St 100 Form 2020

What is the St 100 Form

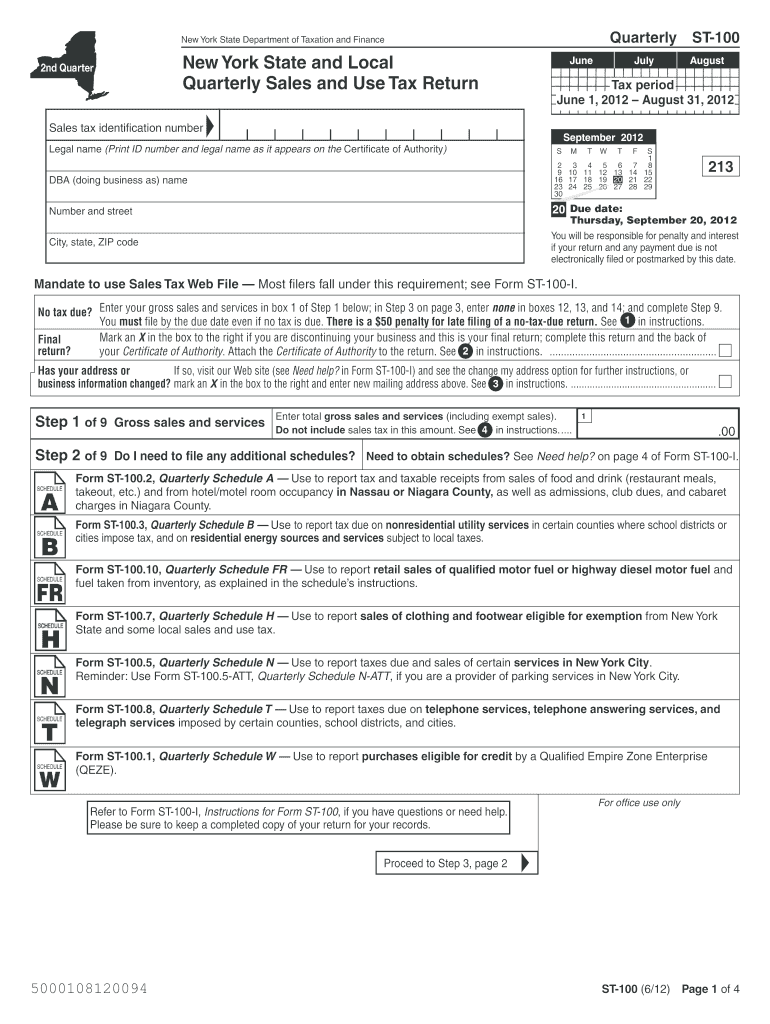

The NYS tax form ST-100 is a sales tax return form used by businesses in New York State. This form is essential for reporting sales tax collected on taxable sales and for calculating the amount of tax owed to the state. It is typically filed quarterly, making it crucial for businesses to maintain accurate records of their sales and tax collections throughout the reporting period. The ST-100 form is designed for various types of businesses, including sole proprietors, partnerships, and corporations, ensuring compliance with New York State tax regulations.

How to use the St 100 Form

Using the ST-100 form involves several steps to ensure accurate reporting of sales tax. First, gather all necessary sales records for the reporting period, including total sales and any exempt sales. Next, calculate the total sales tax collected during the period by applying the appropriate tax rates to taxable sales. Fill out the form by entering the required information, including your business details and the calculated sales tax. Finally, review the completed form for accuracy before submitting it to the New York State Department of Taxation and Finance.

Steps to complete the St 100 Form

Completing the ST-100 form requires careful attention to detail. Follow these steps:

- Gather sales records and documentation for the reporting period.

- Calculate total taxable sales and any exempt sales.

- Determine the total sales tax collected based on applicable rates.

- Fill in your business information at the top of the form.

- Enter the calculated sales tax amounts in the appropriate sections of the form.

