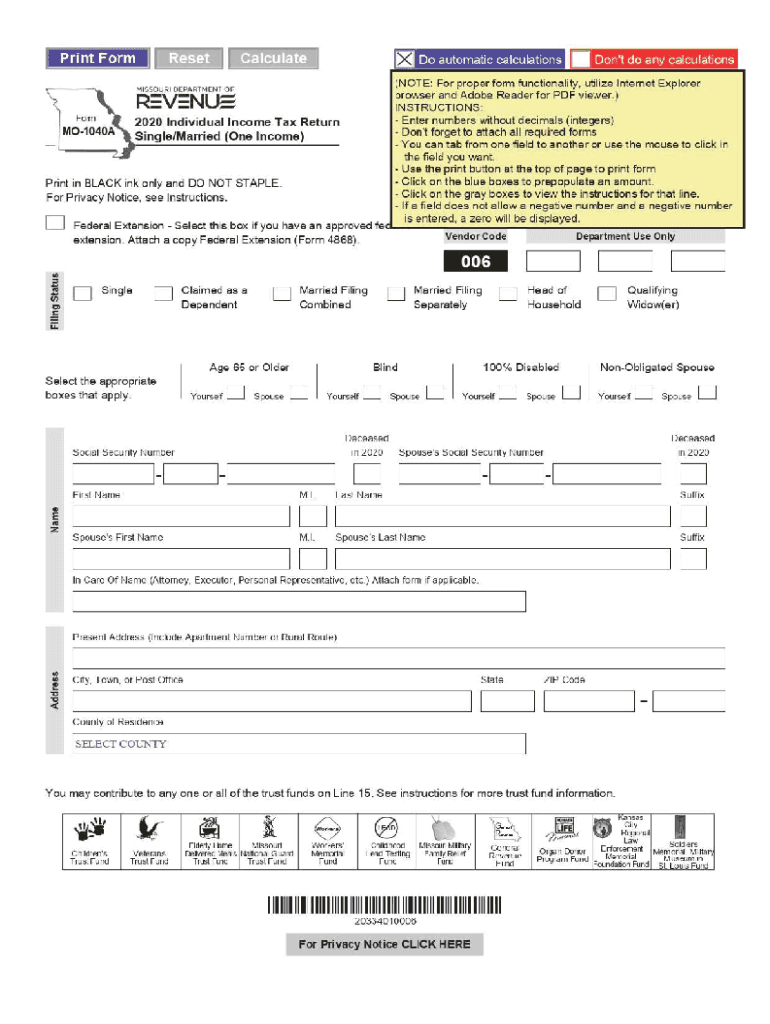

What is the Form MO 1040A?

The MO 1040A is a tax form used by residents of Missouri to report their individual income. This form is specifically designed for taxpayers who meet certain eligibility criteria, allowing them to file their state income tax in a simplified manner. It is essential for individuals who earn income from various sources, including wages, salaries, and other taxable income, to accurately complete this form to ensure compliance with state tax laws.

Steps to Complete the Form MO 1040A

Completing the MO 1040A involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2 forms, 1099 forms, and any other income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income by entering amounts from your income statements in the appropriate sections.

- Calculate your Missouri adjusted gross income by applying any deductions you qualify for.

- Determine your tax liability using the tax tables provided in the instructions.

- Complete any additional schedules if required and ensure all calculations are accurate.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the MO 1040A to avoid penalties. Generally, the form must be filed by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply and ensure they submit their forms on time to avoid interest and penalties.

Required Documents

To accurately complete the MO 1040A, taxpayers need to gather several important documents. These may include:

- W-2 forms from employers detailing annual wages and withheld taxes.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or interest.

- Documentation for any deductions or credits claimed, such as receipts for charitable donations or medical expenses.

Form Submission Methods

The MO 1040A can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file electronically using approved e-filing software, which often provides a streamlined process. Alternatively, the form can be printed and mailed to the appropriate state tax office. In-person submissions may also be possible at designated locations, depending on local regulations.

Key Elements of the Form MO 1040A

The MO 1040A includes several key elements that are essential for accurate tax reporting. These elements consist of personal identification information, income reporting sections, adjustments for deductions, and tax computation areas. Understanding each section is vital for ensuring that all income is reported correctly and that taxpayers receive any eligible refunds or credits.

Quick guide on how to complete form mo 1040a forms and manuals mogov

Effortlessly Prepare Form MO 1040A Forms And Manuals MO gov on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the desired template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Form MO 1040A Forms And Manuals MO gov on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Form MO 1040A Forms And Manuals MO gov with Ease

- Find Form MO 1040A Forms And Manuals MO gov and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important portions of your documents or obscure confidential information with the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form MO 1040A Forms And Manuals MO gov while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040a forms and manuals mogov

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040a forms and manuals mogov

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the form mo 1040a used for?

The form mo 1040a is a simplified version of the Missouri individual income tax return that allows taxpayers to file their state income taxes. This form is designed for those with straightforward tax situations, making it easier to report income and claim deductions. Using airSlate SignNow, you can easily fill out and eSign your form mo 1040a, ensuring a quick and efficient filing process.

-

How can I fill out my form mo 1040a using airSlate SignNow?

To fill out your form mo 1040a using airSlate SignNow, simply upload your tax document to our platform. Our user-friendly interface allows you to fill in the required fields, add your electronic signature, and save your progress. This seamless process can save you time while ensuring your form mo 1040a is ready for submission.

-

What are the benefits of using airSlate SignNow for form mo 1040a?

Using airSlate SignNow for your form mo 1040a provides several benefits, including efficient eSigning capabilities, document tracking, and secure storage. You can save time and streamline your tax filing process while ensuring compliance with Missouri state regulations. Plus, with our affordable pricing plans, managing your forms has never been easier.

-

Is airSlate SignNow secure for submitting form mo 1040a?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting your form mo 1040a. Our platform utilizes advanced encryption and security protocols to protect your personal information during the submission process. You can confidently eSign and manage your tax documents with peace of mind.

-

Can I integrate airSlate SignNow with other software for filing form mo 1040a?

Absolutely! airSlate SignNow offers integrations with a variety of software applications, including popular accounting and tax preparation tools. This means you can effortlessly import your data and manage your form mo 1040a alongside your other financial documents, making your workflow more efficient.

-

What is the pricing structure for using airSlate SignNow with form mo 1040a?

AirSlate SignNow offers flexible pricing plans that cater to individual users and businesses alike. You can choose from monthly or yearly subscriptions based on your needs, providing access to comprehensive features for managing your form mo 1040a efficiently. Review our pricing options to find the plan that best fits your requirements.

-

How does airSlate SignNow improve the signing process for form mo 1040a?

AirSlate SignNow enhances the signing process for your form mo 1040a by offering an intuitive eSignature solution that eliminates the need for printing, scanning, or mailing documents. You can invite others to sign electronically, track the signing process in real-time, and securely store completed forms. This streamlines your tax filing and reduces turnaround times.

Get more for Form MO 1040A Forms And Manuals MO gov

Find out other Form MO 1040A Forms And Manuals MO gov

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe