1nrpy Ma Form 2020

What is the 1nrpy Ma Form

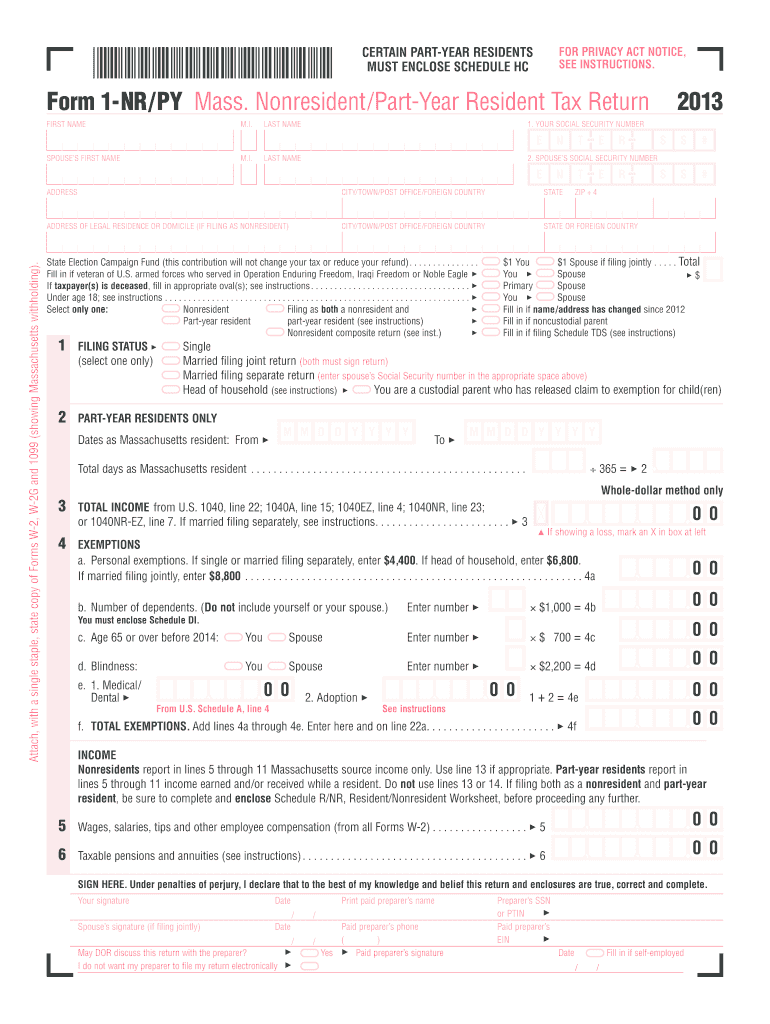

The 1nrpy Ma Form is a document utilized primarily for tax purposes within the state of Massachusetts. It is designed for non-resident individuals who earn income in the state and need to report that income to the Massachusetts Department of Revenue. This form allows non-residents to comply with state tax regulations and ensures that they pay the appropriate amount of taxes on income earned while working or conducting business in Massachusetts.

How to use the 1nrpy Ma Form

Using the 1nrpy Ma Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s and 1099s, which detail your income. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to report all income earned in Massachusetts accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency.

Steps to complete the 1nrpy Ma Form

Completing the 1nrpy Ma Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, such as W-2s and 1099s.

- Provide your personal information, including your full name and address.

- Report all income earned in Massachusetts, ensuring accuracy.

- Calculate your total tax liability based on the income reported.

- Sign and date the form to certify its accuracy.

Legal use of the 1nrpy Ma Form

The legal use of the 1nrpy Ma Form is essential for non-residents to comply with Massachusetts tax laws. Filing this form ensures that individuals are meeting their tax obligations, which can help avoid penalties and legal issues. It is crucial to adhere to the guidelines set forth by the Massachusetts Department of Revenue to ensure the form is valid and accepted.

Filing Deadlines / Important Dates

Filing deadlines for the 1nrpy Ma Form are critical to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. However, if April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines annually.

Form Submission Methods

The 1nrpy Ma Form can be submitted through various methods to accommodate different preferences. Individuals can file the form online through the Massachusetts Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate address provided on the form, or submitted in person at designated state offices. Each method has its own processing times, so choose the one that best fits your needs.

Quick guide on how to complete 1nrpy ma 2013 form

Complete 1nrpy Ma Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle 1nrpy Ma Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign 1nrpy Ma Form with ease

- Locate 1nrpy Ma Form and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your selection. Modify and eSign 1nrpy Ma Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1nrpy ma 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1nrpy ma 2013 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the 1nrpy Ma Form and why is it important?

The 1nrpy Ma Form is a crucial document for individuals engaging in specific transactions in Massachusetts. It ensures compliance with local regulations and aids in accurate tax reporting. Understanding how to fill out this form correctly can save you time and prevent legal issues.

-

How can airSlate SignNow simplify the process of completing the 1nrpy Ma Form?

airSlate SignNow offers a user-friendly platform that streamlines the completion of the 1nrpy Ma Form. With features like templates and intuitive editing tools, you can fill out and sign your forms quickly and efficiently. Additionally, the platform allows for easy sharing and storage of your completed documents.

-

What are the pricing options for using airSlate SignNow for the 1nrpy Ma Form?

airSlate SignNow provides flexible pricing plans tailored to your needs. Users can choose from a variety of subscription options based on features and usage. This means you can find a cost-effective solution whether you're a small business or a large corporation needing to manage the 1nrpy Ma Form consistently.

-

Does airSlate SignNow support integrations for filling out the 1nrpy Ma Form?

Yes, airSlate SignNow integrates with various third-party applications to enhance your document management experience. This includes CRM systems, cloud storage, and productivity tools that can help you manage the 1nrpy Ma Form seamlessly. Integration simplifies your workflow, ensuring all your data is accessible in one place.

-

What security features does airSlate SignNow offer for the 1nrpy Ma Form?

airSlate SignNow takes security seriously, providing advanced encryption and authentication methods to protect your data. When filling out the 1nrpy Ma Form, you can be confident that your information is secure from unauthorized access. Compliance with industry standards ensures your documents are safe.

-

Can I get help with the 1nrpy Ma Form using airSlate SignNow?

Absolutely! airSlate SignNow offers excellent customer support to assist you with any questions regarding the 1nrpy Ma Form. Whether you need help with technical issues or navigating the platform, their support team is readily available to help you succeed.

-

How can airSlate SignNow benefit my business when dealing with the 1nrpy Ma Form?

Using airSlate SignNow for the 1nrpy Ma Form allows your business to streamline document workflows, reducing time spent on paperwork. The eSignature feature enhances the speed of approvals, ultimately improving your overall efficiency. By automating tasks, you free up resources for more important business operations.

Get more for 1nrpy Ma Form

Find out other 1nrpy Ma Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney