Dr 133 2017

What is the DR-133?

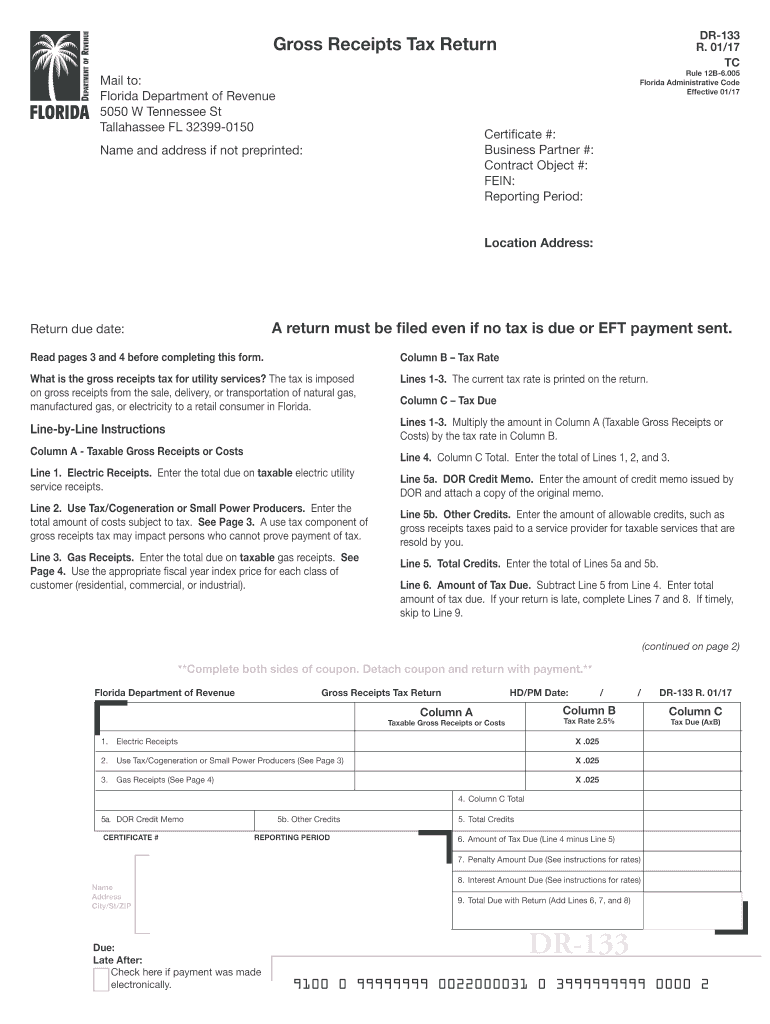

The Florida DR-133 form, also known as the Florida receipts tax return form, is a crucial document for businesses operating within the state. This form is used to report gross receipts for various business activities and is essential for compliance with Florida's tax regulations. The DR-133 is particularly relevant for businesses that are subject to the Florida gross receipts tax, which applies to specific industries and services. Understanding the purpose and requirements of this form is vital for accurate tax reporting and avoiding potential penalties.

Steps to Complete the DR-133

Completing the Florida DR-133 form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide to help you through the process:

- Gather Necessary Information: Collect all relevant financial data, including total gross receipts from the previous year.

- Fill Out the Form: Enter your business details, including name, address, and tax identification number, along with the gross receipts amount.

- Calculate Tax Liability: Determine the amount of tax owed based on the gross receipts reported.

- Review for Accuracy: Double-check all entries for correctness to avoid mistakes that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the due date.

Legal Use of the DR-133

The Florida DR-133 form holds legal significance as it is used to report and remit taxes owed to the state. To be considered legally binding, the form must be completed accurately and submitted on time. Compliance with the state’s tax laws is essential to avoid penalties. The form must be signed by an authorized representative of the business, ensuring that the information provided is truthful and complete. Adhering to these legal requirements helps maintain the integrity of your business operations.

Who Issues the Form?

The Florida Department of Revenue is responsible for issuing the DR-133 form. This state agency oversees the administration of tax laws and ensures compliance among businesses operating in Florida. The Department of Revenue provides resources and guidance for completing the form, including instructions and support for businesses seeking clarification on tax obligations. Understanding the role of this agency is important for staying informed about any updates or changes to tax regulations.

Filing Deadlines / Important Dates

Timely submission of the Florida DR-133 form is critical to avoid penalties. The filing deadlines typically align with the end of the tax year, and businesses should be aware of specific dates to ensure compliance. Generally, the form must be filed annually, but some businesses may have quarterly requirements depending on their gross receipts. Keeping track of these important dates helps maintain good standing with the Florida Department of Revenue.

Examples of Using the DR-133

The Florida DR-133 form is utilized by various types of businesses, including retail stores, service providers, and manufacturers. For instance, a small retail shop would report its total gross receipts from sales on the form, while a service-based business, such as a consulting firm, would report its income from client services. Understanding how different business types use the DR-133 can help ensure accurate reporting and compliance with state tax laws.

Quick guide on how to complete dr 133

Complete Dr 133 effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Handle Dr 133 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Dr 133 without hassle

- Find Dr 133 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or a shared link, or download it to your computer.

Forget about missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Dr 133 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 133

Create this form in 5 minutes!

How to create an eSignature for the dr 133

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What are FL receipts tax printable and how can I use them?

FL receipts tax printable are official documents you can generate for tax purposes in Florida. You can easily create and print these receipts using airSlate SignNow’s eSigning platform, ensuring compliance and accuracy in your tax documents.

-

How does airSlate SignNow help with FL receipts tax printable?

airSlate SignNow streamlines the process of generating FL receipts tax printable by providing customizable templates. This service offers an intuitive interface for quick setup and signing, making it easier to manage your tax documentation.

-

Is there a cost associated with using airSlate SignNow for FL receipts tax printable?

Yes, airSlate SignNow offers various pricing plans to cater to different business sizes and needs. You can select the plan that best suits your requirements for generating FL receipts tax printable and enjoy cost-effective solutions.

-

Can I integrate airSlate SignNow with other software for FL receipts tax printable?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enabling you to streamline your workflow. This integration allows you to easily manage your FL receipts tax printable alongside other business documents.

-

What features does airSlate SignNow offer for creating FL receipts tax printable?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and secure document storage specifically for FL receipts tax printable. These features enhance the efficiency and reliability of your tax documentation.

-

Are FL receipts tax printable secure when using airSlate SignNow?

Yes, FL receipts tax printable generated through airSlate SignNow are secure. The platform employs advanced encryption and compliance measures to ensure your sensitive tax information is protected throughout the signing process.

-

How can I ensure my FL receipts tax printable meet Florida tax regulations?

Using airSlate SignNow’s customizable templates is a great way to ensure your FL receipts tax printable comply with state regulations. The platform stays up-to-date with tax laws and offers guidance to help you generate compliant documents effortlessly.

Get more for Dr 133

- Owners representative contract template form

- Last will and testament louisiana form

- Nycha forms download

- Aeroflow breast pump prescription form

- Approval form template word

- Flipkart bill pdf form

- Declaration re notice temporary restraining order l 0889 occourts form

- This form can be submitted online at www

Find out other Dr 133

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements