Dor Mo GovformsindexForms and Manuals Missouri 2021

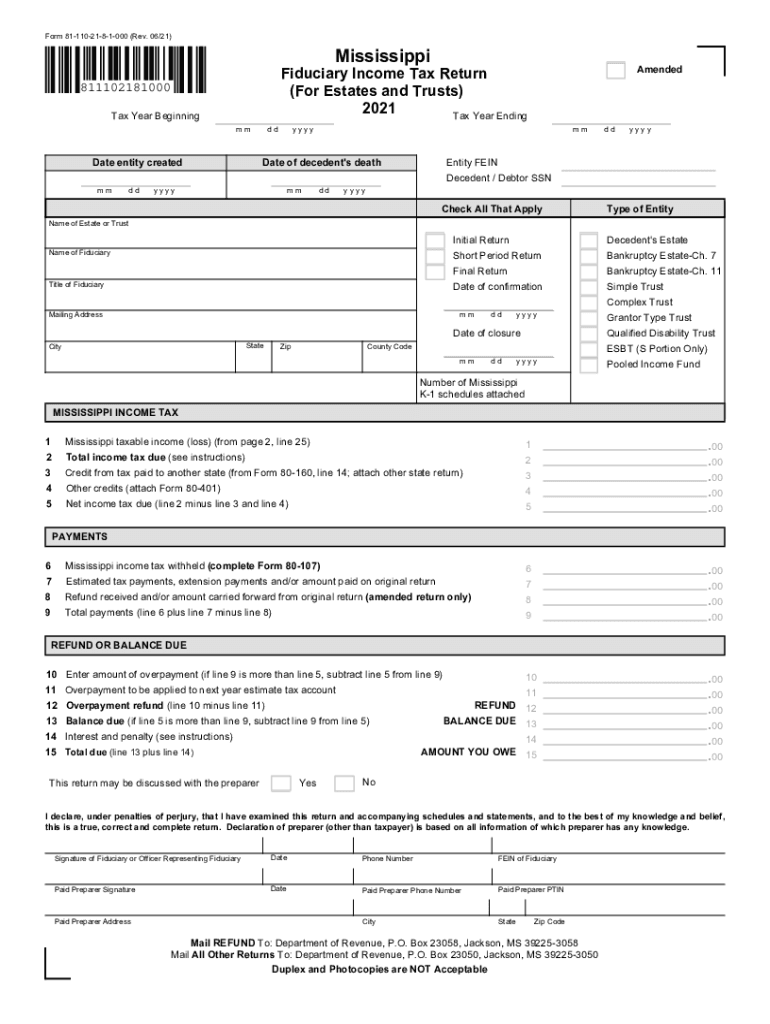

Understanding the Mississippi Tax Trusts Form

The Mississippi tax trusts form, specifically Form 81-110, is essential for reporting income generated by trusts in the state. This form is designed for fiduciaries managing trusts, ensuring compliance with state tax regulations. It captures vital information regarding the income, deductions, and distributions associated with the trust, which is crucial for accurate tax reporting. Understanding the nuances of this form helps fiduciaries navigate their responsibilities effectively.

Steps to Complete the Mississippi Tax Trusts Form

Filling out the Mississippi tax trusts form involves several key steps:

- Gather necessary information about the trust, including its name, tax identification number, and financial details.

- Document all sources of income received by the trust during the tax year.

- List any deductions applicable to the trust, such as administrative expenses or distributions to beneficiaries.

- Complete all sections of Form 81-110 accurately, ensuring that all figures are correct and reflect the trust's financial activities.

- Review the completed form for accuracy before submission.

Required Documents for Filing

When preparing to file the Mississippi tax trusts form, several documents are necessary to support the information provided:

- Trust agreement or declaration, outlining the terms and conditions of the trust.

- Financial statements detailing income and expenses for the tax year.

- Records of distributions made to beneficiaries.

- Any additional documentation required to substantiate deductions claimed.

Filing Deadlines for the Mississippi Tax Trusts Form

Fiduciaries must adhere to specific deadlines when filing the Mississippi tax trusts form. Generally, the form is due on the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this typically means an April 15 deadline. It is essential to stay informed about these deadlines to avoid penalties and ensure compliance.

Form Submission Methods

The Mississippi tax trusts form can be submitted through various methods, providing flexibility for fiduciaries. Options include:

- Online submission through the Mississippi Department of Revenue's electronic filing system.

- Mailing a completed paper form to the appropriate address designated by the state.

- In-person submission at local tax offices, if preferred.

Penalties for Non-Compliance

Failure to file the Mississippi tax trusts form on time or inaccuracies in the submitted information can result in penalties. These penalties may include fines or interest on unpaid taxes. It is crucial for fiduciaries to ensure timely and accurate filing to avoid these consequences and maintain compliance with state tax laws.

Quick guide on how to complete dormogovformsindexforms and manuals missouri

Complete Dor mo govformsindexForms And Manuals Missouri effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Manage Dor mo govformsindexForms And Manuals Missouri on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Dor mo govformsindexForms And Manuals Missouri seamlessly

- Find Dor mo govformsindexForms And Manuals Missouri and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Dor mo govformsindexForms And Manuals Missouri and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dormogovformsindexforms and manuals missouri

Create this form in 5 minutes!

How to create an eSignature for the dormogovformsindexforms and manuals missouri

The way to generate an e-signature for your PDF document online

The way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Mississippi tax trusts form?

The Mississippi tax trusts form is a legal document used to establish a trust in Mississippi for tax purposes. It outlines the terms under which assets can be managed and distributed, ensuring compliance with state tax laws. Understanding how to fill out this form accurately is crucial for effective estate planning.

-

How can airSlate SignNow help with completing the Mississippi tax trusts form?

AirSlate SignNow provides easy-to-use templates that simplify the process of completing the Mississippi tax trusts form. With our platform, you can fill out the form electronically, ensuring all necessary fields are properly completed. This reduces the risk of errors and helps streamline the documentation process.

-

Is there a cost associated with using airSlate SignNow for the Mississippi tax trusts form?

Yes, airSlate SignNow operates on a subscription model, providing various pricing plans to suit different needs. Our pricing is competitive and allows you to access all features, including assistance with the Mississippi tax trusts form. We also offer a free trial for first-time users to explore the platform without commitment.

-

What features does airSlate SignNow offer for the Mississippi tax trusts form?

AirSlate SignNow includes features such as electronic signatures, customizable templates, and real-time collaboration for the Mississippi tax trusts form. Users can easily track document status and send reminders for signatures. These features enhance productivity and ensure compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software while completing the Mississippi tax trusts form?

Absolutely! AirSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and CRM systems. This means you can manage your files and the Mississippi tax trusts form without switching between platforms, ensuring a more efficient workflow.

-

What are the benefits of using airSlate SignNow for my Mississippi tax trusts form needs?

Using airSlate SignNow for the Mississippi tax trusts form streamlines the signing and storing process, saving you time and reducing paperwork. Our user-friendly interface makes it accessible for all users, regardless of their tech savvy. Additionally, secure storage ensures your documents are protected and readily available.

-

How can I ensure my Mississippi tax trusts form is compliant with state laws?

By using airSlate SignNow, you can access templates that are designed to be compliant with Mississippi state laws regarding tax trusts. Additionally, we provide guidance and tips to assist you in filling out the Mississippi tax trusts form correctly. Always consult with a legal advisor for specific questions regarding compliance.

Get more for Dor mo govformsindexForms And Manuals Missouri

- Quitclaim deed by two individuals to husband and wife kentucky form

- Warranty deed from two individuals to husband and wife kentucky form

- Single family dwelling form

- Kentucky succession form

- Notice of furnishing professional individual kentucky form

- Quitclaim deed by two individuals to llc kentucky form

- Warranty deed from two individuals to llc kentucky form

- Kentucky notice 497307900 form

Find out other Dor mo govformsindexForms And Manuals Missouri

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will