M 2848 Fill in Form 2014

What is the M-2848 Fill In Form

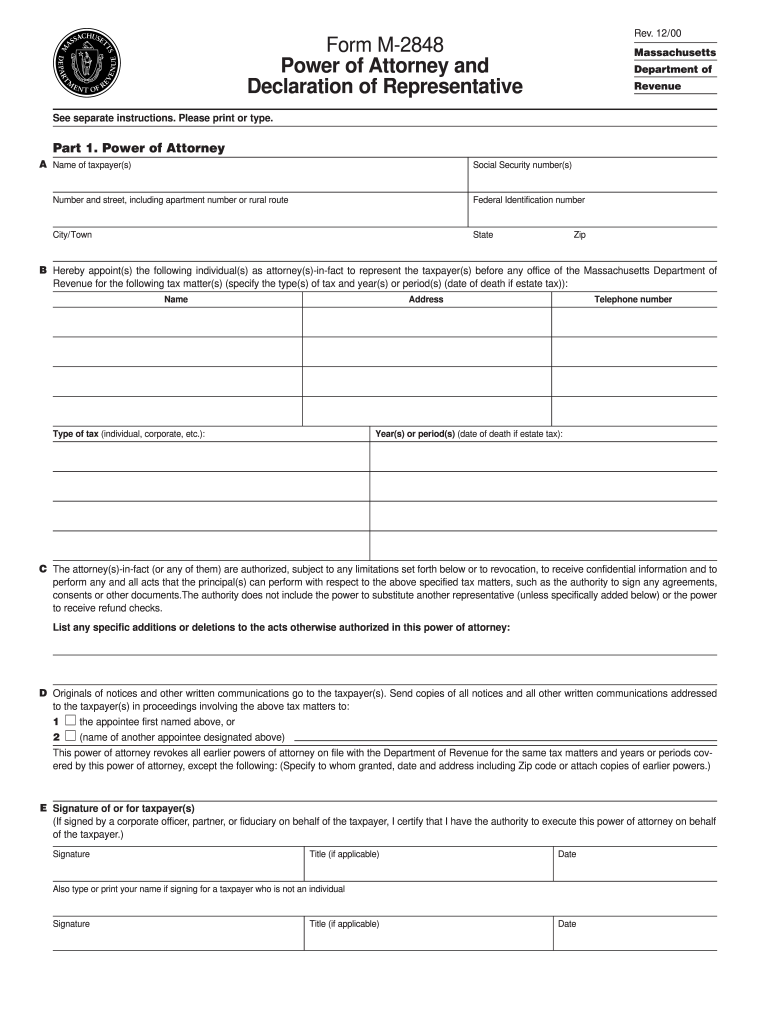

The M-2848 Fill In Form, often referred to as the Power of Attorney and Declaration of Representative, is a crucial document used in the United States for tax-related matters. This form allows individuals to authorize another person to represent them before the Internal Revenue Service (IRS) or other tax authorities. By completing this form, taxpayers can ensure that their designated representative has the authority to handle their tax affairs, including discussions and negotiations with the IRS on their behalf.

How to use the M-2848 Fill In Form

Using the M-2848 Fill In Form involves several straightforward steps. First, download the form from the IRS website or obtain it from a tax professional. Next, fill in the required fields, including the taxpayer's name, address, and Social Security number, as well as the representative's details. It is essential to specify the scope of the authority granted, which can include specific tax matters or broader representation. Once completed, sign and date the form to validate it. Finally, submit the form to the IRS or relevant tax authority, ensuring that your representative receives a copy for their records.

Steps to complete the M-2848 Fill In Form

Completing the M-2848 Fill In Form requires attention to detail. Follow these steps for accurate completion:

- Download the form from the IRS website or acquire it from a tax professional.

- Provide the taxpayer's information, including full name, address, and Social Security number.

- Enter the representative's details, including their name, address, and phone number.

- Clearly define the tax matters for which the representative is authorized to act.

- Sign and date the form, confirming the authorization.

- Submit the completed form to the IRS or the appropriate tax authority.

Legal use of the M-2848 Fill In Form

The M-2848 Fill In Form is legally binding when completed correctly. It allows for the designated representative to act on behalf of the taxpayer in various tax matters. To ensure its legal validity, the form must be signed by the taxpayer and must clearly outline the scope of authority granted. Additionally, compliance with IRS regulations regarding the use of this form is essential. This includes ensuring that the representative is qualified and that the taxpayer understands the implications of granting such authority.

Key elements of the M-2848 Fill In Form

Several key elements must be included in the M-2848 Fill In Form to ensure its effectiveness:

- Taxpayer Information: Full name, address, and Social Security number.

- Representative Information: Name, address, and contact details of the authorized individual.

- Scope of Authority: A clear description of the tax matters the representative is authorized to handle.

- Signature: The taxpayer's signature and date to validate the form.

Form Submission Methods

The M-2848 Fill In Form can be submitted through various methods. Taxpayers may choose to file it online, by mail, or in person, depending on their preference and the requirements of the IRS. For online submissions, ensure that the form is completed accurately and securely uploaded. When mailing the form, use a reliable postal service and consider tracking options to confirm receipt. In-person submissions may be made at local IRS offices, where taxpayers can also seek assistance if needed.

Quick guide on how to complete m 2848 fill in 2000 form

Effortlessly Complete M 2848 Fill In Form on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to swiftly create, modify, and electronically sign your documents without any holdups. Manage M 2848 Fill In Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign M 2848 Fill In Form with Ease

- Find M 2848 Fill In Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to secure your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign M 2848 Fill In Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m 2848 fill in 2000 form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the M 2848 Fill In Form, and how can it be used?

The M 2848 Fill In Form is a crucial document for designating a representative to act on your behalf before the IRS. Users can easily complete this form using airSlate SignNow's intuitive platform, ensuring accuracy and compliance. By simplifying the process, airSlate SignNow helps you manage your tax-related documentation efficiently.

-

Is the M 2848 Fill In Form compliant with IRS regulations?

Yes, the M 2848 Fill In Form processed through airSlate SignNow is fully compliant with IRS regulations. The platform includes built-in validation tools to ensure that all necessary information is filled out correctly, which reduces the risk of errors. Relying on airSlate SignNow guarantees a smooth submission process to the IRS.

-

What features does airSlate SignNow offer for the M 2848 Fill In Form?

airSlate SignNow provides various features for the M 2848 Fill In Form, such as easy drag-and-drop functionality and automated signature requests. Users can also store completed forms securely and access them anytime. These features enhance user experience and streamline the completion of important documents.

-

How much does it cost to use airSlate SignNow for the M 2848 Fill In Form?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes when it comes to using the M 2848 Fill In Form. You can choose from various subscription options that suit your needs, starting with a free trial. This allows you to experience the platform's full capabilities before committing to a purchase.

-

Can I integrate the M 2848 Fill In Form with other software?

Yes, airSlate SignNow allows for seamless integration of the M 2848 Fill In Form with various applications, including CRMs and cloud storage services. This integration capability enhances workflow efficiency by ensuring that your documents and data are synchronized. It's perfect for businesses looking to streamline their processes.

-

What are the benefits of using airSlate SignNow for the M 2848 Fill In Form?

Using airSlate SignNow for the M 2848 Fill In Form provides numerous benefits, including quick turnaround times and increased accuracy in document handling. The platform also ensures that your information is stored securely, enhancing confidentiality. By adopting this solution, you can save time and reduce the stress associated with tax documentation.

-

How secure is my information when using the M 2848 Fill In Form on airSlate SignNow?

Security is paramount at airSlate SignNow. When you use the M 2848 Fill In Form, your data is protected with advanced encryption protocols. The platform complies with industry-standard security measures, which means you can confidently complete your IRS forms without worrying about data bsignNowes.

Get more for M 2848 Fill In Form

- Coding sheet high court form

- Printable alabama divorce papers pdf form

- Sc1 form 42292234

- Shotcut manual form

- Response to petition to modify parent child relationship texas form

- Broward county universal permit application form

- Oral mech exam template form

- Vat andor excise duty exemption certificate form

Find out other M 2848 Fill In Form

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast