Florida F 1065n Form 2016

What is the Florida F 1065N Form

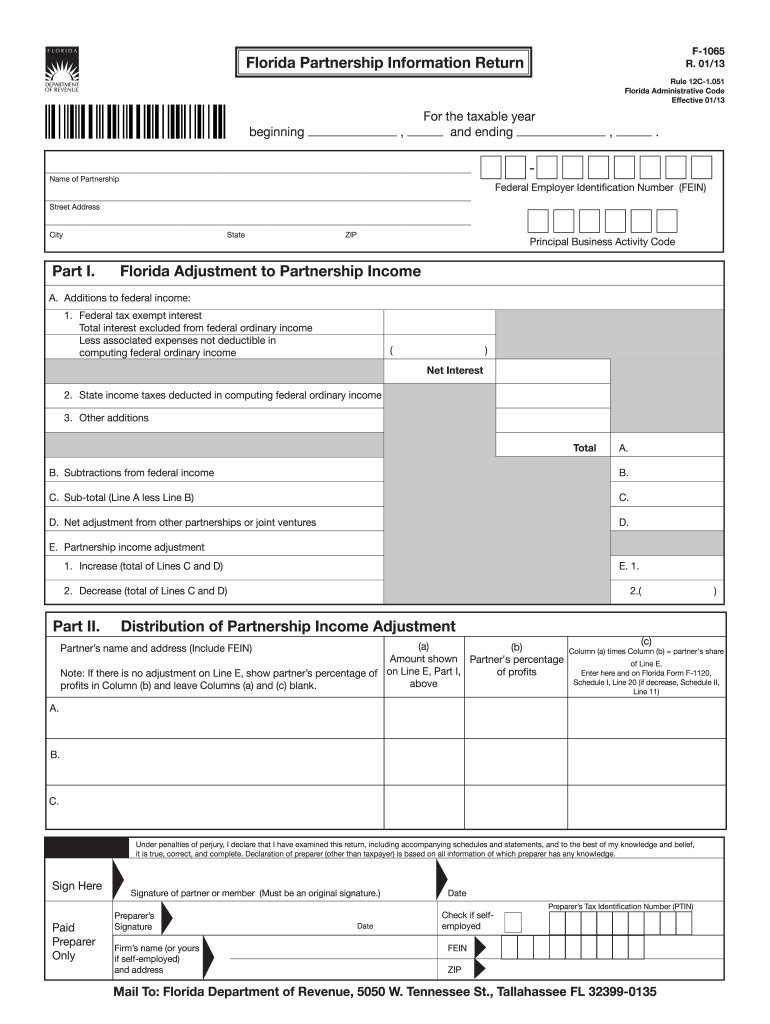

The Florida F 1065N Form is a tax document utilized by partnerships operating in Florida. This form is specifically designed for reporting income, deductions, and credits for partnerships that are not subject to federal income tax. Instead, the income is passed through to the partners, who report it on their individual tax returns. Understanding this form is essential for compliance with state tax regulations and ensuring accurate reporting of partnership-related financial activities.

How to Use the Florida F 1065N Form

Using the Florida F 1065N Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information related to the partnership, including income statements, expense reports, and partner details. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate state tax authority. This careful approach helps avoid potential penalties and ensures compliance with Florida tax laws.

Steps to Complete the Florida F 1065N Form

Completing the Florida F 1065N Form requires a systematic approach. Follow these steps for accuracy:

- Gather financial documents, including income and expense records.

- Enter the partnership's name, address, and federal employer identification number (EIN).

- Report total income and deductions on the form, ensuring all figures are accurate.

- Calculate the net income or loss and allocate it among partners as per the partnership agreement.

- Review the completed form for accuracy and completeness.

- Submit the form to the Florida Department of Revenue by the established deadline.

Legal Use of the Florida F 1065N Form

The Florida F 1065N Form serves a legal purpose in the state’s tax system. It is essential for partnerships to report their financial activities accurately. Failure to file this form can result in penalties, interest, and potential legal issues. The form must be completed according to the guidelines set forth by the Florida Department of Revenue to ensure compliance with state tax laws. Proper use of this form helps maintain transparency and accountability in partnership financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Florida F 1065N Form are crucial for compliance. Typically, the form must be submitted by the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties and interest charges.

Required Documents

When preparing to complete the Florida F 1065N Form, certain documents are required to ensure accurate reporting. These include:

- Partnership financial statements, including income and expense reports.

- Partner information, including names, addresses, and tax identification numbers.

- Records of any deductions or credits the partnership intends to claim.

- Previous year’s tax returns for reference.

Form Submission Methods

The Florida F 1065N Form can be submitted through various methods to accommodate different preferences. Partnerships may choose to file the form online through the Florida Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate address provided by the state tax authority. In-person submissions may also be available at designated tax offices, depending on local regulations. Each method has its own advantages, so partnerships should select the one that best fits their needs.

Quick guide on how to complete florida f 1065n 2013 form

Effortlessly prepare Florida F 1065n Form on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Florida F 1065n Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Florida F 1065n Form seamlessly

- Find Florida F 1065n Form and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Florida F 1065n Form and ensure superior communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida f 1065n 2013 form

Create this form in 5 minutes!

How to create an eSignature for the florida f 1065n 2013 form

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Florida F 1065n Form?

The Florida F 1065n Form is a tax form used by partnerships to report income, deductions, and credits to the state of Florida. It is essential for partnership entities operating within Florida to file this form accurately to comply with state tax regulations. Utilizing a streamlined solution like airSlate SignNow can simplify the process of completing and submitting the Florida F 1065n Form.

-

How can airSlate SignNow assist with the Florida F 1065n Form?

airSlate SignNow offers an easy-to-use platform for electronically signing and managing the Florida F 1065n Form. The platform enables users to fill out the form digitally, ensuring that all necessary details are captured accurately. Additionally, the ability to track document status helps streamline the submission process, making it hassle-free for businesses.

-

What features does airSlate SignNow provide for managing the Florida F 1065n Form?

airSlate SignNow comes with multiple features tailored for efficiently managing the Florida F 1065n Form. Users can create reusable templates, set up reminders for deadlines, and collaborate with team members. These features enhance organization and contribute to a smoother filing experience.

-

Is there a cost associated with using airSlate SignNow for the Florida F 1065n Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing users to choose the most suitable option for handling the Florida F 1065n Form. Each plan provides access to various features that can help simplify document management and electronic signatures. To find the best fit for your requirements, you can explore the pricing section on the airSlate SignNow website.

-

Are there integrations available with airSlate SignNow for the Florida F 1065n Form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing its utility for managing the Florida F 1065n Form. These integrations allow for effortless syncing with popular accounting and tax software, helping businesses maintain consistent data and streamline their overall workflows.

-

What are the benefits of using airSlate SignNow for the Florida F 1065n Form?

Using airSlate SignNow for the Florida F 1065n Form offers several benefits, including improved accuracy, speed, and convenience. The platform minimizes errors associated with manual entry and helps users meet filing deadlines efficiently. By digitizing the process, businesses can save time and focus on other crucial aspects of their operations.

-

How do I get started with airSlate SignNow for the Florida F 1065n Form?

Getting started with airSlate SignNow for the Florida F 1065n Form is simple. First, sign up for an account on the airSlate SignNow website, and then explore the user-friendly features designed to assist you in creating and managing your forms. You can also access tutorials and support resources to help you navigate the process.

Get more for Florida F 1065n Form

- Derriford physio self referral form

- Group attendance sheet pdf literacy volunteers of monmouth lvmonmouthnj form

- Bupa uplift form

- Icea lion pension form

- University of virginia health system contrast reaction virginia form

- T 1 department of veterans affairs vha directive 1070 form

- Arcadia dog license application pasadenahumane org form

- Wedding officiant questionnaire pdf form

Find out other Florida F 1065n Form

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple