Massachusetts Department of Revenue Form 355 Es 2020

What is the Massachusetts Department Of Revenue Form 355 Es

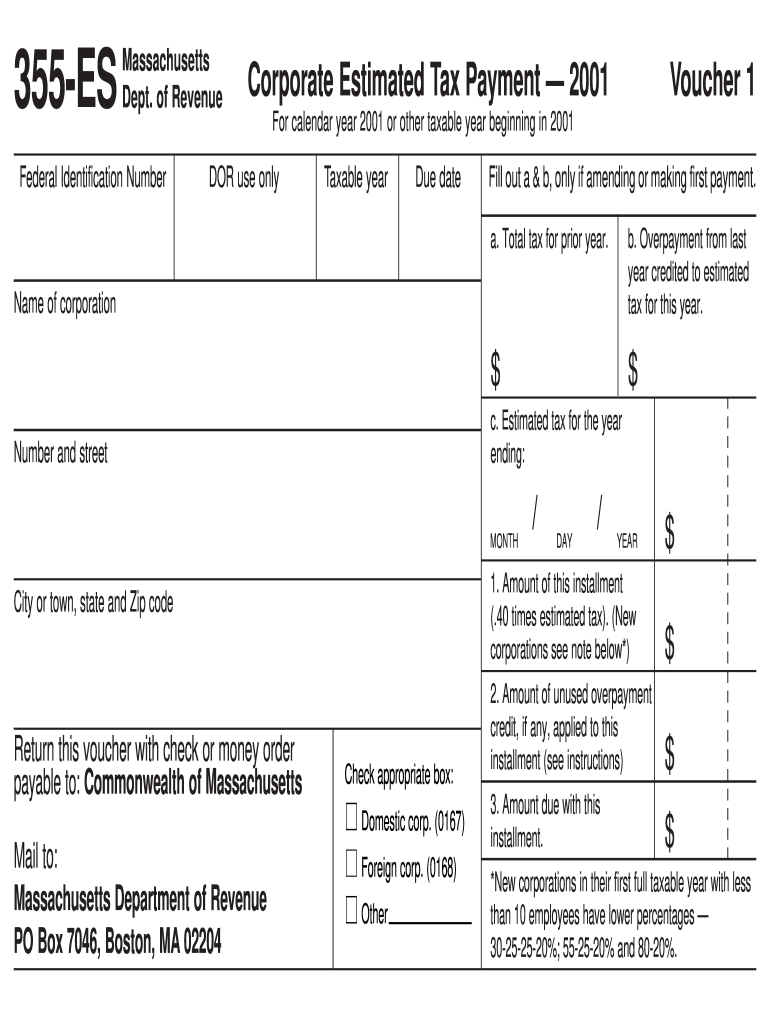

The Massachusetts Department Of Revenue Form 355 Es is a tax form used by corporations to report estimated tax payments. This form is essential for businesses operating within Massachusetts, allowing them to calculate and remit their estimated corporate excise tax obligations. It is particularly relevant for C corporations and S corporations that are subject to taxation under Massachusetts law.

How to use the Massachusetts Department Of Revenue Form 355 Es

To effectively use the Massachusetts Department Of Revenue Form 355 Es, businesses must first determine their estimated tax liability for the year. This involves calculating the expected income and applying the appropriate tax rates. Once the estimated tax amount is established, the form can be completed with the necessary details, including the business name, identification number, and payment information. After filling out the form, it should be submitted according to the specified guidelines to ensure compliance with state regulations.

Steps to complete the Massachusetts Department Of Revenue Form 355 Es

Completing the Massachusetts Department Of Revenue Form 355 Es involves several key steps:

- Gather necessary financial information, including previous tax returns and current income projections.

- Calculate the estimated tax liability based on projected income and applicable tax rates.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, as per the guidelines provided by the Massachusetts Department of Revenue.

Legal use of the Massachusetts Department Of Revenue Form 355 Es

The Massachusetts Department Of Revenue Form 355 Es is legally binding when completed and submitted correctly. It must adhere to state tax laws and regulations. The form serves as an official record of estimated tax payments, and failure to submit it on time can result in penalties. Businesses should ensure that they maintain copies of the submitted form and any supporting documentation for their records.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Department Of Revenue Form 355 Es are crucial for compliance. Typically, estimated tax payments are due quarterly, with specific dates outlined by the Massachusetts Department of Revenue. Businesses should mark their calendars for these deadlines to avoid late fees and interest charges. It is advisable to check the official state resources for any updates or changes to the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Massachusetts Department Of Revenue Form 355 Es can be submitted through various methods to accommodate different preferences. Businesses may choose to file online through the Massachusetts Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the designated address provided by the department. In-person submissions may also be possible at local tax offices, depending on the current regulations and office hours.

Quick guide on how to complete massachusetts department of revenue form 355 es 2001

Prepare Massachusetts Department Of Revenue Form 355 Es effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly without any hold-ups. Manage Massachusetts Department Of Revenue Form 355 Es on any device using airSlate SignNow's applications for Android or iOS and streamline any document-related process today.

How to amend and electronically sign Massachusetts Department Of Revenue Form 355 Es with ease

- Locate Massachusetts Department Of Revenue Form 355 Es and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form—via email, text message (SMS), or invite link—or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Massachusetts Department Of Revenue Form 355 Es to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form 355 es 2001

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 355 es 2001

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the Massachusetts Department Of Revenue Form 355 Es?

The Massachusetts Department Of Revenue Form 355 Es is a tax form used by businesses to pay estimated corporate income taxes. It helps ensure that corporations comply with tax obligations by allowing them to make quarterly payments. Using this form can prevent penalties for underpayment.

-

How can airSlate SignNow help with submitting the Massachusetts Department Of Revenue Form 355 Es?

airSlate SignNow simplifies the process of submitting the Massachusetts Department Of Revenue Form 355 Es by allowing you to eSign and send documents securely. Our platform ensures that your submissions are timely and compliant with state regulations. This efficiency can save you time and reduce the risk of errors.

-

Is airSlate SignNow cost-effective for managing the Massachusetts Department Of Revenue Form 355 Es?

Yes, airSlate SignNow offers a cost-effective solution for managing the Massachusetts Department Of Revenue Form 355 Es. Our pricing plans are designed to cater to businesses of all sizes, ensuring that you have access to essential features without breaking the bank. This affordability makes it easier to stay compliant with tax regulations.

-

What features does airSlate SignNow provide for handling tax documents like Form 355 Es?

airSlate SignNow offers several features for handling tax documents, including secure eSigning, document tracking, and automated workflows. These features help streamline the process of preparing and submitting the Massachusetts Department Of Revenue Form 355 Es. Efficient management of documents can enhance your overall productivity.

-

Are there integrations with accounting software for the Massachusetts Department Of Revenue Form 355 Es?

airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage the Massachusetts Department Of Revenue Form 355 Es. These integrations simplify data transfer and improve workflow efficiency. With interconnected systems, you can have a more unified approach to handling your tax responsibilities.

-

Can airSlate SignNow ensure the security of my Massachusetts Department Of Revenue Form 355 Es?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Massachusetts Department Of Revenue Form 355 Es. We employ state-of-the-art encryption and security protocols to protect sensitive information during the signing and submission process. You can trust that your data is safe with us.

-

How does airSlate SignNow improve the efficiency of submitting the Massachusetts Department Of Revenue Form 355 Es?

airSlate SignNow streamlines the submission process for the Massachusetts Department Of Revenue Form 355 Es by reducing manual tasks and eliminating paperwork. With features like templates and automated reminders, you can manage your tax forms efficiently. This increased efficiency can lead to timely submissions and reduce stress during tax season.

Get more for Massachusetts Department Of Revenue Form 355 Es

- Publix vendor application form

- Form 706 see rule 74 applicant for the enrolment as a sales tax

- Current event sheet 245560044 form

- Nys rabies exemption form

- Axis bank signature verification form

- Hong leong increase credit limit form

- How agri produce marketing works in indian mandies form

- Fundraising event planning template form

Find out other Massachusetts Department Of Revenue Form 355 Es

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal