DR 133 Florida Department of Revenue 2023-2026

What is the DR 133 Florida Department Of Revenue

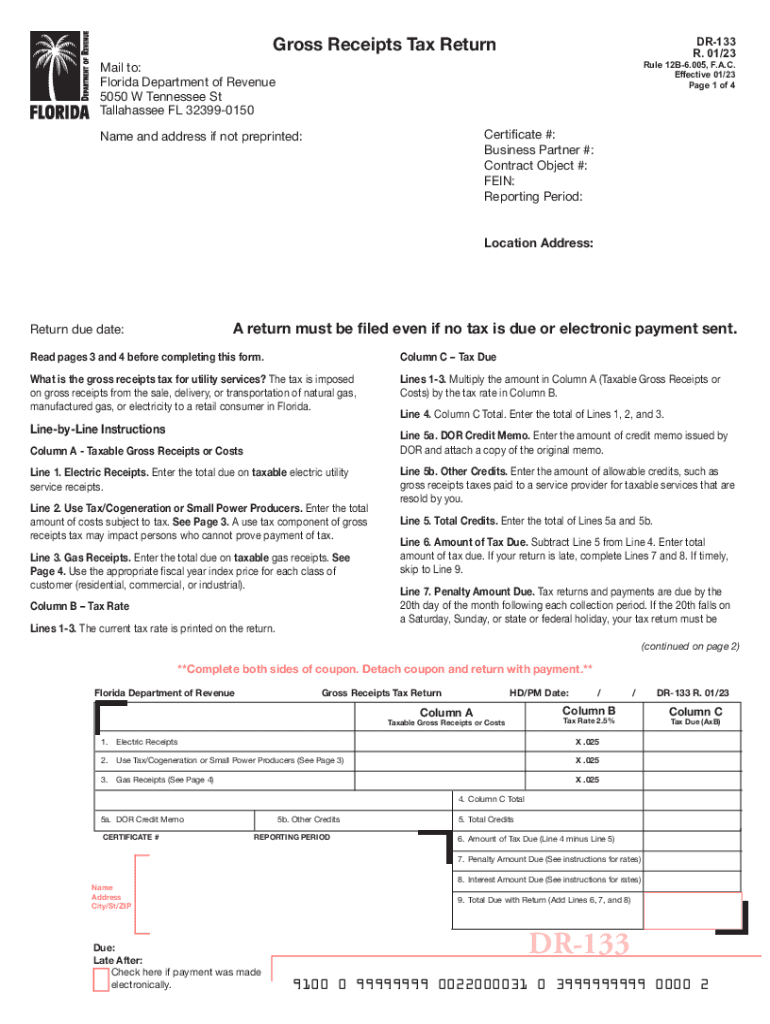

The DR 133 form is a crucial document issued by the Florida Department of Revenue. It is specifically designed for reporting gross receipts tax, which applies to businesses operating within the state. This form plays a vital role in ensuring compliance with state tax regulations, allowing businesses to accurately report their gross receipts and remit the appropriate tax amount. Understanding the purpose and requirements of the DR 133 is essential for any business owner in Florida.

Steps to complete the DR 133 Florida Department Of Revenue

Completing the DR 133 form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records, including sales receipts and revenue reports.

- Calculate your total gross receipts for the reporting period.

- Fill out the DR 133 form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online or via mail, depending on your preference.

Legal use of the DR 133 Florida Department Of Revenue

The legal use of the DR 133 form is governed by Florida state tax laws. It is essential for businesses to use this form correctly to avoid penalties or legal issues. The form must be completed accurately and submitted by the designated deadlines to maintain compliance. Additionally, businesses should retain copies of submitted forms for their records, as they may be required for audits or other legal inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the DR 133 form are critical for compliance. Businesses must be aware of the specific dates for submission to avoid late fees or penalties. Typically, the form is due on a quarterly basis, but it is advisable to check the Florida Department of Revenue's official guidelines for any updates or changes in the schedule. Marking these important dates on your calendar can help ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The DR 133 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to file electronically through the Florida Department of Revenue's online portal, which offers a streamlined process.

- Mail: Completed forms can be printed and mailed to the appropriate address provided by the Florida Department of Revenue.

- In-Person: Businesses may also choose to deliver the form in person at designated Department of Revenue offices.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the DR 133 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand the implications of non-compliance and to take proactive steps to ensure timely and accurate filing of the form. Regularly reviewing tax obligations can help mitigate risks associated with penalties.

Quick guide on how to complete dr 133 florida department of revenue

Complete DR 133 Florida Department Of Revenue effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your files swiftly without delays. Handle DR 133 Florida Department Of Revenue on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign DR 133 Florida Department Of Revenue with ease

- Obtain DR 133 Florida Department Of Revenue and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign DR 133 Florida Department Of Revenue while ensuring exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 133 florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dr 133 florida department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida receipts tax and how does it affect my business?

The Florida receipts tax is a tax imposed on the sale of goods and services in Florida. It affects businesses by requiring them to collect and remit this tax to the state. Understanding how to calculate and document this tax is crucial for compliance.

-

How can airSlate SignNow help with Florida receipts tax documentation?

airSlate SignNow offers an easy-to-use platform that simplifies the process of sending and eSigning documents related to Florida receipts tax. You can easily store and manage receipts, making it simpler to present proof of tax status if needed.

-

Is there a cost associated with using airSlate SignNow for managing Florida receipts tax?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. These plans include essential features for handling documentation related to Florida receipts tax, ensuring you get value for your investment.

-

Can I integrate airSlate SignNow with my accounting software to manage Florida receipts tax?

Absolutely! airSlate SignNow provides seamless integrations with popular accounting software. This allows you to automatically sync documents related to Florida receipts tax and streamline your tax reporting process.

-

What features does airSlate SignNow offer to help with compliance regarding Florida receipts tax?

airSlate SignNow includes features such as customizable templates, automatic reminders, and document tracking. These features ensure you maintain compliance with Florida receipts tax regulations and keep your documents organized.

-

Does airSlate SignNow provide support for inquiries related to Florida receipts tax?

Yes, airSlate SignNow offers customer support that can assist with questions concerning Florida receipts tax. Our team is experienced in guiding businesses through tax documentation and compliance queries.

-

How can airSlate SignNow improve my workflow for handling Florida receipts tax?

By using airSlate SignNow, you can digitize and automate your document workflow, making it more efficient for handling Florida receipts tax. This leads to faster processing times and reduced errors compared to traditional methods.

Get more for DR 133 Florida Department Of Revenue

Find out other DR 133 Florida Department Of Revenue

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy