Sctc 111 Form 2020

What is the Sctc 111 Form

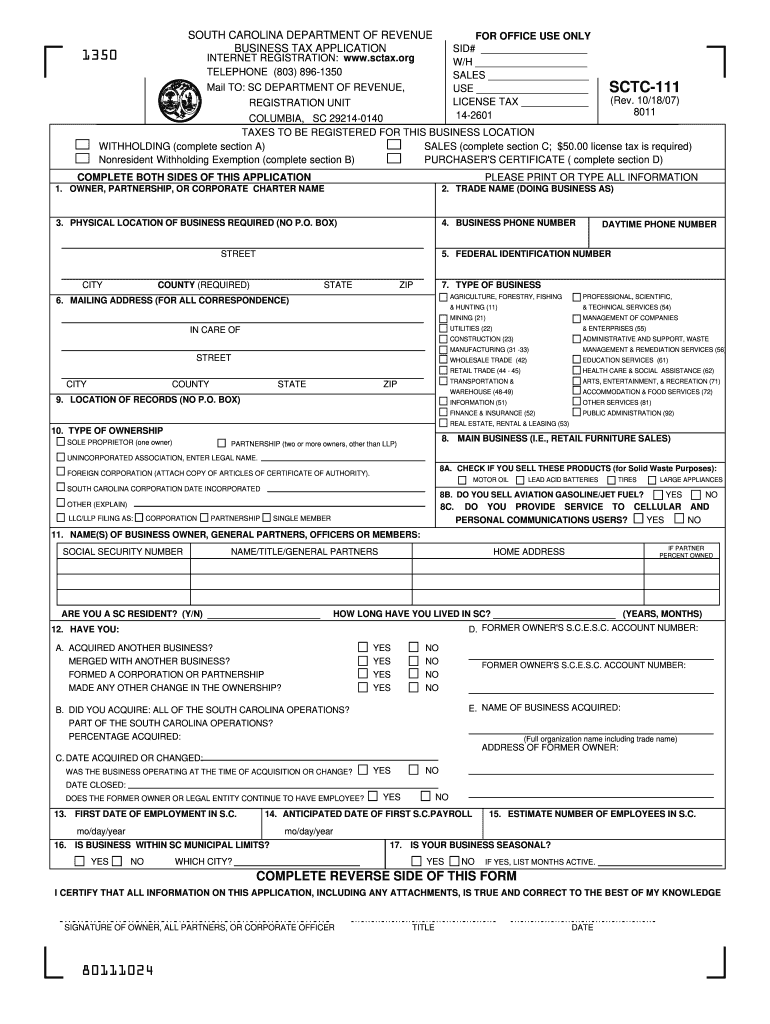

The Sctc 111 Form is a specific document used primarily in tax-related processes within the United States. This form is essential for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of the Sctc 111 Form is crucial for compliance and accurate reporting.

How to use the Sctc 111 Form

Using the Sctc 111 Form involves several key steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents and information required for the form. Next, carefully fill out each section of the form, ensuring that all details are correct. Once completed, review the form for any errors before submission. It is also important to keep a copy for your records.

Steps to complete the Sctc 111 Form

Completing the Sctc 111 Form involves a systematic approach:

- Collect all relevant financial information, including income statements and expense records.

- Fill out the form accurately, ensuring that each section is addressed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the form according to the specified submission methods.

Legal use of the Sctc 111 Form

The legal use of the Sctc 111 Form is governed by IRS regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid penalties. The information provided must be truthful and reflect actual financial data. Failure to comply with IRS guidelines can lead to legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Sctc 111 Form are crucial for compliance. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances or changes in tax law. It is advisable to check the IRS website or consult a tax professional for the most current deadlines.

Who Issues the Form

The Sctc 111 Form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides this form to facilitate the reporting of specific financial information. It is essential for taxpayers to use the correct version of the form as issued by the IRS to ensure compliance.

Quick guide on how to complete sctc 111 form 2007

Complete Sctc 111 Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Sctc 111 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Sctc 111 Form without any hassle

- Obtain Sctc 111 Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Alter and eSign Sctc 111 Form and ensure exceptional communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sctc 111 form 2007

Create this form in 5 minutes!

How to create an eSignature for the sctc 111 form 2007

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Sctc 111 Form?

The Sctc 111 Form is a specific document used for submitting claims for State Tax Credit. With airSlate SignNow, you can easily fill out and eSign this form, ensuring all required information is accurately captured and submitted.

-

How can airSlate SignNow help with the Sctc 111 Form?

airSlate SignNow streamlines the process of creating, filling, and eSigning the Sctc 111 Form. Our intuitive platform enables users to access templates, automate workflows, and securely store documents for easy retrieval.

-

Is there a cost associated with using airSlate SignNow for the Sctc 111 Form?

Yes, there is a subscription fee to use airSlate SignNow, but it is a cost-effective solution for managing documents like the Sctc 111 Form. We offer various pricing plans that suit different business needs and budgets.

-

What features does airSlate SignNow offer for dealing with the Sctc 111 Form?

AirSlate SignNow provides features such as document templates, custom branding, eSigning capabilities, and automated workflow processes specifically designed for handling the Sctc 111 Form efficiently and securely.

-

Can I track the status of my Sctc 111 Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track all activities related to your Sctc 111 Form. You can receive real-time notifications, view completion statuses, and ensure that your documents are processed timely.

-

Does airSlate SignNow integrate with other applications for the Sctc 111 Form?

Yes, airSlate SignNow offers multiple integrations with popular applications such as CRMs, cloud storage, and productivity tools. This makes it easy to incorporate the Sctc 111 Form into your existing workflows.

-

Is airSlate SignNow secure for handling the Sctc 111 Form?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and secure servers to ensure that your Sctc 111 Form and other sensitive documents are protected throughout the entire signing process.

Get more for Sctc 111 Form

- Compost activity sheet form

- Subpoena forms north carolina

- Montana department of labor and industry license renewal form

- Kotak mahindra bank salary slip form

- Air standard multi tenant office lease gross form

- Singtel authorisation letter 250148359 form

- 25 literary terms crossword puzzle answer key form

- Supervised driving log form

Find out other Sctc 111 Form

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe