Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap AI Form

What is the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

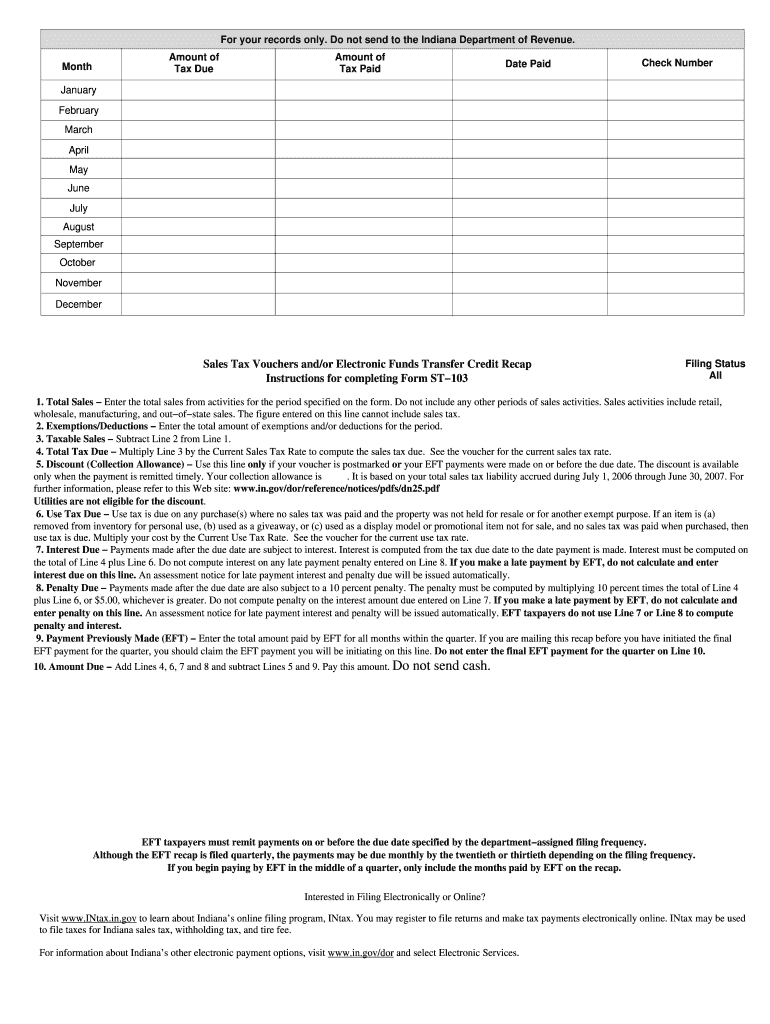

The Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form serves as a crucial document for businesses and individuals managing sales tax obligations. This form is designed to facilitate the tracking and reporting of sales tax payments made via vouchers or electronic funds transfers. It ensures that all transactions are documented accurately, providing a clear record for both the taxpayer and the tax authorities. Understanding this form is essential for maintaining compliance with state tax regulations and avoiding potential penalties.

How to use the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

Using the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form involves several straightforward steps. First, gather all necessary information regarding your sales tax payments, including transaction dates, amounts, and payment methods. Next, fill out the form accurately, ensuring that all details are correct. After completing the form, review it for any errors before submitting it electronically or via mail, depending on your preference. Utilizing digital tools can simplify this process, allowing for easier tracking and management of your submissions.

Steps to complete the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

Completing the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form involves a series of methodical steps:

- Collect all relevant sales tax payment records.

- Access the form through a secure digital platform.

- Input your business information, including name and tax identification number.

- Detail each transaction, specifying the date, amount, and method of payment.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

The legal use of the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form is governed by various federal and state regulations. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with applicable tax laws. Compliance with eSignature laws, such as the ESIGN Act and UETA, is also crucial when submitting the form electronically. These regulations provide the necessary framework to ensure that digital signatures and submissions are recognized as valid in legal contexts.

Key elements of the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

Several key elements are essential for the effective use of the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form:

- Accurate Information: Ensure all details, including payment amounts and dates, are correct.

- Signature: A valid signature, whether digital or handwritten, is necessary for legal acceptance.

- Compliance: Adhere to state-specific tax regulations and submission deadlines.

- Documentation: Keep copies of the completed form and related payment records for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai form vary by state and can significantly impact compliance. It is essential to be aware of these deadlines to avoid penalties. Typically, businesses must submit their sales tax forms on a monthly, quarterly, or annual basis, depending on their sales volume and state requirements. Keeping a calendar of these important dates can help ensure timely submissions and maintain good standing with tax authorities.

Quick guide on how to complete sales tax vouchers andor electronic funds transfer credit recap ai

Complete Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai effortlessly

- Locate Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to secure your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you choose. Modify and eSign Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax vouchers andor electronic funds transfer credit recap ai

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What are Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai are digital tools designed to streamline the process of managing sales tax payments and credits. With these features, businesses can easily track tax liabilities and process electronic transfers efficiently.

-

How does airSlate SignNow support Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

airSlate SignNow provides an intuitive platform that allows businesses to manage Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai through electronic signatures and document management. This integration simplifies the process, ensuring compliance and accuracy in sales tax handling.

-

What are the benefits of using airSlate SignNow for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

Using airSlate SignNow for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai can signNowly reduce the time spent on paperwork and increase efficiency. The platform's automation features ensure that all tax documents are accurate, reducing the risk of costly errors.

-

Is airSlate SignNow cost-effective for businesses wanting to manage Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With various pricing plans and a focus on reducing administrative burdens, it effectively supports the management of Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai.

-

What integrations does airSlate SignNow offer for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

airSlate SignNow seamlessly integrates with leading accounting software and ERP systems, making it easier to manage Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai. This ensures that all financial data is synchronized and up-to-date across your business processes.

-

How can I ensure compliance while using Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai with airSlate SignNow?

airSlate SignNow helps maintain compliance with tax regulations by providing templates and automated workflows for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai. This feature minimizes the risk of non-compliance by ensuring accurate documentation and timely submissions.

-

Can small businesses benefit from using airSlate SignNow for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai?

Absolutely, small businesses can greatly benefit from using airSlate SignNow for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai. The platform is user-friendly and tailored to meet the needs of smaller operations, enabling them to manage tax documentation efficiently.

Get more for Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

- Dialysis flow sheet example form

- Volet d 27accident de travail form

- Autobiography outline template form

- Police clearance reference form

- Volume word problems worksheets with answers pdf form

- Nm cid homeowners responsibility form los alamos county losalamosnm

- Form ny annual notice fill online printable

- Ar4p 779132792 form

Find out other Sales Tax Vouchers Andor Electronic Funds Transfer Credit Recap Ai

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service