Ct 6 1 2019-2026

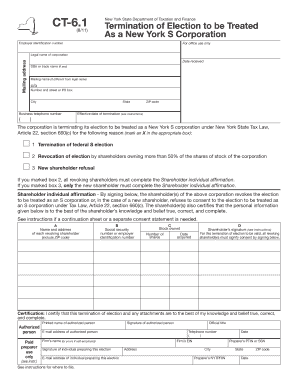

What is the CT-6 Form?

The CT-6 form, also known as the Request for Extension of Time to File, is a crucial document for businesses operating in the United States. This form is primarily used by corporations and partnerships to request an extension for filing their tax returns. It allows entities to extend their filing deadline, providing additional time to gather necessary financial information and ensure accurate reporting to the IRS.

How to Obtain the CT-6 Form

Obtaining the CT-6 form is straightforward. It can be accessed through the official state tax authority's website or by contacting their office directly. Many states also provide downloadable PDF versions of the form, which can be printed and filled out manually. Additionally, some tax preparation software may include the CT-6 form as part of their offerings, allowing for easy completion and submission.

Steps to Complete the CT-6 Form

Completing the CT-6 form involves several key steps:

- Gather Required Information: Collect all necessary financial data, including income statements and expense reports.

- Fill Out the Form: Enter the required information accurately, ensuring all fields are completed as instructed.

- Review for Accuracy: Double-check the information provided to avoid any errors that could lead to penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the CT-6 Form

The CT-6 form is legally binding once submitted, provided that it is completed accurately and in compliance with relevant tax laws. It is essential for businesses to understand the legal implications of submitting this form, as failure to file correctly can result in penalties or delays in processing. The form serves as an official request for an extension, and it must be filed before the original due date of the tax return to be valid.

Form Submission Methods

There are several methods available for submitting the CT-6 form:

- Online Submission: Many states offer online portals where businesses can submit the CT-6 form electronically.

- Mail: The form can be printed and mailed to the appropriate tax authority address.

- In-Person Submission: Businesses may also choose to deliver the form directly to their local tax office.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the CT-6 form. Typically, the request for an extension must be submitted by the original due date of the tax return. Missing this deadline can result in automatic penalties. Businesses should also keep track of any specific state deadlines that may apply, as these can vary.

Eligibility Criteria

To be eligible to file the CT-6 form, businesses must meet certain criteria. Generally, the form is intended for corporations and partnerships that require additional time to prepare their tax returns. It is important for applicants to ensure they fall within the specified eligibility guidelines set forth by their state tax authority to avoid complications during the filing process.

Quick guide on how to complete ct 6 1

Effortlessly Prepare Ct 6 1 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to swiftly create, modify, and eSign your documents without any holdups. Manage Ct 6 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Ct 6 1 without Stress

- Find Ct 6 1 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced forms, tedious document searching, or errors that necessitate printing additional copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct 6 1 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 6 1

Create this form in 5 minutes!

How to create an eSignature for the ct 6 1

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the ct61 form pdf and why do I need it?

The ct61 form pdf is a tax return used in the UK for reporting certain payments made to the HMRC. Businesses need this form to ensure compliance with tax regulations and to avoid penalties. It serves as an essential document for maintaining accurate financial records.

-

How can I fill out the ct61 form pdf using airSlate SignNow?

With airSlate SignNow, filling out the ct61 form pdf is straightforward. Users can upload the PDF, fill it out digitally, and add electronic signatures seamlessly. This feature simplifies the process and saves time, reducing the hassle associated with paper forms.

-

Is there a cost associated with using the ct61 form pdf templates in airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to various templates, including the ct61 form pdf. Pricing varies based on subscription tiers, so it’s best to explore our options to find the plan that suits your business needs. You can utilize the platform effectively without breaking the bank.

-

What are the benefits of using airSlate SignNow for the ct61 form pdf?

Using airSlate SignNow for the ct61 form pdf provides numerous benefits, such as enhanced efficiency, reduced paperwork, and improved compliance. The platform allows for easy tracking of document status and secure storage, ensuring that your tax forms are safely managed. By digitizing the process, businesses can streamline their workflows.

-

Can I integrate airSlate SignNow with my existing software for handling the ct61 form pdf?

Yes, airSlate SignNow offers integrations with various business applications, making it easy to handle the ct61 form pdf within your existing ecosystems. Whether it's connecting with tools like CRM software or accounting solutions, our platform enables seamless data flow. This integration helps maintain continuity and efficiency.

-

How do I ensure my ct61 form pdf is secure when using airSlate SignNow?

AirSlate SignNow prioritizes security, providing encryption and secure storage for your ct61 form pdf documents. We comply with industry standards to protect sensitive information during transmission and storage. You can trust that your data remains confidential and secure when using our platform.

-

What document formats does airSlate SignNow support aside from the ct61 form pdf?

In addition to the ct61 form pdf, airSlate SignNow supports various document formats, including DOCX, XLSX, and image files. This flexibility allows you to manage different types of documents easily within one platform. You can convert and work with various files seamlessly to meet your business needs.

Get more for Ct 6 1

Find out other Ct 6 1

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist