Oklahoma Resident Income Tax Return Form 511 2019

What is the Oklahoma Resident Income Tax Return Form 511

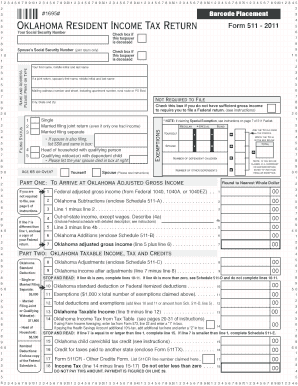

The Oklahoma Resident Income Tax Return Form 511 is a crucial document for individuals residing in Oklahoma who need to report their income and calculate their state tax liability. This form is specifically designed for residents, allowing them to detail their income sources, deductions, and credits applicable under Oklahoma tax law. It is essential for ensuring compliance with state tax regulations and for determining the amount of tax owed or the refund due.

How to use the Oklahoma Resident Income Tax Return Form 511

Using the Oklahoma Resident Income Tax Return Form 511 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits. Next, accurately fill out the form, ensuring that all income is reported and that deductions are claimed where applicable. After completing the form, review it for accuracy before submitting it either electronically or by mail. Utilizing digital tools can simplify this process, allowing for easy editing and signing.

Steps to complete the Oklahoma Resident Income Tax Return Form 511

Completing the Oklahoma Resident Income Tax Return Form 511 requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, such as W-2 forms and 1099 statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any deductions or credits for which you qualify, such as education credits or medical expenses.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or mail it to the appropriate tax authority.

Legal use of the Oklahoma Resident Income Tax Return Form 511

The Oklahoma Resident Income Tax Return Form 511 is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal repercussions. Utilizing secure electronic signature solutions can enhance the legal validity of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Resident Income Tax Return Form 511 are typically aligned with federal tax deadlines. Generally, the form must be filed by April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure timely submission to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Resident Income Tax Return Form 511 can be submitted through various methods. Taxpayers have the option to file electronically using approved e-filing software, which often provides a streamlined process and faster refunds. Alternatively, the form can be printed and mailed to the appropriate tax office. In-person submissions may also be accepted at designated tax offices, providing another avenue for taxpayers to ensure their forms are filed correctly.

Quick guide on how to complete oklahoma resident income tax return form 511 2011

Effortlessly Prepare Oklahoma Resident Income Tax Return Form 511 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic environmentally friendly substitute for traditional printed and signed documents, as it allows you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Manage Oklahoma Resident Income Tax Return Form 511 across any platform with the airSlate SignNow Android or iOS applications and streamline any document handling today.

The Easiest Method to Modify and eSign Oklahoma Resident Income Tax Return Form 511 with Ease

- Locate Oklahoma Resident Income Tax Return Form 511 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or redact sensitive data using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of misplaced or lost documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Oklahoma Resident Income Tax Return Form 511 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma resident income tax return form 511 2011

Create this form in 5 minutes!

How to create an eSignature for the oklahoma resident income tax return form 511 2011

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is the Oklahoma Resident Income Tax Return Form 511?

The Oklahoma Resident Income Tax Return Form 511 is a document used by residents of Oklahoma to report their income and calculate taxes owed to the state. This form is crucial for ensuring compliance with state tax regulations and for receiving potential refunds.

-

How can I obtain the Oklahoma Resident Income Tax Return Form 511?

You can obtain the Oklahoma Resident Income Tax Return Form 511 from the official Oklahoma Tax Commission website or through various tax preparation software that provides state forms. Additionally, filing online through platforms like airSlate SignNow can streamline the process.

-

What features does airSlate SignNow offer for completing the Oklahoma Resident Income Tax Return Form 511?

airSlate SignNow offers user-friendly tools that allow you to fill out, eSign, and send the Oklahoma Resident Income Tax Return Form 511 effortlessly. The platform ensures secure document management and provides options for templates to save time during the tax filing process.

-

Is airSlate SignNow a cost-effective solution for filing the Oklahoma Resident Income Tax Return Form 511?

Yes, airSlate SignNow is a cost-effective solution compared to traditional tax preparation methods. With various pricing plans and features designed for efficiency, it helps reduce expenses related to tax filing, including the Oklahoma Resident Income Tax Return Form 511.

-

How does eSigning the Oklahoma Resident Income Tax Return Form 511 work in airSlate SignNow?

eSigning the Oklahoma Resident Income Tax Return Form 511 in airSlate SignNow is simple and secure. You can electronically sign the document using any device, ensuring a fast and legally binding signature that complies with state regulations.

-

Can I track the status of my Oklahoma Resident Income Tax Return Form 511 after submission?

Yes, airSlate SignNow provides features that allow you to track the status of your submitted Oklahoma Resident Income Tax Return Form 511. You will receive notifications and updates on the document's progress, ensuring that you are informed throughout the process.

-

What integrations does airSlate SignNow offer for the Oklahoma Resident Income Tax Return Form 511?

airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to import and export the Oklahoma Resident Income Tax Return Form 511. This connectivity streamlines your workflow and improves the efficiency of your tax preparation process.

Get more for Oklahoma Resident Income Tax Return Form 511

Find out other Oklahoma Resident Income Tax Return Form 511

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free