Form it 2104 1911New York State, City of New York, and 2020

What is the Form IT 2 New York State, City Of New York, And

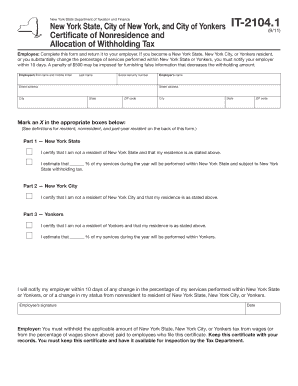

The Form IT 2 is a tax form used in New York State, specifically for residents of the City of New York. This form is essential for employees to determine the appropriate amount of New York City income tax to withhold from their paychecks. It is particularly relevant for individuals who work in the city but may reside elsewhere, as well as for those who live and work in New York City. The form helps ensure compliance with local tax laws and allows taxpayers to manage their withholding effectively.

How to use the Form IT 2 New York State, City Of New York, And

To use the Form IT 2, individuals must first complete the form accurately, providing necessary personal information such as name, address, and Social Security number. After filling out the form, it should be submitted to the employer, who will use the information to adjust the tax withholding from the employee's paycheck. It is important to review the form periodically, especially if there are changes in personal circumstances, such as marital status or additional sources of income, as these can affect tax liability.

Steps to complete the Form IT 2 New York State, City Of New York, And

Completing the Form IT 2 involves several key steps:

- Gather necessary information, including your Social Security number and details about your employment.

- Fill out the form, ensuring all personal information is accurate.

- Indicate your filing status and any additional allowances you wish to claim.

- Review the completed form for accuracy before submission.

- Submit the form to your employer for processing.

Legal use of the Form IT 2 New York State, City Of New York, And

The legal use of the Form IT 2 is governed by New York State tax laws. This form must be filled out correctly to ensure that the appropriate amount of income tax is withheld. Failure to submit the form or providing inaccurate information can lead to penalties or under-withholding, resulting in unexpected tax liabilities. Employers are required to keep the form on file for their records and to ensure compliance with state tax regulations.

Key elements of the Form IT 2 New York State, City Of New York, And

Key elements of the Form IT 2 include:

- Personal identification details, such as name and Social Security number.

- Filing status options, which determine tax withholding rates.

- Allowances claimed, which can reduce the amount of tax withheld.

- Signature and date, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2 coincide with the start of employment or any changes in personal circumstances that affect tax withholding. It is advisable to submit the form as soon as employment begins or when there is a change in tax status to avoid under-withholding. Employers typically require this form to be submitted before the first paycheck is issued to ensure accurate withholding from the outset.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 2 is typically submitted in person to the employer. However, some employers may allow for electronic submission through their payroll systems. It is essential to check with the employer regarding their specific submission methods to ensure compliance and proper processing of the form.

Quick guide on how to complete form it 21041911new york state city of new york and

Complete Form IT 2104 1911New York State, City Of New York, And effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Form IT 2104 1911New York State, City Of New York, And on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Form IT 2104 1911New York State, City Of New York, And with ease

- Obtain Form IT 2104 1911New York State, City Of New York, And and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign Form IT 2104 1911New York State, City Of New York, And and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 21041911new york state city of new york and

Create this form in 5 minutes!

How to create an eSignature for the form it 21041911new york state city of new york and

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is Form IT 2104 1911New York State, City Of New York, And?

Form IT 2104 1911 is a crucial tax form used by employers in New York State and the City of New York. It helps in determining the correct amount of tax to withhold from employees’ earnings. Using this form ensures compliance with state law and avoids potential penalties.

-

How can airSlate SignNow help with Form IT 2104 1911New York State, City Of New York, And?

airSlate SignNow makes it easy to electronically sign and send Form IT 2104 1911. Our platform allows you to manage all your documents efficiently while ensuring that your tax forms are completed correctly and securely. This streamlines your workflow and saves valuable time.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to suit different business needs. Our flexible pricing allows businesses to choose a plan that fits their budget while accessing features that simplify the signing and management of documents like Form IT 2104 1911New York State, City Of New York, And.

-

What features does airSlate SignNow offer for handling documents?

With airSlate SignNow, you get features such as customizable templates, real-time tracking, and secure storage. These features are essential for managing important documents, such as the Form IT 2104 1911New York State, City Of New York, And. Our user-friendly interface ensures that even non-tech-savvy individuals can navigate it with ease.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports a variety of integrations with popular applications and services. This helps streamline your processes and ensures that all your necessary tools work seamlessly together, enhancing the management of documents like Form IT 2104 1911New York State, City Of New York, And.

-

Is airSlate SignNow secure for my sensitive documents?

Absolutely! airSlate SignNow employs top-notch security measures to protect your sensitive documents. With secure encryption and compliance with industry standards, you can confidently use our platform to manage your Form IT 2104 1911New York State, City Of New York, And and other important documents.

-

How does airSlate SignNow improve the signing process?

airSlate SignNow digitizes the signing process, making it quick and easy for all parties involved. This eliminates the need for physical paperwork and reduces the chances of errors when filling out forms like Form IT 2104 1911New York State, City Of New York, And, speeding up the entire workflow.

Get more for Form IT 2104 1911New York State, City Of New York, And

- Histograms multiple choice practice answer key form

- Us family health plan referral form

- Trip consent waiver agreement form

- Identifying text structure 4 answer key form

- Dropout nation viewing questions answers form

- Grec background clearance application form

- Morristown housing authority form

- Is pdffiller hipaa compliant form

Find out other Form IT 2104 1911New York State, City Of New York, And

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement