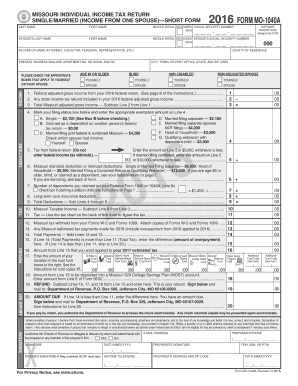

Individual Income Tax Return Short Form MO 1040A Dor Mo 2016

What is the Individual Income Tax Return Short Form MO 1040A Dor Mo

The Individual Income Tax Return Short Form MO 1040A Dor Mo is a simplified tax form used by residents of Missouri to report their income and calculate their state tax liability. This form is designed for individuals with straightforward tax situations, allowing for a more efficient filing process. It typically includes sections for reporting income, claiming deductions, and determining the amount of tax owed or refund due. The MO 1040A is particularly beneficial for those who do not have complex financial circumstances, such as multiple income sources or extensive deductions.

Steps to Complete the Individual Income Tax Return Short Form MO 1040A Dor Mo

Completing the Individual Income Tax Return Short Form MO 1040A Dor Mo involves several key steps:

- Gather Required Documents: Collect all necessary financial documents, including W-2 forms, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Input your total income as reported on your W-2s and other income sources in the designated sections.

- Claim Deductions: Identify and enter any applicable deductions, such as standard deductions or specific credits for which you qualify.

- Calculate Tax Liability: Use the tax tables provided with the form to determine your tax due based on your taxable income.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

How to Obtain the Individual Income Tax Return Short Form MO 1040A Dor Mo

The Individual Income Tax Return Short Form MO 1040A Dor Mo can be obtained through various means. It is available for download from the Missouri Department of Revenue's official website. Additionally, physical copies can be requested from local tax offices or public libraries. Many tax preparation services also provide copies of this form during the tax filing season. Ensuring you have the correct version of the form is crucial, as updates may occur annually.

Legal Use of the Individual Income Tax Return Short Form MO 1040A Dor Mo

The Individual Income Tax Return Short Form MO 1040A Dor Mo is legally recognized for filing state income taxes in Missouri. To ensure its legal standing, it must be completed accurately and submitted by the designated deadline. The form must also be signed by the taxpayer, and electronic submissions must comply with eSignature laws to be considered valid. Utilizing a secure electronic signature solution can enhance the legal acceptance of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Return Short Form MO 1040A Dor Mo typically align with federal tax deadlines. Generally, the deadline for filing your state tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines and to file your return on time to avoid penalties.

Required Documents

To complete the Individual Income Tax Return Short Form MO 1040A Dor Mo, several documents are necessary:

- W-2 forms from employers

- 1099 forms for any additional income

- Records of any deductions or credits being claimed

- Social Security number and identification

- Bank account information for direct deposit of refunds

Having these documents ready will streamline the filing process and help ensure accuracy in reporting income and claiming deductions.

Quick guide on how to complete 2016 individual income tax return short form mo 1040a dor mo

Effortlessly Prepare Individual Income Tax Return Short Form MO 1040A Dor Mo on Any Device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Individual Income Tax Return Short Form MO 1040A Dor Mo on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Alter and eSign Individual Income Tax Return Short Form MO 1040A Dor Mo with Ease

- Find Individual Income Tax Return Short Form MO 1040A Dor Mo and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Income Tax Return Short Form MO 1040A Dor Mo while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 individual income tax return short form mo 1040a dor mo

Create this form in 5 minutes!

How to create an eSignature for the 2016 individual income tax return short form mo 1040a dor mo

How to create an electronic signature for the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo in the online mode

How to create an electronic signature for the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo in Chrome

How to generate an electronic signature for signing the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo in Gmail

How to create an eSignature for the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo from your smart phone

How to create an eSignature for the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo on iOS devices

How to make an electronic signature for the 2016 Individual Income Tax Return Short Form Mo 1040a Dor Mo on Android

People also ask

-

What is the Individual Income Tax Return Short Form MO 1040A Dor Mo?

The Individual Income Tax Return Short Form MO 1040A Dor Mo is a simplified tax return form designed for Missouri residents. It allows eligible taxpayers to file their state income taxes easily and efficiently. This form is particularly beneficial for individuals with straightforward tax situations, minimizing the complexities often associated with longer forms.

-

How can airSlate SignNow help with filing the Individual Income Tax Return Short Form MO 1040A Dor Mo?

airSlate SignNow provides a user-friendly platform to electronically sign and send your Individual Income Tax Return Short Form MO 1040A Dor Mo. By simplifying the document management process, you can ensure that your tax return is submitted accurately and on time. Our secure e-signature solution enhances efficiency in handling important tax documents.

-

What are the features of using airSlate SignNow for the Individual Income Tax Return Short Form MO 1040A Dor Mo?

Using airSlate SignNow for the Individual Income Tax Return Short Form MO 1040A Dor Mo includes features like intuitive drag-and-drop document assembly, real-time collaboration, and the ability to track the status of your tax submissions. Additionally, the platform supports multiple file formats, making it versatile for various tax-related documents. These features ensure a seamless user experience.

-

Is airSlate SignNow cost-effective for filing the Individual Income Tax Return Short Form MO 1040A Dor Mo?

Yes, airSlate SignNow offers cost-effective solutions for managing documents including the Individual Income Tax Return Short Form MO 1040A Dor Mo. The pricing plans are designed to accommodate different user needs, whether you are an individual taxpayer or a professional service provider. You can choose a plan that best fits your requirements without compromising on functionality.

-

Can I integrate airSlate SignNow with other software for filing the Individual Income Tax Return Short Form MO 1040A Dor Mo?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and financial software solutions to streamline the filing of your Individual Income Tax Return Short Form MO 1040A Dor Mo. This integration allows for automatic data transfer, reducing the risk of errors and saving time in your tax preparation process. Enjoy a more efficient workflow by combining our eSigning features with your existing software.

-

What benefits does airSlate SignNow provide when using the Individual Income Tax Return Short Form MO 1040A Dor Mo?

The main benefits of using airSlate SignNow for the Individual Income Tax Return Short Form MO 1040A Dor Mo include enhanced security through encrypted e-signatures, faster processing times, and the ability to store and manage documents securely. Additionally, our platform is designed for ease of use, enabling anyone to navigate the filing process confidently. This reduces stress during tax season and ensures compliance with state regulations.

-

How do I begin using airSlate SignNow for my Individual Income Tax Return Short Form MO 1040A Dor Mo?

Getting started with airSlate SignNow for your Individual Income Tax Return Short Form MO 1040A Dor Mo is simple. Just sign up for an account on our website, choose a suitable pricing plan, and start uploading your documents. From there, you can easily customize your forms, gather signatures, and manage your tax return electronically—all in one centralized platform.

Get more for Individual Income Tax Return Short Form MO 1040A Dor Mo

- District nominating committee worksheet boy scouts of america ntier form

- Ar form arkansas 2015 2019

- Nycha pet registration form

- Osss 2 odometer disclosure statement the state of new jersey newjersey form

- Application for enrolment kimberley college kimberleycollege form

- Kimberley college application form

- Appendix ix i hud 52667 ua schedule california department of hcd ca form

- Mv2971 in god we trust license plate information and application

Find out other Individual Income Tax Return Short Form MO 1040A Dor Mo

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors