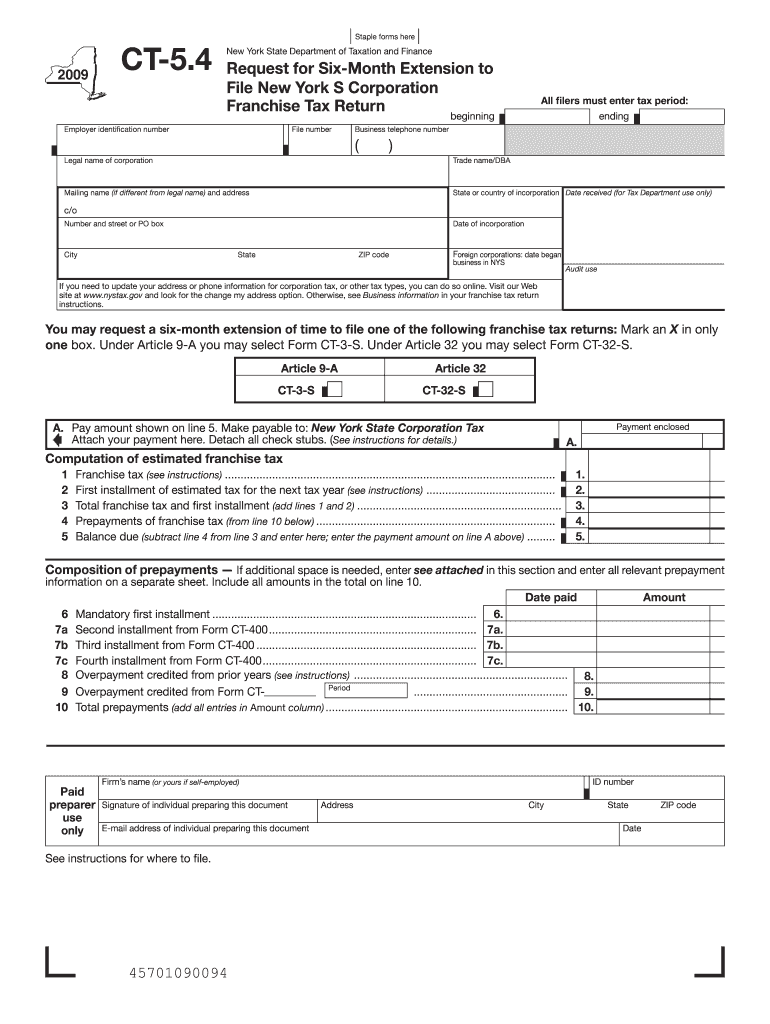

Form CT 5 4 2009

What is the Form CT 5 4

The Form CT 5 4 is a tax-related document used in the state of Connecticut. It serves as a request for a tax exemption for certain property types, primarily aimed at businesses and organizations that meet specific criteria. This form is essential for entities seeking to reduce their tax burden by demonstrating eligibility for exemptions under Connecticut state law. Understanding the purpose and requirements of the Form CT 5 4 is crucial for ensuring compliance and optimizing tax benefits.

How to obtain the Form CT 5 4

To obtain the Form CT 5 4, individuals and organizations can visit the official Connecticut Department of Revenue Services website. The form is typically available for download in PDF format, allowing users to print and fill it out manually. Additionally, individuals may request a physical copy by contacting the department directly. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the Form CT 5 4

Completing the Form CT 5 4 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the entity's legal name, address, and tax identification number. Next, provide details about the property for which the exemption is requested, including its location and type. Carefully fill out all sections of the form, ensuring that you meet the eligibility criteria. Once completed, review the form for any errors before submitting it to the appropriate authority.

Legal use of the Form CT 5 4

The legal use of the Form CT 5 4 is governed by Connecticut state tax laws. It is crucial to submit this form accurately and on time to avoid penalties. The form must be used by eligible entities only, as misuse can lead to legal repercussions, including fines or loss of exemption status. Understanding the legal framework surrounding this form helps ensure that it is utilized correctly and effectively.

Key elements of the Form CT 5 4

Several key elements define the Form CT 5 4. These include the applicant's information, property details, and the specific exemption being requested. Each section must be filled out completely and accurately to ensure the form is processed correctly. Additionally, supporting documentation may be required to substantiate the exemption claim, such as proof of ownership or occupancy. Familiarity with these elements is essential for a successful application.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 5 4 can be submitted through various methods, depending on the preferences of the applicant and the requirements of the Connecticut Department of Revenue Services. Options typically include online submission via the department's portal, mailing the completed form to the designated address, or delivering it in person at a local office. Each method may have different processing times and requirements, so it is advisable to check the latest guidelines before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 5 4 are critical to ensure compliance with state tax regulations. Generally, the form must be submitted by a specific date each year, which may vary based on the type of exemption being requested. Missing the deadline can result in the denial of the exemption claim, leading to potential tax liabilities. It is important to stay informed about these deadlines and plan accordingly to avoid any issues.

Quick guide on how to complete form ct 54

Complete Form CT 5 4 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the right form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form CT 5 4 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form CT 5 4 without hassle

- Find Form CT 5 4 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your preference. Edit and eSign Form CT 5 4 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 54

Create this form in 5 minutes!

How to create an eSignature for the form ct 54

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is Form CT 5 4?

Form CT 5 4 is a specific tax form used in Connecticut for corporate tax purposes. Businesses need to accurately complete this form to comply with state regulations. Using airSlate SignNow, you can easily eSign and manage your Form CT 5 4 digitally, streamlining the submission process.

-

How does airSlate SignNow help with Form CT 5 4 compliance?

airSlate SignNow provides a user-friendly platform that ensures your Form CT 5 4 is signed and submitted promptly. Features like templates and reminders automate the process, helping you avoid late penalties. Our solution keeps you compliant with ease.

-

What are the pricing options for using airSlate SignNow for Form CT 5 4?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Each plan provides access to essential features for managing Form CT 5 4 and other documents. You can choose from monthly or annual subscriptions to fit your budget.

-

Can I integrate airSlate SignNow with other software for Form CT 5 4 handling?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easy to handle your Form CT 5 4 alongside other workflows. Whether you're using CRM systems, project management tools, or cloud storage, our platform enhances efficiency. Integrations help ensure a smooth document flow.

-

What features does airSlate SignNow offer for managing Form CT 5 4?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and document tracking that are essential for managing Form CT 5 4. You can quickly create and edit forms, ensuring all necessary information is captured. These features contribute to a more organized and efficient process.

-

Is airSlate SignNow secure for handling Form CT 5 4?

Absolutely, airSlate SignNow prioritizes security with encryption and compliance standards, ensuring that your Form CT 5 4 and other sensitive documents are protected. Our platform undergoes regular audits to maintain high security levels. You can trust us to keep your information safe.

-

What benefits can I expect from using airSlate SignNow for Form CT 5 4?

Using airSlate SignNow for Form CT 5 4 provides multiple benefits, including time savings, increased efficiency, and improved accuracy in document handling. The platform allows you to focus on your core business while we handle the paperwork. It’s a cost-effective solution for managing your forms.

Get more for Form CT 5 4

- Worksheet 34 gross pay with overtime answer key form

- Dental records release form

- How to eat an elephant pdf form

- Colorado residential lease agreement dora form

- Biodata form for domestic helper 401272245

- Ics 214 excel form

- Infinite bank statement form

- Instructions for form it 230 tax ny gov new york state

Find out other Form CT 5 4

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT