W 3 Form for State of Delaware for 2017

What is the W-3 Form for State of Delaware?

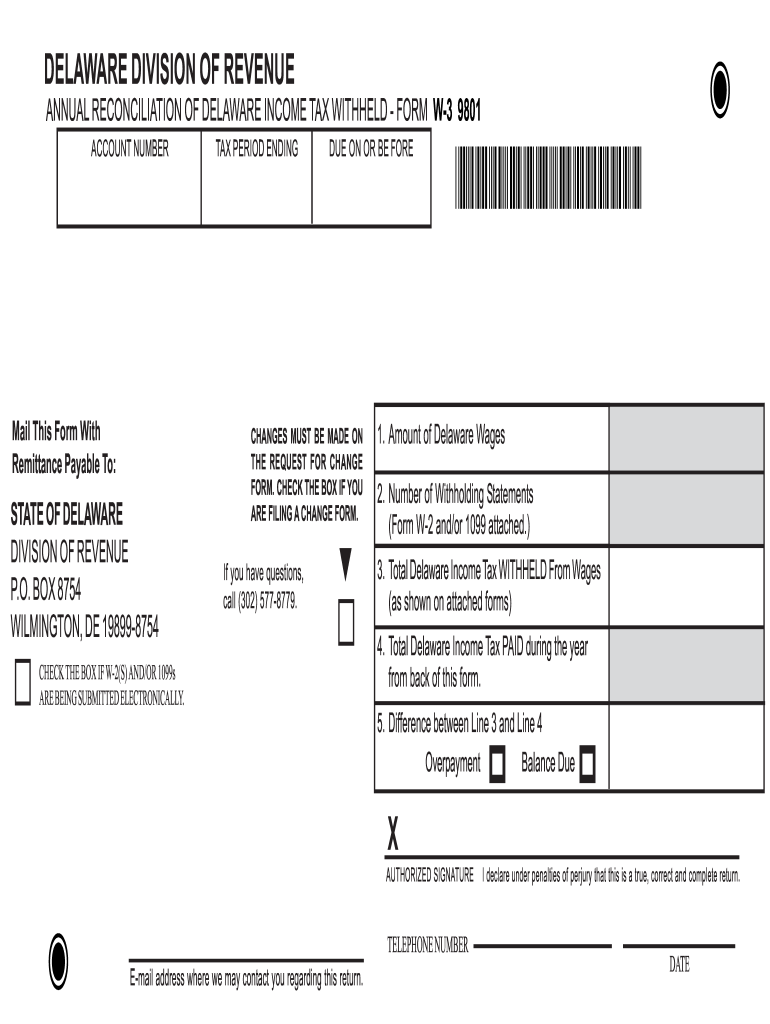

The W-3 Form for the State of Delaware is a summary form that accompanies the W-2 forms submitted by employers to report wages paid to employees and the taxes withheld from those wages. This form is essential for businesses to comply with state and federal reporting requirements. It consolidates the information from all W-2 forms issued by an employer during the tax year, providing a comprehensive overview of payroll data.

How to Use the W-3 Form for State of Delaware

Using the W-3 Form involves filling out the form accurately based on the information from all W-2 forms issued. Employers must ensure that the total number of W-2 forms aligns with the total wages and taxes reported. Once completed, the W-3 must be submitted to the Delaware Division of Revenue along with the W-2 forms. This submission can be done electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to Complete the W-3 Form for State of Delaware

Completing the W-3 Form requires careful attention to detail. Here are the steps to follow:

- Gather all W-2 forms issued to employees during the tax year.

- Fill in the employer's information, including name, address, and federal employer identification number (EIN).

- Summarize total wages, tips, and other compensation paid to employees.

- Calculate total state income tax withheld from employees' wages.

- Review all entries for accuracy before submission.

Legal Use of the W-3 Form for State of Delaware

The W-3 Form serves a legal purpose by ensuring that employers report employee wages and taxes accurately to the state. This compliance is critical to avoid penalties and ensure that employees receive proper credit for their earnings and tax contributions. The form must be submitted by the designated deadline to maintain compliance with Delaware state laws.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the W-3 Form. Typically, the deadline for submitting the W-3 and W-2 forms to the Delaware Division of Revenue is January thirty-first of the year following the tax year. It is essential for employers to keep track of these dates to avoid late filing penalties.

Required Documents

To complete the W-3 Form, employers need the following documents:

- Completed W-2 forms for each employee.

- Employer identification number (EIN).

- Records of total wages paid and taxes withheld.

Form Submission Methods

The W-3 Form can be submitted to the Delaware Division of Revenue using various methods. Employers can choose to file electronically through the state’s online portal or submit paper forms by mail. Each method has its own guidelines and requirements, so it is important to follow the instructions provided by the Delaware Division of Revenue for successful submission.

Quick guide on how to complete w 3 form for state of delaware for 2015

Prepare W 3 Form For State Of Delaware For effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle W 3 Form For State Of Delaware For on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign W 3 Form For State Of Delaware For without hassle

- Find W 3 Form For State Of Delaware For and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature utilizing the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign W 3 Form For State Of Delaware For and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 3 form for state of delaware for 2015

Create this form in 5 minutes!

How to create an eSignature for the w 3 form for state of delaware for 2015

The best way to generate an eSignature for a PDF document in the online mode

The best way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the W 3 Form For State Of Delaware For?

The W 3 Form For State Of Delaware For is a summary form used to report the total earnings, taxes withheld, and other information for employees throughout the year. It provides a comprehensive overview of the W-2 forms you send to the state, ensuring compliance with tax regulations. This form is essential for businesses operating in Delaware to accurately fulfill their tax obligations.

-

How can airSlate SignNow help me manage the W 3 Form For State Of Delaware For?

airSlate SignNow streamlines the management of the W 3 Form For State Of Delaware For by allowing businesses to upload, eSign, and securely send documents electronically. You can easily create templates for the W 3 Form and ensure that all information is filled out correctly. This saves time and improves efficiency in your payroll management process.

-

Is there a cost associated with using airSlate SignNow for the W 3 Form For State Of Delaware For?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs, with pricing designed to be cost-effective. The cost will depend on the features you choose and the number of users. Regardless of the plan, using airSlate SignNow simplifies the process of handling the W 3 Form For State Of Delaware For, ultimately reducing overhead costs.

-

What features does airSlate SignNow offer for the W 3 Form For State Of Delaware For?

airSlate SignNow provides several features that enhance your experience with the W 3 Form For State Of Delaware For. These include customizable templates, electronic signatures, cloud storage, and automated reminders to ensure timely submissions. These features help you keep your documents organized and compliant with state regulations.

-

Can I integrate airSlate SignNow with other software for the W 3 Form For State Of Delaware For?

Absolutely! airSlate SignNow offers integrations with popular accounting and HR software to help streamline your workflow. This means you can easily combine your payroll systems with the W 3 Form For State Of Delaware For, enabling efficient data transfer and minimizing errors in document handling.

-

What are the benefits of using airSlate SignNow for the W 3 Form For State Of Delaware For?

Using airSlate SignNow for the W 3 Form For State Of Delaware For provides many benefits, such as enhanced efficiency, reduced paperwork, and improved document security. The platform simplifies your eSignature processes and allows for quicker approvals. By using this service, you can focus more on your business operations rather than getting bogged down by paperwork.

-

Is airSlate SignNow secure for processing the W 3 Form For State Of Delaware For?

Yes, airSlate SignNow prioritizes security and is compliant with industry standards to protect your sensitive information related to the W 3 Form For State Of Delaware For. All documents are encrypted both in transit and at rest, ensuring that your data remains confidential. You can trust airSlate SignNow to keep your tax documents safe.

Get more for W 3 Form For State Of Delaware For

Find out other W 3 Form For State Of Delaware For

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple