Schedule C Profit and Loss Form 2020

What is the Schedule C Profit And Loss Form

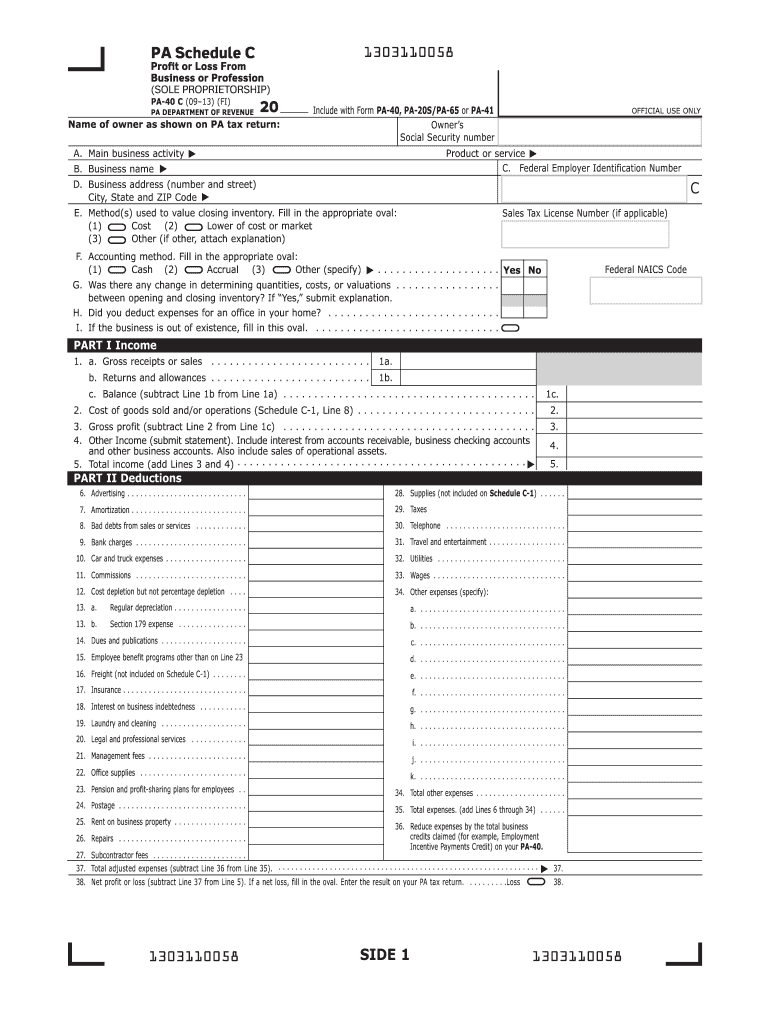

The Schedule C Profit and Loss Form is a crucial document used by self-employed individuals and sole proprietors in the United States to report income and expenses related to their business activities. This form is filed with the IRS as part of the individual income tax return, specifically Form 1040. It allows taxpayers to detail their business earnings and deduct eligible expenses, ultimately determining the net profit or loss for the tax year. Understanding this form is essential for accurate tax reporting and compliance.

How to use the Schedule C Profit And Loss Form

Using the Schedule C Profit and Loss Form involves several steps to ensure accurate reporting of your business income and expenses. First, gather all relevant financial records, including income statements, receipts, and invoices. Next, complete the form by entering your gross income, followed by listing all allowable business expenses in their respective categories. After completing the form, calculate your net profit or loss by subtracting total expenses from gross income. Finally, attach the completed Schedule C to your Form 1040 when filing your taxes.

Steps to complete the Schedule C Profit And Loss Form

Completing the Schedule C Profit and Loss Form requires careful attention to detail. Follow these steps for accurate completion:

- Start with your business name and address at the top of the form.

- Report your gross receipts or sales in Part I.

- Deduct any returns or allowances to determine your gross income.

- In Part II, list all business expenses, categorizing them appropriately (e.g., advertising, utilities, supplies).

- Calculate your total expenses and subtract this from your gross income to find your net profit or loss.

- Sign and date the form before submission.

Legal use of the Schedule C Profit And Loss Form

The Schedule C Profit and Loss Form is legally recognized by the IRS for reporting business income and expenses. To ensure its legal validity, it must be completed accurately and submitted alongside your Form 1040. Digital signatures are accepted, provided they comply with eSignature regulations. It's vital to maintain accurate records to support the information reported on the form, as discrepancies can lead to audits or penalties.

Key elements of the Schedule C Profit And Loss Form

Several key elements are essential to the Schedule C Profit and Loss Form:

- Gross Income: Total income generated from business activities.

- Business Expenses: Costs incurred in the operation of the business, which can be deducted from gross income.

- Net Profit or Loss: The difference between gross income and total expenses, indicating the financial performance of the business.

- Signature: Required to validate the form upon submission.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Profit and Loss Form align with the individual income tax return deadlines. Typically, the deadline for filing Form 1040, along with Schedule C, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also file for an extension, which allows additional time to submit their forms, but any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule c profit and loss 2013 form

Effortlessly Prepare Schedule C Profit And Loss Form on Any Gadget

Web-based document organization has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule C Profit And Loss Form on any gadget using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

The easiest method to modify and electronically sign Schedule C Profit And Loss Form with ease

- Locate Schedule C Profit And Loss Form and select Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule C Profit And Loss Form to guarantee excellent communication at every step of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule c profit and loss 2013 form

Create this form in 5 minutes!

How to create an eSignature for the schedule c profit and loss 2013 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Schedule C Profit And Loss Form used for?

The Schedule C Profit And Loss Form is used by sole proprietors to report income and expenses from their business. This form helps determine net profit or loss, which is essential for tax filing. Using airSlate SignNow, you can easily generate and eSign this form to streamline your tax preparation.

-

How can airSlate SignNow help with the Schedule C Profit And Loss Form?

AirSlate SignNow allows users to create, edit, and eSign the Schedule C Profit And Loss Form quickly and efficiently. With templates available, you save time when preparing critical documents. Plus, our platform ensures your documents are legally binding and secure.

-

Are there any costs associated with using airSlate SignNow for the Schedule C Profit And Loss Form?

AirSlate SignNow offers flexible pricing plans to cater to different business needs. The cost-effective solution allows you to manage and eSign your Schedule C Profit And Loss Form without breaking the bank. Check our pricing page for detailed information on subscription options.

-

Can I integrate airSlate SignNow with other software for managing my Schedule C Profit And Loss Form?

Yes, airSlate SignNow seamlessly integrates with popular software solutions like Google Drive, Salesforce, and Zapier. This allows you to easily sync your Schedule C Profit And Loss Form and other documents across platforms. Enhancing your workflow has never been easier.

-

What security measures does airSlate SignNow have for my Schedule C Profit And Loss Form?

AirSlate SignNow prioritizes document security with advanced encryption and compliance with industry standards. Your Schedule C Profit And Loss Form will be safeguarded against unauthorized access. We offer features like user authentication and audit trails for added security.

-

Can I access my Schedule C Profit And Loss Form on mobile devices using airSlate SignNow?

Absolutely! AirSlate SignNow is mobile-friendly, allowing you to access and manage your Schedule C Profit And Loss Form from any device. Whether you’re on the go or at your office, you can eSign and share documents effortlessly.

-

How quickly can I get my Schedule C Profit And Loss Form signed using airSlate SignNow?

With airSlate SignNow, you can get your Schedule C Profit And Loss Form signed quickly, often in minutes. The intuitive process allows you to send documents for eSignature to multiple parties at once, enhancing efficiency and reducing turnaround time.

Get more for Schedule C Profit And Loss Form

Find out other Schedule C Profit And Loss Form

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast