Amended PA Fiduciary Income Tax Schedule PA 41X 2019

What is the Amended PA Fiduciary Income Tax Schedule PA 41X

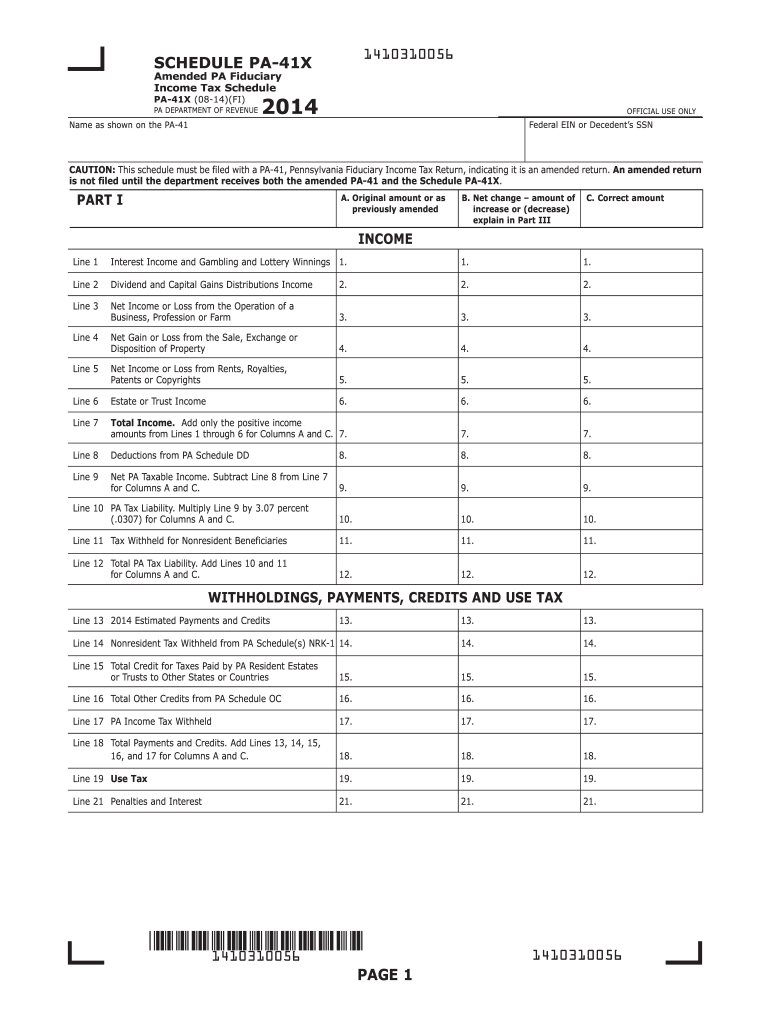

The Amended PA Fiduciary Income Tax Schedule PA 41X is a specific form used by fiduciaries to report changes to previously filed Pennsylvania fiduciary income tax returns. This form allows estates and trusts to amend their tax filings when errors or omissions are discovered after the original submission. It ensures that the correct tax liability is reported and any necessary adjustments are made to comply with state tax regulations.

How to use the Amended PA Fiduciary Income Tax Schedule PA 41X

Using the Amended PA Fiduciary Income Tax Schedule PA 41X involves several key steps. First, gather all relevant documents, including the original tax return and any supporting documentation for the changes being made. Next, accurately complete the form by providing updated information, such as adjusted income, deductions, or credits. Finally, submit the amended form to the Pennsylvania Department of Revenue, ensuring that all required signatures are included for validation.

Steps to complete the Amended PA Fiduciary Income Tax Schedule PA 41X

Completing the Amended PA Fiduciary Income Tax Schedule PA 41X requires careful attention to detail. Follow these steps:

- Review the original tax return for any errors or omissions.

- Obtain the Amended PA Fiduciary Income Tax Schedule PA 41X form from the Pennsylvania Department of Revenue.

- Fill in the necessary information, including the fiduciary's name, address, and identification number.

- Indicate the specific changes being made and provide explanations for each amendment.

- Calculate any adjustments to tax liability based on the amended information.

- Sign and date the form, ensuring compliance with all submission requirements.

Legal use of the Amended PA Fiduciary Income Tax Schedule PA 41X

The legal use of the Amended PA Fiduciary Income Tax Schedule PA 41X is crucial for ensuring compliance with Pennsylvania tax laws. This form must be filed in accordance with the state's regulations, and any amendments should be supported by appropriate documentation. Failure to properly use this form can result in penalties or issues with tax assessments. It is important to keep records of all submitted forms and communications with the tax authorities.

Key elements of the Amended PA Fiduciary Income Tax Schedule PA 41X

Several key elements are essential to the Amended PA Fiduciary Income Tax Schedule PA 41X. These include:

- Identification information for the fiduciary and the estate or trust.

- Details of the original return and the specific changes being made.

- Revised calculations for income, deductions, and tax liability.

- Signature of the fiduciary or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Amended PA Fiduciary Income Tax Schedule PA 41X are critical to avoid penalties. Generally, the amended form must be submitted within three years from the original filing date or within one year of the date the tax was paid, whichever is later. It is advisable to check the Pennsylvania Department of Revenue for any specific updates or changes to these deadlines.

Quick guide on how to complete 2014 amended pa fiduciary income tax schedule pa 41x

Easily Create Amended PA Fiduciary Income Tax Schedule PA 41X on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly without any holdups. Manage Amended PA Fiduciary Income Tax Schedule PA 41X on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign Amended PA Fiduciary Income Tax Schedule PA 41X Effortlessly

- Find Amended PA Fiduciary Income Tax Schedule PA 41X and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight signNow sections of the documents or obscure confidential information with tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget the hassle of losing or misplacing documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Amended PA Fiduciary Income Tax Schedule PA 41X and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 amended pa fiduciary income tax schedule pa 41x

Create this form in 5 minutes!

How to create an eSignature for the 2014 amended pa fiduciary income tax schedule pa 41x

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Amended PA Fiduciary Income Tax Schedule PA 41X used for?

The Amended PA Fiduciary Income Tax Schedule PA 41X is used by estates and trusts to amend previously filed Pennsylvania fiduciary income tax returns. It allows for corrections to be made to income, deductions, or credits that were reported inaccurately. Using the schedule ensures compliance with state tax regulations and can help in receiving refunds for overpaid taxes.

-

How can airSlate SignNow facilitate the filing of the Amended PA Fiduciary Income Tax Schedule PA 41X?

airSlate SignNow makes it easy to electronically sign and send the Amended PA Fiduciary Income Tax Schedule PA 41X. With its user-friendly platform, you can upload your documents, eSign them, and share them securely with tax professionals or stakeholders. This streamlines the process and reduces the risk of errors or miscommunication.

-

Are there any associated costs for using airSlate SignNow to handle the Amended PA Fiduciary Income Tax Schedule PA 41X?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The pricing is competitive, considering the comprehensive features provided, including the ability to manage the Amended PA Fiduciary Income Tax Schedule PA 41X efficiently. You can choose a plan that fits your budget while benefiting from a seamless document management experience.

-

Can I integrate airSlate SignNow with other accounting software when filing the Amended PA Fiduciary Income Tax Schedule PA 41X?

Absolutely! airSlate SignNow supports integration with popular accounting software solutions, allowing for a more streamlined workflow when preparing the Amended PA Fiduciary Income Tax Schedule PA 41X. By integrating your tools, you can automate data transfer and ensure that your information is consistent across all platforms.

-

What are the benefits of using airSlate SignNow for the Amended PA Fiduciary Income Tax Schedule PA 41X?

Using airSlate SignNow for the Amended PA Fiduciary Income Tax Schedule PA 41X provides signNow advantages, such as enhanced efficiency in document preparation and eSigning. The platform is designed to eliminate paperwork challenges, reduce processing time, and enhance collaboration with stakeholders throughout the tax amendment process.

-

Is it safe to send the Amended PA Fiduciary Income Tax Schedule PA 41X through airSlate SignNow?

Yes, airSlate SignNow prioritizes security when it comes to sending sensitive documents like the Amended PA Fiduciary Income Tax Schedule PA 41X. It employs robust encryption technologies to protect your data during transmission and ensures that you have the necessary controls, such as password protection and access permissions, to safeguard your information.

-

How quickly can I complete the Amended PA Fiduciary Income Tax Schedule PA 41X using airSlate SignNow?

With airSlate SignNow's streamlined features, you can complete the Amended PA Fiduciary Income Tax Schedule PA 41X in a matter of minutes. The platform enables quick document preparation, eSigning, and sharing, ensuring that you're not delayed in meeting tax deadlines. Rapid completion helps in expediting potential refunds or avoiding penalties.

Get more for Amended PA Fiduciary Income Tax Schedule PA 41X

Find out other Amended PA Fiduciary Income Tax Schedule PA 41X

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template