- Review the form for accuracy and completeness.

- Submit the form by the due date, either online or by mail.

Legal use of the St 100 Form

The legal use of the ST-100 form is governed by New York State tax laws. It is essential for businesses to file this form accurately and on time to avoid penalties. The form serves as a legal document that confirms the sales tax collected and remitted to the state. Proper completion and submission of the ST-100 ensure compliance with state regulations and help maintain good standing with the New York State Department of Taxation and Finance.

Form Submission Methods

The ST-100 form can be submitted through various methods to accommodate different business needs. Businesses have the option to file the form online through the New York State Department of Taxation and Finance website, which offers a streamlined process for electronic submission. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submission is also an option, allowing businesses to deliver the form directly to a tax office if preferred. Each method has its own deadlines and requirements, so it is important to choose the one that best fits your situation.

Filing Deadlines / Important Dates

Filing deadlines for the ST-100 form are crucial for maintaining compliance with New York State tax regulations. The form is typically due on the last day of the month following the end of each quarter. For example, the due dates are generally April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. It is important for businesses to mark these dates on their calendars and ensure timely submission to avoid late fees and penalties.

Quick guide on how to complete st 100 form

Prepare St 100 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage St 100 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign St 100 Form with ease

- Find St 100 Form and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign St 100 Form and guarantee smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 100 form

Create this form in 5 minutes!

How to create an eSignature for the st 100 form

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the nys tax form st100 and why do I need it?

The nys tax form st100 is a New York State sales tax return that businesses need to file to report sales and pay the appropriate sales tax. It is crucial for compliance with state tax regulations, ensuring your business avoids penalties. By using airSlate SignNow, you can easily eSign and submit your nys tax form st100, simplifying the process.

-

How can airSlate SignNow help me with my nys tax form st100?

airSlate SignNow provides an efficient platform to send, sign, and manage your nys tax form st100 electronically. The user-friendly interface allows for quick document preparation and collaboration, ensuring you can focus on business rather than paperwork. With real-time tracking, you can stay updated on the status of your nys tax form st100 submission.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs, including options specifically designed for managing forms like the nys tax form st100. Each plan includes features that enhance document workflow and compliance management. Choose the plan that aligns best with your budget and requirements for handling tax forms.

-

Are there integrations available with airSlate SignNow for filing the nys tax form st100?

Yes, airSlate SignNow integrates with various accounting and business software, making it easier to manage your nys tax form st100 processes. Integrations streamline your workflow by allowing easy access to your financial data for accurate form completion. This setup enhances efficiency and helps ensure compliance with state regulations.

-

Can I store my completed nys tax form st100 on airSlate SignNow?

Absolutely! airSlate SignNow offers secure document storage, allowing you to keep your completed nys tax form st100 and other important documents organized and accessible at any time. This feature ensures that you can quickly retrieve past forms when needed, helping you stay compliant with tax obligations. Data security is a top priority, ensuring your information remains protected.

-

Is the process of eSigning the nys tax form st100 secure?

Yes, eSigning the nys tax form st100 through airSlate SignNow is highly secure. The platform uses advanced encryption and authentication measures to protect your documents and personal information. This ensures that your eSigned forms are legally binding and that your data remains confidential.

-

What benefits do businesses get from using airSlate SignNow for nys tax form st100?

Using airSlate SignNow for your nys tax form st100 can signNowly reduce the time spent on paperwork while improving accuracy and compliance. It streamlines the entire signing and submission process, allowing you to focus on your business operations. Additionally, the convenience of electronic records simplifies audits and financial reviews.

Get more for St 100 Form

- Personal information sheet

- Iec 17050 1 download form

- Sa1 form pdf editable

- Discharge planning form 82484907

- Icc 619 664 form

- Bambino maternity programme form

- Simulation design template form

- Behaviour interventionmental illness instructional support planning process behaviour interventionmental illness instructional form

Find out other St 100 Form

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself