Form DR 133 Florida Department of Revenue MyFlorida Com 2007

What is the Form DR 133 Florida Department Of Revenue MyFlorida com

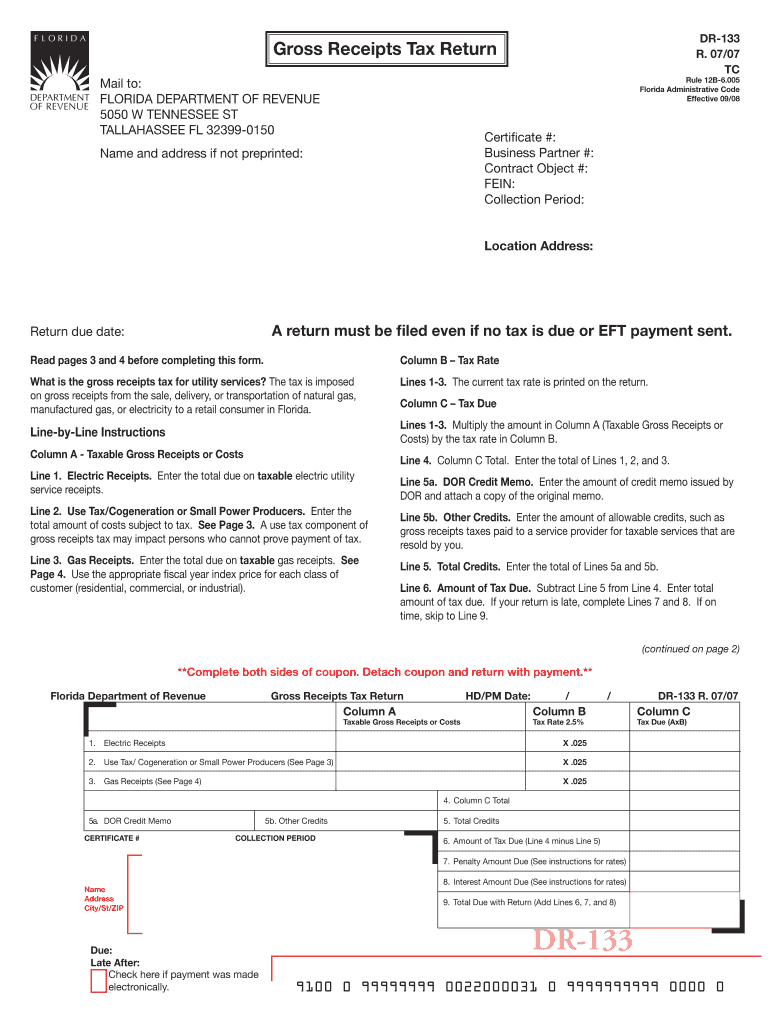

The Form DR 133 is a document issued by the Florida Department of Revenue, primarily used for tax-related purposes. This form is essential for taxpayers who need to report specific information regarding their tax obligations. It serves as a means to communicate important financial details to the state, ensuring compliance with Florida tax laws. Understanding the purpose and requirements of Form DR 133 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form DR 133 Florida Department Of Revenue MyFlorida com

Using the Form DR 133 involves several key steps to ensure that it is filled out correctly. First, gather all necessary financial documents and information that pertain to your tax situation. This includes income statements, deductions, and any relevant tax credits. Next, access the form through the Florida Department of Revenue's official website. After downloading the form, carefully fill it out, ensuring that all fields are completed accurately. Once completed, you can submit the form according to the guidelines provided by the Florida Department of Revenue.

Steps to complete the Form DR 133 Florida Department Of Revenue MyFlorida com

Completing the Form DR 133 requires attention to detail. Here are the steps to follow:

- Review the form’s instructions to understand each section.

- Gather all required documentation, including income and deduction records.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Sign and date the form as required.

- Submit the form via the method specified in the instructions, whether online, by mail, or in person.

Legal use of the Form DR 133 Florida Department Of Revenue MyFlorida com

The legal use of Form DR 133 is governed by Florida tax regulations. This form must be completed accurately to ensure that it is considered valid by the Florida Department of Revenue. It is essential to adhere to all guidelines and requirements outlined in the form’s instructions. Failure to comply with these regulations may result in penalties or delays in processing your tax information. Therefore, understanding the legal implications of this form is vital for all taxpayers in Florida.

Key elements of the Form DR 133 Florida Department Of Revenue MyFlorida com

Key elements of the Form DR 133 include specific sections that require detailed information about the taxpayer’s financial situation. Important components typically include:

- Taxpayer identification information, such as name and address.

- Details regarding income sources and amounts.

- Applicable deductions and credits that may reduce tax liability.

- Signature and date fields to validate the submission.

Each of these elements plays a significant role in ensuring that the form is processed correctly by the Florida Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form DR 133 can be done through various methods, depending on the taxpayer’s preference and the specific requirements of the Florida Department of Revenue. The available submission methods include:

- Online: Many taxpayers opt to submit the form electronically through the Florida Department of Revenue’s website, which may offer a more efficient processing time.

- Mail: The form can also be printed and mailed to the appropriate address as indicated in the submission instructions.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local Department of Revenue office is another option.

Eligibility Criteria

Eligibility to use the Form DR 133 is generally determined by the taxpayer's specific financial situation and tax obligations. Individuals and businesses must meet certain criteria, such as residency status and income thresholds, to complete this form accurately. It is important for taxpayers to review these criteria carefully to ensure compliance with state regulations. Understanding eligibility helps prevent errors in submission and potential legal issues with the Florida Department of Revenue.

Quick guide on how to complete form dr 133 florida department of revenue myfloridacom

Manage Form DR 133 Florida Department Of Revenue MyFlorida com effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Handle Form DR 133 Florida Department Of Revenue MyFlorida com on any device with airSlate SignNow Android or iOS applications and streamline your document-driven processes today.

The simplest way to modify and eSign Form DR 133 Florida Department Of Revenue MyFlorida com without hassle

- Obtain Form DR 133 Florida Department Of Revenue MyFlorida com and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important parts of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Form DR 133 Florida Department Of Revenue MyFlorida com and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dr 133 florida department of revenue myfloridacom

Create this form in 5 minutes!

How to create an eSignature for the form dr 133 florida department of revenue myfloridacom

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form DR 133 Florida Department Of Revenue MyFlorida com?

Form DR 133 Florida Department Of Revenue MyFlorida com is a tax-related document used for various purposes by taxpayers in Florida. This form is crucial for reporting specific financial information to the Florida Department of Revenue, ensuring compliance with state tax regulations.

-

How can I fill out Form DR 133 Florida Department Of Revenue MyFlorida com?

To fill out Form DR 133 Florida Department Of Revenue MyFlorida com, you need to gather the necessary financial data and complete the form online through the MyFlorida com portal. airSlate SignNow can streamline this process, allowing you to eSign and send the completed form easily.

-

What are the benefits of using airSlate SignNow for Form DR 133 Florida Department Of Revenue MyFlorida com?

Using airSlate SignNow for Form DR 133 Florida Department Of Revenue MyFlorida com offers a cost-effective and efficient way to manage your eSigning needs. You can securely send, receive, and track your documents, ensuring a seamless experience while complying with Florida's tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form DR 133 Florida Department Of Revenue MyFlorida com?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost of using our platform for Form DR 133 Florida Department Of Revenue MyFlorida com depends on the features you select, but we provide a cost-effective solution tailored to help you manage your document workflows.

-

Can airSlate SignNow integrate with other tools for Form DR 133 Florida Department Of Revenue MyFlorida com?

Absolutely! airSlate SignNow can integrate with various popular business applications, making it easier to manage your documents associated with Form DR 133 Florida Department Of Revenue MyFlorida com. You can connect our platform with tools like Google Drive, Salesforce, and more to enhance your productivity.

-

What features does airSlate SignNow offer for Form DR 133 Florida Department Of Revenue MyFlorida com?

airSlate SignNow provides a range of features including eSigning, document templates, and secure storage for Form DR 133 Florida Department Of Revenue MyFlorida com. These features simplify document management and help ensure compliance with state regulations.

-

How can I ensure the security of my Form DR 133 Florida Department Of Revenue MyFlorida com documents?

Security is a priority at airSlate SignNow. We use advanced encryption and comply with industry standards to protect your Form DR 133 Florida Department Of Revenue MyFlorida com documents, ensuring your sensitive information remains confidential during the eSigning process.

Get more for Form DR 133 Florida Department Of Revenue MyFlorida com

Find out other Form DR 133 Florida Department Of Revenue MyFlorida com

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement