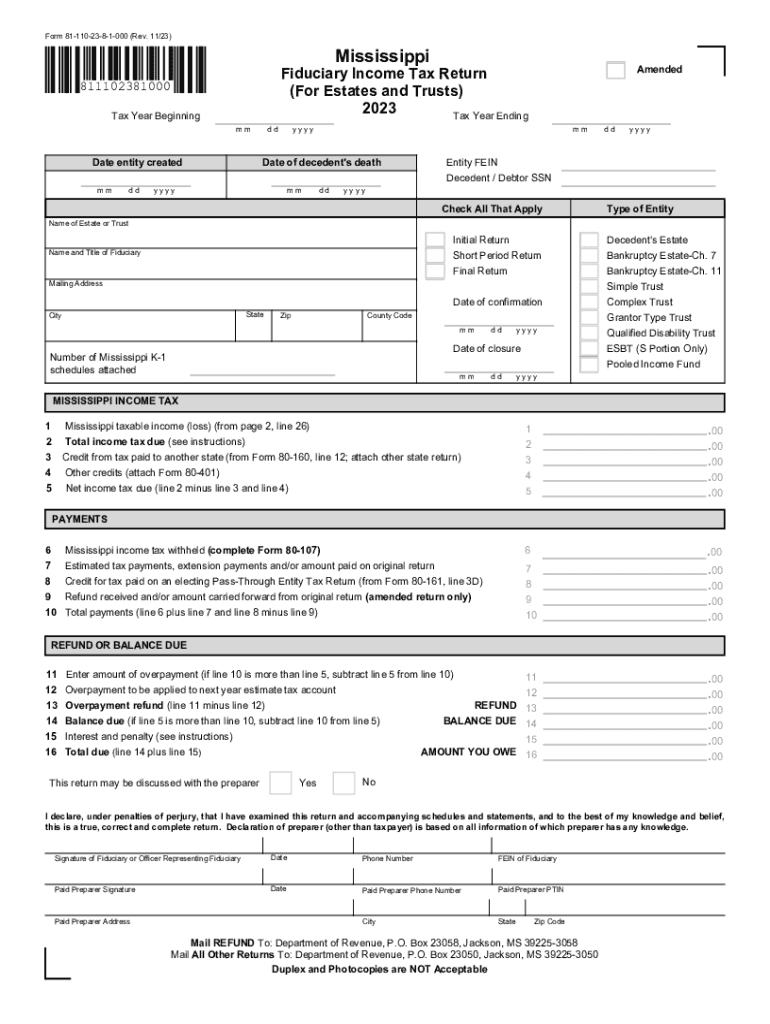

Form 81 110 23 8 1 000 Rev 2023

Understanding IRS Form 1310

IRS Form 1310, also known as the Statement of Person Claiming Refund Due a Deceased Taxpayer, is a tax form used in the United States. This form is essential for individuals who are claiming a tax refund on behalf of a deceased taxpayer. The IRS requires this form to ensure that the refund is issued to the correct person, typically the executor or administrator of the deceased's estate. Understanding the purpose and requirements of Form 1310 is crucial for those handling the financial affairs of a deceased individual.

Key Elements of Form 1310

Form 1310 includes several important sections that must be completed accurately. Key elements include:

- Taxpayer Information: This section requires details about the deceased taxpayer, including their name, Social Security number, and the tax year for which the refund is being claimed.

- Claimant Information: The person claiming the refund must provide their own name, address, and relationship to the deceased.

- Reason for Claim: The form asks for the reason the claimant is entitled to the refund, which typically relates to being the executor or administrator of the estate.

- Signature: The claimant must sign and date the form, certifying that the information provided is accurate.

Steps to Complete Form 1310

Completing IRS Form 1310 involves several straightforward steps:

- Gather Required Information: Collect all necessary details about the deceased taxpayer and the claimant.

- Fill Out the Form: Carefully enter the required information in each section of the form, ensuring accuracy.

- Attach Supporting Documentation: Include any necessary documents, such as a copy of the death certificate and proof of your relationship to the deceased.

- Review the Form: Double-check all entries for completeness and accuracy before submitting.

- Submit the Form: File Form 1310 along with the deceased taxpayer's final return or separately, depending on the situation.

Where to Mail IRS Form 1310

Mailing IRS Form 1310 requires attention to detail, as the submission address varies based on the deceased taxpayer's state of residence. Generally, the form should be sent to the address specified in the IRS instructions for the deceased's final tax return. It is essential to check the latest IRS guidelines to ensure the form is sent to the correct location to avoid delays in processing.

Filing Deadlines for Form 1310

Filing deadlines for IRS Form 1310 align with the deadlines for the deceased taxpayer's final income tax return. Typically, the final return is due on April fifteenth of the year following the taxpayer's death. If the return is filed late, it may result in penalties or interest on any taxes owed. Understanding these deadlines is crucial for ensuring compliance and timely processing of the refund claim.

Eligibility Criteria for Filing Form 1310

To file IRS Form 1310, certain eligibility criteria must be met. The claimant must be the executor, administrator, or an individual entitled to the refund due to the deceased taxpayer's estate. Additionally, the deceased must have been entitled to a tax refund for the year in question. Meeting these criteria ensures that the claim is valid and can be processed by the IRS.

Quick guide on how to complete form 81 110 23 8 1 000 rev

Effortlessly Prepare Form 81 110 23 8 1 000 Rev on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the suitable form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without holdups. Manage Form 81 110 23 8 1 000 Rev on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign Form 81 110 23 8 1 000 Rev with Ease

- Locate Form 81 110 23 8 1 000 Rev and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 81 110 23 8 1 000 Rev to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 81 110 23 8 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 81 110 23 8 1 000 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1310 and why is it important?

Form 1310 is a tax form used to claim a refund on behalf of a deceased taxpayer. It's crucial for individuals or executors of estates to ensure that all eligible refunds are claimed, helping beneficiaries manage their finances efficiently.

-

How can airSlate SignNow help with form 1310?

AirSlate SignNow simplifies the eSigning process for form 1310, allowing you to quickly send and sign documents online. This eliminates the need for physical signatures, accelerated workflows, and ensures compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for form 1310?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. By using our service for form 1310, you can avoid costly delays in document processing and ensure a seamless experience at an affordable price.

-

What are the key features of airSlate SignNow for completing form 1310?

AirSlate SignNow provides a range of features including customizable templates for form 1310, secure cloud storage, and real-time tracking of document status. These features enhance your productivity and streamline the signing process.

-

Can I integrate airSlate SignNow with other applications when working on form 1310?

Absolutely! AirSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Zapier. This integration helps to manage your documents related to form 1310 efficiently and allows for easy access and sharing.

-

How secure is airSlate SignNow for handling sensitive documents like form 1310?

Security is a top priority at airSlate SignNow. Your documents, including form 1310, are encrypted and stored securely, ensuring that sensitive information remains protected throughout the signing process.

-

Can multiple users collaborate on form 1310 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on form 1310 concurrently. This feature enhances teamwork and ensures all necessary signatures are collected in a timely manner, improving overall document processing.

Get more for Form 81 110 23 8 1 000 Rev

- Iowa individual cdac form

- Form 470 5170 iowa department of human services iowagov dhs state ia

- Vital statistics idaho state form

- How fill out ioci 15 383 form

- Drowning injury illness report illinois department of public health idph state il form

- Polst illinois form

- Is illinois dept of human services open form

- Cfs 717 g form

Find out other Form 81 110 23 8 1 000 Rev

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe