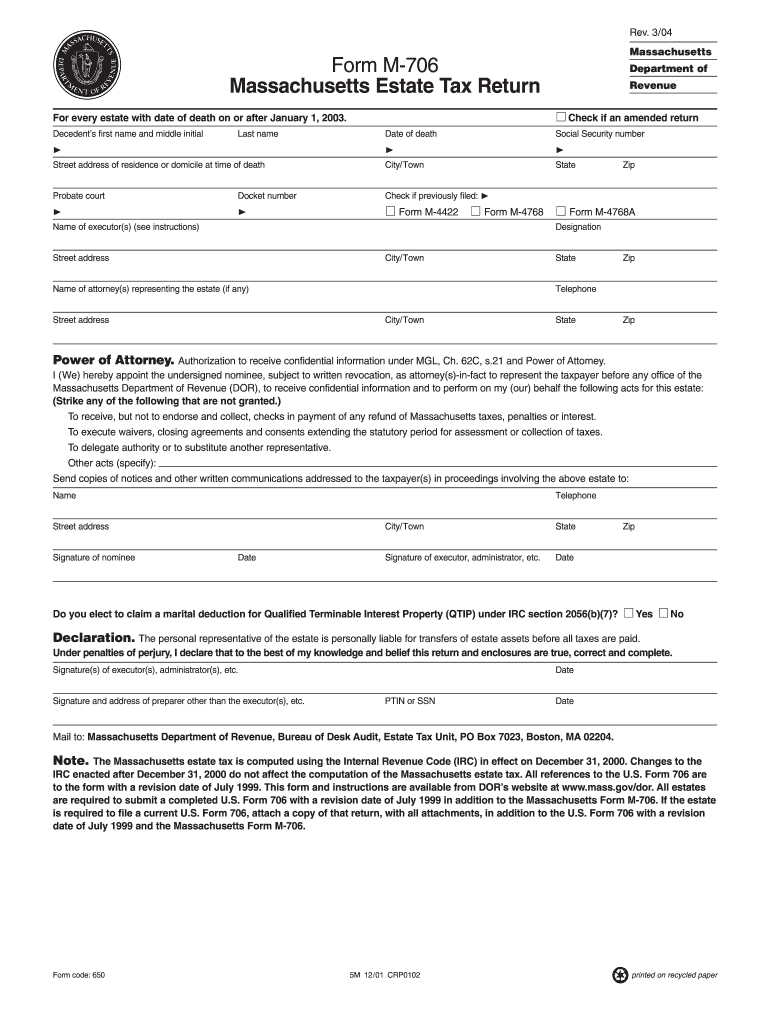

Massachusetts M 706 Amended Return Form 2018

What is the Massachusetts M 706 Amended Return Form

The Massachusetts M 706 Amended Return Form is a tax form specifically designed for individuals and businesses in Massachusetts who need to amend their previously filed tax returns. This form allows taxpayers to correct errors, update information, or claim additional deductions or credits that were not included in the original filing. It is essential for ensuring that tax records are accurate and up to date, which can help prevent potential issues with the Massachusetts Department of Revenue.

How to use the Massachusetts M 706 Amended Return Form

To use the Massachusetts M 706 Amended Return Form effectively, begin by gathering all relevant documents from your original tax return. Carefully review the changes you need to make, whether they involve income adjustments, deductions, or credits. Fill out the form with accurate information, ensuring that you clearly indicate the changes from the original return. Once completed, the amended return must be submitted to the appropriate state tax authority, either electronically or via mail, depending on your preference.

Steps to complete the Massachusetts M 706 Amended Return Form

Completing the Massachusetts M 706 Amended Return Form involves several important steps:

- Gather your original tax return and any supporting documents.

- Identify the specific changes you need to make.

- Fill out the M 706 form, ensuring that all new information is accurate.

- Clearly indicate the reasons for the amendments in the designated section.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mailing it to the Massachusetts Department of Revenue.

Legal use of the Massachusetts M 706 Amended Return Form

The Massachusetts M 706 Amended Return Form is legally recognized as a valid means of correcting tax information. To ensure its legal standing, it must be completed accurately and submitted within the prescribed time limits. Compliance with state tax laws and regulations is crucial, as failure to adhere to these guidelines may result in penalties or issues with your tax status. Using the form properly helps maintain the integrity of your tax records and ensures that any corrections are officially recognized by the state.

Filing Deadlines / Important Dates

When filing the Massachusetts M 706 Amended Return Form, it is important to be aware of the deadlines. Typically, amended returns must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Staying informed about these deadlines helps avoid penalties and ensures that any potential refunds are processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts M 706 Amended Return Form can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online: Submit the form electronically through the Massachusetts Department of Revenue's online portal.

- Mail: Print the completed form and send it via postal mail to the designated address provided by the state.

- In-Person: Deliver the form directly to a local Massachusetts Department of Revenue office, if preferred.

Quick guide on how to complete massachusetts m 706 amended return 2004 form

Effortlessly complete Massachusetts M 706 Amended Return Form on any device

Managing documents online has surged in popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without complications. Handle Massachusetts M 706 Amended Return Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Massachusetts M 706 Amended Return Form effortlessly

- Locate Massachusetts M 706 Amended Return Form and select Get Form to begin.

- Make use of the tools we provide to fill in your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to finalize your modifications.

- Choose your method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, exhausting form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from your chosen device. Modify and eSign Massachusetts M 706 Amended Return Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts m 706 amended return 2004 form

Create this form in 5 minutes!

How to create an eSignature for the massachusetts m 706 amended return 2004 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Massachusetts M 706 Amended Return Form?

The Massachusetts M 706 Amended Return Form is a tax document that allows taxpayers to correct any errors on a previously submitted Massachusetts estate tax return. Filling out this form ensures that all information is accurate and up to date. It's essential for compliance with Massachusetts tax laws.

-

How do I obtain the Massachusetts M 706 Amended Return Form?

You can download the Massachusetts M 706 Amended Return Form directly from the Massachusetts Department of Revenue website. Alternatively, airSlate SignNow provides an accessible platform for filling out and eSigning this form online, streamlining the submission process.

-

What features does airSlate SignNow offer for the Massachusetts M 706 Amended Return Form?

AirSlate SignNow offers a user-friendly interface that simplifies the eSigning and document management process for the Massachusetts M 706 Amended Return Form. With features like templates and automated workflows, users can complete and send documents quickly, ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts M 706 Amended Return Form?

Yes, airSlate SignNow provides a cost-effective solution with flexible pricing plans tailored to various business needs. Users can choose a plan that fits their budget while benefiting from the seamless handling of the Massachusetts M 706 Amended Return Form and other documents.

-

How can airSlate SignNow enhance my experience with the Massachusetts M 706 Amended Return Form?

AirSlate SignNow enhances your experience by enabling quick and easy eSignatures for the Massachusetts M 706 Amended Return Form. This boosts efficiency and reduces turnaround times, allowing you to focus on important tasks rather than paperwork.

-

Can I integrate airSlate SignNow with other applications when working on the Massachusetts M 706 Amended Return Form?

Absolutely! AirSlate SignNow offers robust integrations with various applications, making it easy to manage the Massachusetts M 706 Amended Return Form within your existing workflow. This flexibility enhances productivity and allows for better data management.

-

What are the benefits of using airSlate SignNow for the Massachusetts M 706 Amended Return Form?

Using airSlate SignNow for the Massachusetts M 706 Amended Return Form provides several benefits, including reduced processing time, improved accuracy with eSignatures, and enhanced document security. It simplifies the tax amendment process, ensuring you stay compliant.

Get more for Massachusetts M 706 Amended Return Form

Find out other Massachusetts M 706 Amended Return Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors