Form 81 110 Mississippi Department of Revenue Dor Ms 2019

What is the Form 81 110 Mississippi Department Of Revenue Dor Ms

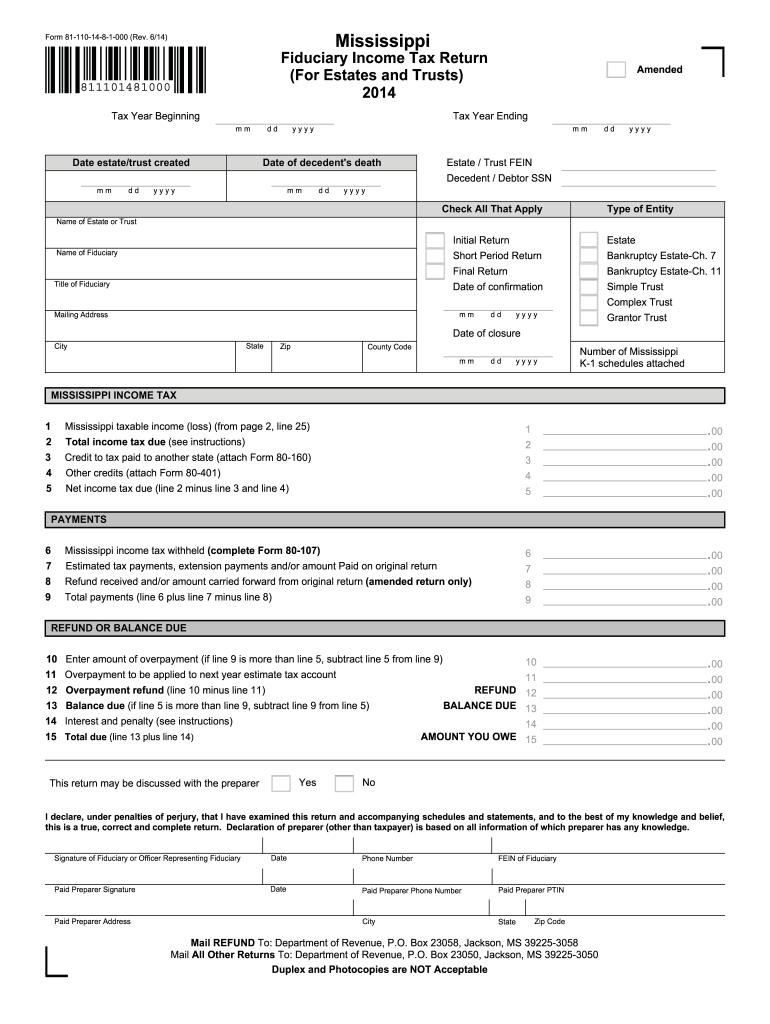

The Form 81 110 is a document issued by the Mississippi Department of Revenue, specifically designed for taxpayers in the state. This form is utilized primarily for reporting specific tax-related information and ensuring compliance with state tax regulations. It serves as a crucial tool for individuals and businesses to accurately report their financial activities to the state authorities.

How to use the Form 81 110 Mississippi Department Of Revenue Dor Ms

Using the Form 81 110 involves several steps to ensure that the information provided is accurate and complete. Taxpayers should first download the form from the Mississippi Department of Revenue's official website. After obtaining the form, it is essential to read the instructions carefully to understand the required fields. Once the necessary information is filled out, the form can be submitted either electronically or via traditional mail, depending on the submission guidelines provided by the department.

Steps to complete the Form 81 110 Mississippi Department Of Revenue Dor Ms

Completing the Form 81 110 requires attention to detail. Here are the steps to follow:

- Download the form from the Mississippi Department of Revenue website.

- Read the instructions thoroughly to understand what information is needed.

- Fill in your personal or business information as required.

- Provide any necessary financial data, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified method, either online or by mail.

Legal use of the Form 81 110 Mississippi Department Of Revenue Dor Ms

The Form 81 110 holds legal significance as it is a formal declaration to the state regarding tax obligations. Proper completion and submission of this form ensure compliance with Mississippi tax laws. Failure to submit the form accurately or on time may result in penalties, making it crucial for taxpayers to understand its legal implications. The form must be filled out truthfully, as any misinformation can lead to legal consequences.

State-specific rules for the Form 81 110 Mississippi Department Of Revenue Dor Ms

Each state has its own set of rules and regulations regarding tax forms, including the Form 81 110. In Mississippi, taxpayers must adhere to specific guidelines outlined by the Department of Revenue. These may include deadlines for submission, the type of information required, and any additional documentation that must accompany the form. It is important for taxpayers to stay informed about these rules to ensure compliance and avoid potential issues with their tax filings.

Form Submission Methods (Online / Mail / In-Person)

The Form 81 110 can be submitted through various methods, providing flexibility for taxpayers. The Mississippi Department of Revenue allows for electronic submission via their online portal, which is often the quickest method. Alternatively, taxpayers can print the completed form and mail it to the appropriate address. In some cases, in-person submission may also be an option at designated state offices. It is advisable to check the latest submission guidelines to choose the most suitable method.

Quick guide on how to complete form 81 110 mississippi department of revenue dor ms

Effortlessly Prepare Form 81 110 Mississippi Department Of Revenue Dor Ms on Any Device

Digital document management has gained signNow traction among companies and individuals alike. It serves as a fantastic eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your paperwork without any delays. Handle Form 81 110 Mississippi Department Of Revenue Dor Ms on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-driven process today.

The easiest method to edit and electronically sign Form 81 110 Mississippi Department Of Revenue Dor Ms effortlessly

- Find Form 81 110 Mississippi Department Of Revenue Dor Ms and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere moments and carries the same legal validity as a conventional handwritten signature.

- Review the information carefully and click on the Done button to finalize your changes.

- Select your preferred method for sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Form 81 110 Mississippi Department Of Revenue Dor Ms to ensure smooth communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 81 110 mississippi department of revenue dor ms

Create this form in 5 minutes!

How to create an eSignature for the form 81 110 mississippi department of revenue dor ms

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 81 110 Mississippi Department Of Revenue Dor Ms. used for?

Form 81 110 Mississippi Department Of Revenue Dor Ms. is utilized for specific tax filings and compliance related to the state of Mississippi. This form helps ensure that businesses accurately report their tax obligations. It is crucial for maintaining proper compliance with state regulations.

-

How can I fill out Form 81 110 Mississippi Department Of Revenue Dor Ms. using airSlate SignNow?

With airSlate SignNow, filling out Form 81 110 Mississippi Department Of Revenue Dor Ms. is a breeze. You can easily upload the form, add necessary information, and utilize electronic signatures for a seamless workflow. The platform's user-friendly interface simplifies the entire process, making it efficient and straightforward.

-

Is there a cost associated with using airSlate SignNow for Form 81 110 Mississippi Department Of Revenue Dor Ms.?

airSlate SignNow offers various pricing plans tailored to fit different business needs. While there may be costs associated with premium features, the platform provides a cost-effective solution for managing documents, including Form 81 110 Mississippi Department Of Revenue Dor Ms. You can choose a plan that aligns with your requirements.

-

What are the key features of airSlate SignNow relevant to Form 81 110 Mississippi Department Of Revenue Dor Ms.?

airSlate SignNow boasts several features that enhance the handling of Form 81 110 Mississippi Department Of Revenue Dor Ms. These include customizable templates, real-time collaboration, and secure eSigning capabilities. These features streamline the filing process and improve overall efficiency.

-

Can I integrate airSlate SignNow with other tools when working on Form 81 110 Mississippi Department Of Revenue Dor Ms.?

Yes, airSlate SignNow supports various integrations with popular applications and platforms. You can seamlessly connect your tools to manage Form 81 110 Mississippi Department Of Revenue Dor Ms. effectively. This integration capability helps businesses enhance their workflow and document management.

-

What is the benefit of eSigning Form 81 110 Mississippi Department Of Revenue Dor Ms. with airSlate SignNow?

eSigning Form 81 110 Mississippi Department Of Revenue Dor Ms. through airSlate SignNow provides numerous advantages, including faster turnaround times and enhanced accessibility. It eliminates the need for physical paperwork, making the process more efficient and eco-friendly. Additionally, it ensures that signatures are legally binding and secure.

-

How does airSlate SignNow ensure the security of my Form 81 110 Mississippi Department Of Revenue Dor Ms. documents?

airSlate SignNow prioritizes the security of all documents, including Form 81 110 Mississippi Department Of Revenue Dor Ms. The platform employs advanced encryption techniques and secure cloud storage to protect your sensitive information. This commitment to security ensures that your data remains safe and confidential.

Get more for Form 81 110 Mississippi Department Of Revenue Dor Ms

- Natures morphology pdf form

- Read the clues and fill in the missing words form

- Anganwadi all form pdf

- Mike ferry daily tracking form 59358707

- Fillable std results form

- Form it 256 claim for special additional mortgage

- Ds 5511 affidavit for the surviving spouse or next of kin form

- Date mmddyyyy evidence of property insurance this evidence of property insurance is issued as a matter of information only and

Find out other Form 81 110 Mississippi Department Of Revenue Dor Ms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors