Mo 1040a Fillable 2019

What is the Mo 1040a Fillable

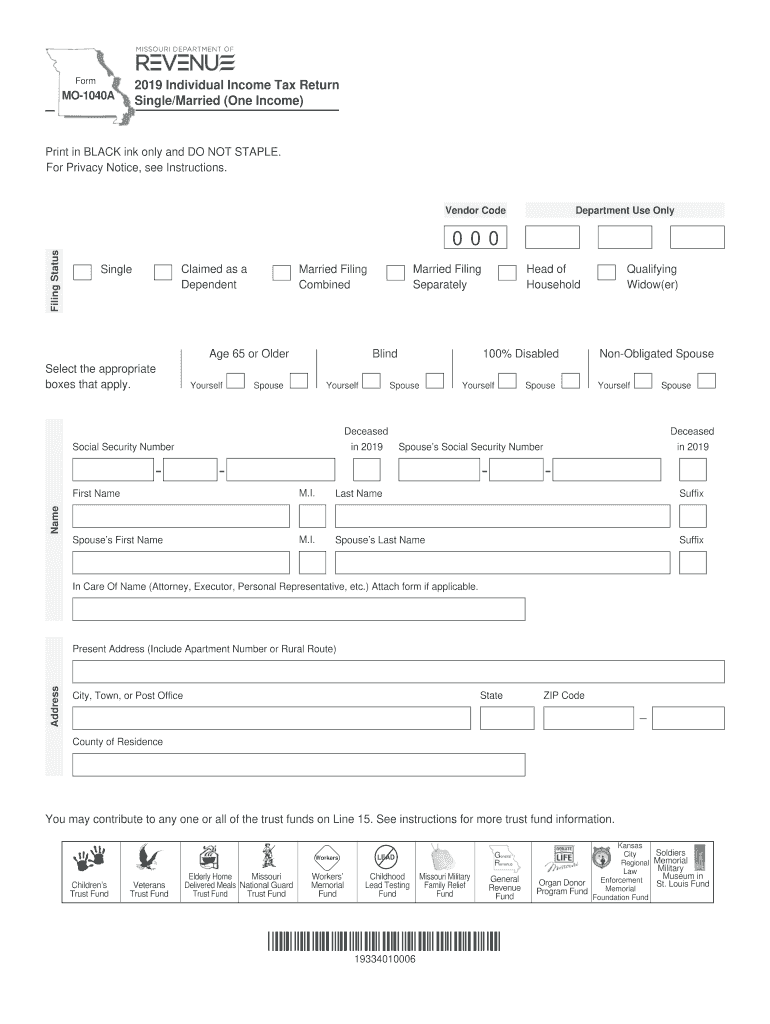

The Mo 1040a fillable form is a simplified state tax return used by residents of Missouri to report their income and calculate their state tax liability. This form is specifically designed for individuals with straightforward tax situations, making it easier to complete compared to more complex forms. The fillable version allows taxpayers to enter their information directly into the document, which can then be printed or submitted electronically. This format enhances accessibility and convenience for users who prefer to manage their tax documents digitally.

Steps to Complete the Mo 1040a Fillable

Completing the Mo 1040a fillable form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Access the fillable form online and enter personal information, such as name, address, and Social Security number.

- Input your income details in the designated sections, ensuring accuracy to avoid issues with your tax return.

- Calculate your tax liability using the provided instructions and any applicable deductions or credits.

- Review the completed form for errors or omissions before finalizing.

How to Obtain the Mo 1040a Fillable

The Mo 1040a fillable form can be obtained through the Missouri Department of Revenue's official website. Users can download the form in a fillable PDF format, allowing for easy completion on a computer. Additionally, many tax preparation software programs include the Mo 1040a fillable form as part of their offerings, providing another avenue for taxpayers to access and complete their state tax returns.

Legal Use of the Mo 1040a Fillable

The Mo 1040a fillable form is legally recognized for filing state income taxes in Missouri, provided that it is completed accurately and submitted by the designated deadlines. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Missouri Department of Revenue. Utilizing a fillable form does not alter its legal standing, as long as all necessary signatures and information are included.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines when filing the Mo 1040a fillable form. Typically, the deadline for submitting state income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates, as they can impact the timely filing of tax returns.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Mo 1040a fillable form:

- Online Submission: Taxpayers can electronically file their completed forms through the Missouri Department of Revenue's e-filing system.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Missouri Department of Revenue.

- In-Person: Some taxpayers may choose to deliver their forms in person at local Department of Revenue offices.

Quick guide on how to complete css fix the flex display in edge stack overflow

Effortlessly Prepare Mo 1040a Fillable on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents quickly without hold-ups. Handle Mo 1040a Fillable seamlessly across any platform using the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

How to Modify and Electronically Sign Mo 1040a Fillable with Ease

- Locate Mo 1040a Fillable and click on Get Form to initiate the process.

- Employ the tools available to complete your document accurately.

- Emphasize important sections of your documents or obscure sensitive information using features provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Mo 1040a Fillable to ensure excellent communication throughout every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct css fix the flex display in edge stack overflow

Create this form in 5 minutes!

How to create an eSignature for the css fix the flex display in edge stack overflow

How to create an eSignature for the Css Fix The Flex Display In Edge Stack Overflow online

How to make an eSignature for the Css Fix The Flex Display In Edge Stack Overflow in Chrome

How to create an electronic signature for putting it on the Css Fix The Flex Display In Edge Stack Overflow in Gmail

How to generate an electronic signature for the Css Fix The Flex Display In Edge Stack Overflow straight from your smart phone

How to create an electronic signature for the Css Fix The Flex Display In Edge Stack Overflow on iOS

How to generate an eSignature for the Css Fix The Flex Display In Edge Stack Overflow on Android devices

People also ask

-

What is the Mo 1040a Fillable form and how can I use it?

The Mo 1040a Fillable form is a simplified version of the Missouri individual income tax return that allows taxpayers to report their income and claim deductions. You can easily fill out this form electronically using airSlate SignNow, making the submission process faster and more efficient. This fillable form helps ensure that you don’t miss any important sections or deductions, simplifying your tax filing experience.

-

Is there a cost associated with using the Mo 1040a Fillable form on airSlate SignNow?

Using the Mo 1040a Fillable form on airSlate SignNow is cost-effective, with various pricing plans available to suit your needs. Whether you're an individual taxpayer or a business, our affordable options ensure you have access to essential features without overspending. You can choose a plan that fits your budget and enjoy the convenience of eSigning documents.

-

What features does airSlate SignNow offer for the Mo 1040a Fillable form?

airSlate SignNow provides several features for the Mo 1040a Fillable form, including easy editing, eSignature capabilities, and secure document storage. Our platform allows you to complete the form electronically, ensuring accuracy and saving you time. Additionally, you can collaborate with others in real-time, making tax preparation a seamless process.

-

How can I eSign the Mo 1040a Fillable form through airSlate SignNow?

eSigning the Mo 1040a Fillable form through airSlate SignNow is straightforward. Once you have filled out your form, simply click on the eSign option, and follow the prompts to add your signature. Our platform ensures that your signature is legally binding and securely stored, giving you peace of mind when submitting your tax documents.

-

Can I store my completed Mo 1040a Fillable forms on airSlate SignNow?

Yes, you can securely store your completed Mo 1040a Fillable forms on airSlate SignNow. Our platform offers cloud storage solutions that allow you to access your documents anytime, anywhere. This means you can easily retrieve your forms for future reference or audits without hassle.

-

Does airSlate SignNow integrate with other tax software for the Mo 1040a Fillable?

Absolutely! airSlate SignNow integrates seamlessly with various tax software applications, allowing you to import and export your Mo 1040a Fillable forms effortlessly. These integrations enhance your workflow by connecting your tax documents with the tools you already use, streamlining the tax filing process.

-

What are the benefits of using airSlate SignNow for the Mo 1040a Fillable form?

Using airSlate SignNow for the Mo 1040a Fillable form offers numerous benefits, including efficiency, accuracy, and convenience. Our platform simplifies the tax filing process, reduces paper usage, and minimizes errors associated with manual entry. Additionally, the ability to eSign documents securely enhances your overall tax preparation experience.

Get more for Mo 1040a Fillable

- Ci 1 rev 9 14ofm ctgov ct form

- Confidential tax information authorization ctia dor wa

- Form 23 13

- Transmitter form

- Vr 056 form

- Official transcript request community colleges of spokane ccs spokane form

- Pc 400 probate 2011 2019 form

- Authorization for payoff vermont department of motor vehicles dmv vermont form

Find out other Mo 1040a Fillable

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form