Form or Stt 1 2020

What is the Form Or STT 1

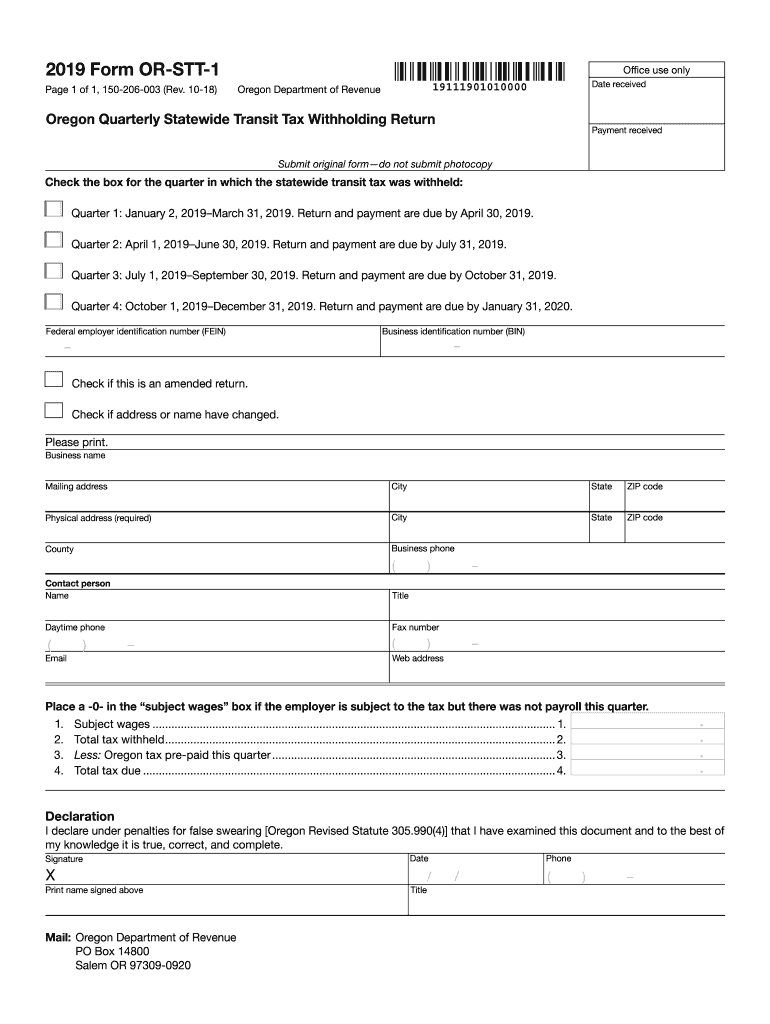

The 2019 form or STT 1 is a specific tax form used primarily for reporting certain financial transactions and information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to disclose various types of income or tax-related information. Understanding the purpose and requirements of the form is crucial for ensuring compliance with federal tax regulations.

How to Use the Form Or STT 1

Using the 2019 form or STT 1 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the transactions being reported. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the IRS. It is important to retain a copy of the completed form for your records.

Steps to Complete the Form Or STT 1

Completing the 2019 form or STT 1 requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or other authorized sources.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details of the transactions that require reporting, ensuring all amounts are accurate.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

Legal Use of the Form Or STT 1

The 2019 form or STT 1 is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is important to understand the legal implications of the information reported on the form, as inaccuracies or omissions can lead to penalties or audits. Compliance with all relevant tax laws is essential to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 form or STT 1 are critical for compliance. Typically, the form must be submitted by a specific date each year, often aligning with the tax filing deadline. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties or interest charges.

Required Documents

To complete the 2019 form or STT 1 accurately, certain documents are required. These may include:

- Previous tax returns for reference.

- Income statements such as W-2s or 1099s.

- Documentation of any deductions or credits being claimed.

- Any additional forms related to specific transactions.

Form Submission Methods

The 2019 form or STT 1 can be submitted through various methods. Options typically include:

- Online submission through the IRS e-file system.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Quick guide on how to complete 2019 form or stt 1

Easily Create Form Or Stt 1 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, as you can acquire the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your documents swiftly without delays. Manage Form Or Stt 1 on any device using airSlate SignNow Android or iOS apps and enhance any document-related process today.

The easiest way to modify and eSign Form Or Stt 1 effortlessly

- Obtain Form Or Stt 1 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to send your form, either via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced paperwork, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Or Stt 1 and ensure excellent communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form or stt 1

Create this form in 5 minutes!

How to create an eSignature for the 2019 form or stt 1

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 2019 form or stt 1 used for?

The 2019 form or stt 1 is primarily used for reporting specific financial information to relevant authorities. It ensures compliance with tax regulations and facilitates easier management of financial records. Utilizing airSlate SignNow to sign this form helps streamline the process and ensure timely submissions.

-

How can I easily eSign the 2019 form or stt 1?

With airSlate SignNow, you can effortlessly eSign the 2019 form or stt 1 in just a few clicks. Our platform provides a user-friendly interface that allows you to upload your form, add your electronic signature, and share it with necessary parties securely. This eliminates the hassle of printing and scanning documents.

-

Is airSlate SignNow cost-effective for signing multiple 2019 forms or stt 1?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for signing multiple 2019 forms or stt 1. Depending on your usage, you can choose a plan that fits your budget while still providing robust features. This helps businesses save time and money on document management.

-

What features does airSlate SignNow offer for managing the 2019 form or stt 1?

airSlate SignNow includes features such as customizable templates, automatic reminders, and secure storage for the 2019 form or stt 1. Additionally, you can track the status of your documents and receive notifications once they are signed. These features enhance efficiency and help keep your workflow organized.

-

Can I integrate airSlate SignNow with other applications for the 2019 form or stt 1?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Microsoft Office, and CRM systems, making it easier to manage the 2019 form or stt 1 within your existing workflows. This connectivity improves collaboration and ensures that all relevant documents are easily accessible.

-

What benefits can I expect from using airSlate SignNow for the 2019 form or stt 1?

Using airSlate SignNow for the 2019 form or stt 1 offers numerous benefits, including enhanced security, faster turnaround times, and improved compliance. Our secure platform protects sensitive data while allowing for quick signatures, ensuring that your documents are processed efficiently. Overall, it simplifies your workflow and allows you to focus on your core business activities.

-

Is it easy to get started with airSlate SignNow for signing the 2019 form or stt 1?

Yes, getting started with airSlate SignNow is incredibly easy and straightforward. Simply sign up for an account, upload your 2019 form or stt 1, and follow the prompts to add your signature. Our intuitive interface and helpful customer support make the onboarding process seamless for all users.

Get more for Form Or Stt 1

Find out other Form Or Stt 1

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template