Vermont Ptt Form 2016

What is the Vermont Ptt Form

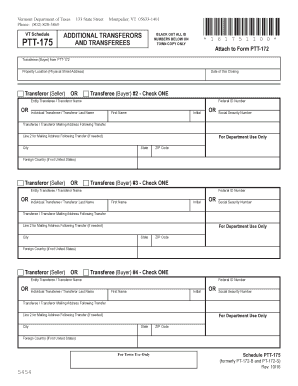

The Vermont Ptt form, specifically known as the Ptt 175, is a tax document used in the state of Vermont. This form is primarily utilized for reporting property transfer tax obligations during real estate transactions. It is essential for both buyers and sellers to understand the implications of this form, as it ensures compliance with state tax regulations and facilitates the proper transfer of property ownership.

How to use the Vermont Ptt Form

Using the Vermont Ptt 175 form involves several key steps. First, ensure that you have the correct version of the form, as there may be updates or changes from previous years. Next, gather all necessary information, including property details and the parties involved in the transaction. Fill out the form accurately, providing all required signatures. Finally, submit the completed form to the appropriate state authority, either electronically or via mail, depending on your preference and the specific requirements of the transaction.

Steps to complete the Vermont Ptt Form

Completing the Vermont Ptt 175 form requires careful attention to detail. The following steps outline the process:

- Obtain the latest version of the Ptt 175 form from the Vermont Department of Taxes website.

- Fill in the property information, including the address, type of property, and sale price.

- Provide details about the buyer and seller, including names and contact information.

- Calculate the property transfer tax based on the sale price and applicable rates.

- Sign and date the form, ensuring all parties involved have provided their signatures.

- Submit the completed form to the Vermont Department of Taxes, either online or by mail.

Legal use of the Vermont Ptt Form

The Vermont Ptt 175 form is legally binding when filled out and submitted correctly. It serves as an official record of the property transfer and ensures that all tax obligations are met. To maintain its legal standing, the form must be completed with accurate information and submitted within the required time frame. Failure to comply with these regulations may result in penalties or complications in the property transfer process.

Required Documents

When completing the Vermont Ptt 175 form, certain documents are necessary to support the information provided. These documents may include:

- Proof of identity for both the buyer and seller.

- Sales contract or agreement detailing the terms of the property transfer.

- Previous property tax statements or assessments.

- Any additional documentation required by the Vermont Department of Taxes.

Form Submission Methods (Online / Mail / In-Person)

The Vermont Ptt 175 form can be submitted through various methods, providing flexibility for users. Options include:

- Online: Submit the form electronically via the Vermont Department of Taxes website.

- By Mail: Send the completed form to the designated address provided on the form.

- In-Person: Deliver the form directly to a local tax office, if preferred.

Quick guide on how to complete vermont ptt form

Effortlessly prepare Vermont Ptt Form on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers a fantastic environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and without delays. Access Vermont Ptt Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest method to modify and electronically sign Vermont Ptt Form with ease

- Obtain Vermont Ptt Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details carefully and click on the Done button to save your changes.

- Select how you wish to share your form—via email, text (SMS), an invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Vermont Ptt Form to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct vermont ptt form

Create this form in 5 minutes!

How to create an eSignature for the vermont ptt form

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the ptt 175 feature in airSlate SignNow?

The ptt 175 feature in airSlate SignNow provides advanced signing options that enhance the efficiency of document management. With ptt 175, users can easily create, send, and track eSignatures, ensuring a seamless workflow. This feature is essential for businesses looking to streamline their document processes.

-

How much does airSlate SignNow with ptt 175 cost?

The pricing for airSlate SignNow that includes the ptt 175 feature is designed to be cost-effective for businesses of all sizes. Plans start at competitive rates, allowing you to choose a package that best fits your needs. By leveraging ptt 175, companies can save time and reduce costs associated with traditional document signing.

-

What are the key benefits of using ptt 175 in airSlate SignNow?

Using the ptt 175 feature in airSlate SignNow offers numerous benefits, including improved document turnaround times and enhanced security for eSignatures. It simplifies the signing process, making it more user-friendly, which can lead to higher completion rates. Additionally, businesses can customize their workflows to fit specific needs.

-

Does airSlate SignNow with ptt 175 integrate with other tools?

Yes, airSlate SignNow with the ptt 175 feature integrates seamlessly with a variety of third-party applications. This includes popular tools like Google Drive, Salesforce, and Microsoft Office, enabling users to create a cohesive workflow. These integrations enhance the overall utility of the ptt 175 functionality.

-

How secure is the ptt 175 feature in airSlate SignNow?

The ptt 175 feature in airSlate SignNow is built with high-level security measures to protect sensitive information during the signing process. It employs encryption technologies and complies with industry standards such as GDPR and HIPAA, ensuring data integrity. Businesses can trust that their documents are safe with ptt 175.

-

Can I track the status of documents signed with ptt 175?

Absolutely! With ptt 175 in airSlate SignNow, users have real-time tracking capabilities for their documents. This feature allows you to monitor the status of sent documents, from when they are sent to when they are signed, giving you valuable insights into your signing process.

-

Is there a mobile version of airSlate SignNow with ptt 175?

Yes, airSlate SignNow offers a mobile-friendly version that includes the ptt 175 feature, allowing users to manage their documents on the go. The mobile app is designed to provide all the essential functionalities, making it convenient for users to send and receive signed documents anywhere. This flexibility is critical for today's fast-paced business environment.

Get more for Vermont Ptt Form

Find out other Vermont Ptt Form

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online