it 2104 1 2020-2026

What is the IT-21041 Form?

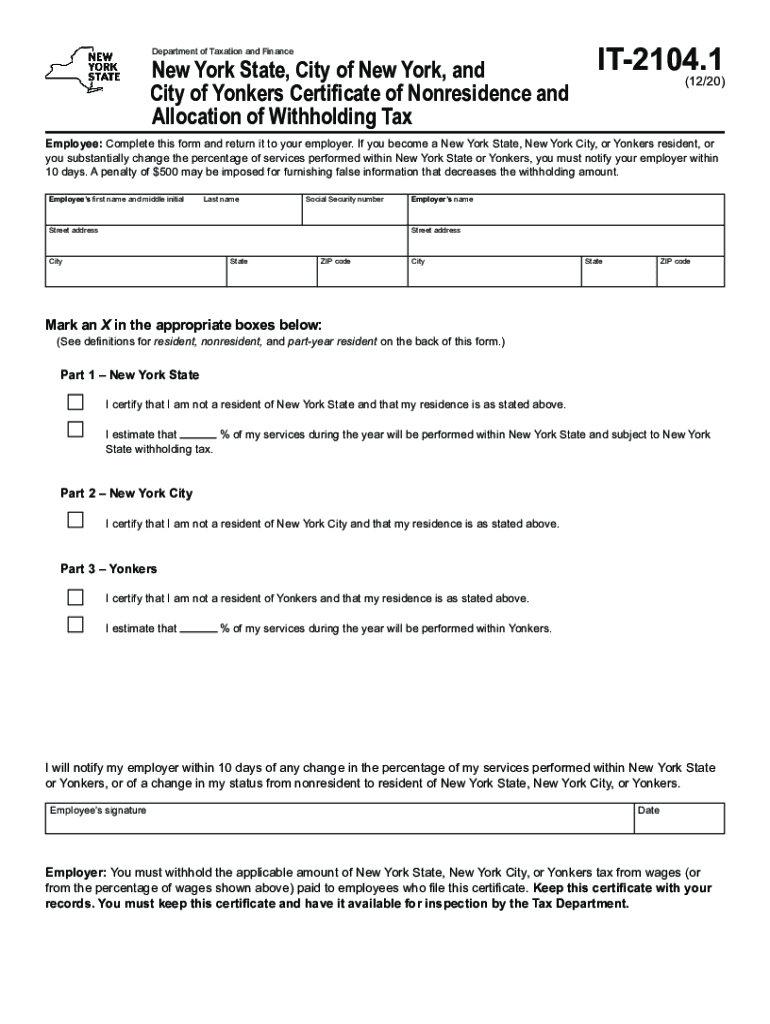

The IT-21041 form, also known as the IT-2104 allocation form, is a crucial document used by taxpayers in New York. This form is primarily designed for individuals who need to allocate their income and withholding tax amounts accurately. It is particularly relevant for nonresidents or part-year residents who earn income in New York State. By completing the IT-21041, taxpayers can ensure that they are withholding the correct amount of state tax based on their specific circumstances.

Steps to Complete the IT-21041 Form

Completing the IT-21041 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your income details and any applicable deductions. Next, follow these steps:

- Begin by filling out your personal information, including your name, address, and taxpayer identification number.

- Indicate your residency status—whether you are a resident, nonresident, or part-year resident.

- Detail your income sources and amounts, ensuring to include any income earned in New York State.

- Calculate the total amount of withholding tax based on the income allocated to New York.

- Review the completed form for accuracy before submission.

Legal Use of the IT-21041 Form

The IT-21041 form holds legal significance as it ensures compliance with New York State tax laws. When filled out correctly, it serves as a legally binding document that reflects your income allocation and tax withholding. To maintain its validity, it is essential to adhere to the regulations set forth by the New York State Department of Taxation and Finance. This includes ensuring that the form is submitted by the appropriate deadlines and that all information provided is accurate and truthful.

How to Obtain the IT-21041 Form

Obtaining the IT-21041 form is a straightforward process. Taxpayers can access the form through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing for easy printing and completion. Additionally, the form may be provided by employers or tax professionals who assist with tax preparation. Ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IT-21041 form are crucial to avoid penalties. Typically, the form must be submitted by the same deadlines as your New York State income tax return. For most taxpayers, this is April fifteenth of each year. However, if you are a nonresident or part-year resident, be sure to check specific deadlines that may apply to your situation. Keeping track of these dates is essential for ensuring compliance and avoiding unnecessary fines.

Examples of Using the IT-21041 Form

The IT-21041 form can be used in various scenarios. For instance, a nonresident who works in New York but lives in another state may use the form to allocate their income correctly and ensure the right amount of tax is withheld. Similarly, a part-year resident who moves to New York during the tax year would also use this form to report income earned while residing in the state. These examples illustrate the form's importance in accurately reflecting tax obligations based on residency status.

Quick guide on how to complete 2021 it 2104 1

Effortlessly Prepare It 2104 1 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage It 2104 1 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centered task today.

The simplest way to modify and electronically sign It 2104 1 with ease

- Obtain It 2104 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form via email, text message (SMS), or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign It 2104 1 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 it 2104 1

Create this form in 5 minutes!

How to create an eSignature for the 2021 it 2104 1

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the IT 21041 form and why is it important?

The IT 21041 form is a crucial document used by businesses to report tax credits for New York State. It helps in claiming the Empire State Film Production Credit, therefore, it's important for entities involved in qualifying film production activities. By using the IT 21041 form correctly, businesses can ensure they maximize their tax benefits.

-

How does airSlate SignNow simplify the completion of the IT 21041 form?

airSlate SignNow streamlines the process of filling out the IT 21041 form by providing an intuitive platform for document management. Users can easily upload, eSign, and share the IT 21041 form with all stakeholders, ensuring a seamless and efficient workflow. Our solution enables businesses to focus on their core activities while we handle the complexities of the paperwork.

-

What features does airSlate SignNow offer for the IT 21041 form?

airSlate SignNow offers various features tailored for the IT 21041 form, including customizable templates, cloud storage, and secure eSignature capabilities. These features allow users to create, edit, and manage their IT 21041 forms effortlessly. Additionally, integrations with popular applications ensure that your tax documentation process is both efficient and secure.

-

Is airSlate SignNow a cost-effective solution for managing the IT 21041 form?

Yes, airSlate SignNow is a cost-effective solution designed to meet the needs of businesses looking to manage the IT 21041 form efficiently. With various pricing plans available, our service offers flexibility to suit any budget. Investing in airSlate SignNow saves time and resources while enhancing your document workflow.

-

Can I integrate airSlate SignNow with other software for the IT 21041 form?

Absolutely! airSlate SignNow is designed to integrate with numerous software applications, making it easier to manage the IT 21041 form alongside your other business processes. Popular integrations include CRM platforms, document storage solutions, and collaboration tools, ensuring a smooth experience across all your digital resources.

-

What are the benefits of using airSlate SignNow for the IT 21041 form?

Using airSlate SignNow for the IT 21041 form provides several benefits, including increased efficiency, reduced errors, and enhanced security. The platform allows for easy tracking of document status, ensuring timely submissions. Furthermore, our eSigning feature ensures compliance and fast processing times.

-

How secure is airSlate SignNow when handling the IT 21041 form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the IT 21041 form. We employ industry-standard encryption and robust compliance measures to protect your data. Our platform ensures that your documents remain confidential and secure throughout the signing and storage process.

Get more for It 2104 1

Find out other It 2104 1

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free