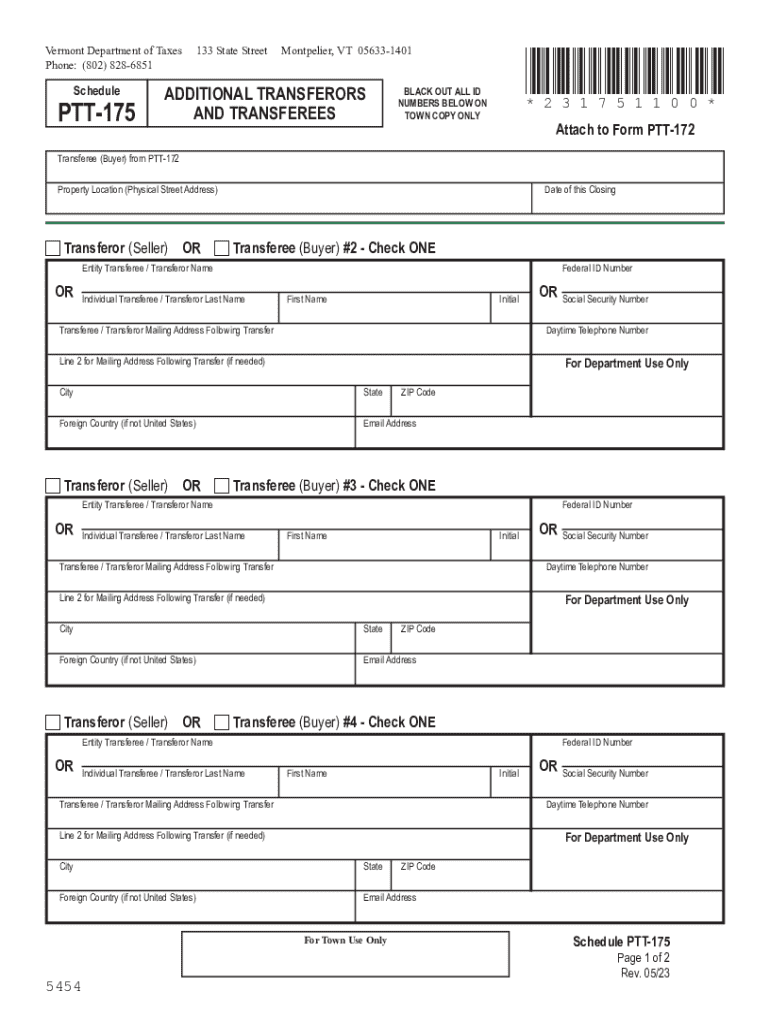

Tax Department, 133 State St, Montpelier, VT 05602, US 2023-2026

Understanding the Tax Department at 133 State St, Montpelier, VT 05602, US

The Tax Department located at 133 State St, Montpelier, VT 05602, US, is responsible for administering state tax laws and regulations. It serves as a vital resource for individuals and businesses seeking guidance on tax-related matters. This department handles various tax types, including income, sales, and property taxes, ensuring compliance with state and federal regulations. Understanding the functions of this department is essential for navigating the tax landscape in Vermont.

How to Interact with the Tax Department

Interacting with the Tax Department can be done through multiple channels. Individuals can visit the office in person, call for assistance, or utilize online resources for information and services. It is advisable to prepare necessary documents before visiting or calling to ensure a smooth experience. This department also provides forms and guidance for filing taxes, making it easier for taxpayers to comply with their obligations.

Essential Steps for Completing Tax Forms

Completing tax forms accurately is crucial for compliance and avoiding penalties. Begin by gathering all necessary documentation, including income statements, deductions, and previous tax returns. Next, follow the instructions provided with the tax forms carefully. Ensure all information is filled out completely and accurately. After completing the forms, review them for any errors before submission. The Tax Department offers guidance on common mistakes to avoid, which can be helpful during this process.

Required Documents for Tax Filing

When filing taxes with the Tax Department, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents ready can streamline the filing process and help ensure that all necessary information is included.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for timely submissions. The Tax Department typically sets specific dates for when tax returns are due, including extensions. It is important to mark these dates on your calendar to avoid late penalties. Additionally, understanding the timeline for any potential refunds can aid in financial planning.

Legal Considerations for Tax Compliance

Compliance with tax laws is not only essential for avoiding penalties but also for maintaining good standing with the state. The Tax Department enforces various regulations that taxpayers must adhere to. Understanding these legal requirements helps individuals and businesses navigate their tax obligations effectively. It is advisable to consult with tax professionals if there are uncertainties regarding compliance.

Create this form in 5 minutes or less

Find and fill out the correct tax department 133 state st montpelier vt 05602 us

Create this form in 5 minutes!

How to create an eSignature for the tax department 133 state st montpelier vt 05602 us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for the Tax Department, 133 State St, Montpelier, VT 05602, US?

airSlate SignNow provides a range of features tailored for the Tax Department, 133 State St, Montpelier, VT 05602, US, including document eSigning, templates, and automated workflows. These features streamline the signing process, making it efficient and secure. Additionally, users can track document status in real-time, ensuring that all necessary signatures are collected promptly.

-

How does airSlate SignNow ensure the security of documents for the Tax Department, 133 State St, Montpelier, VT 05602, US?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to the Tax Department, 133 State St, Montpelier, VT 05602, US. The platform employs advanced encryption methods and complies with industry standards to protect your data. Users can also set permissions and access controls to further safeguard their documents.

-

What is the pricing structure for airSlate SignNow for the Tax Department, 133 State St, Montpelier, VT 05602, US?

airSlate SignNow offers flexible pricing plans suitable for the Tax Department, 133 State St, Montpelier, VT 05602, US, including monthly and annual subscriptions. Each plan is designed to cater to different needs, ensuring that you only pay for the features you require. Additionally, a free trial is available to help you evaluate the service before committing.

-

Can airSlate SignNow integrate with other software used by the Tax Department, 133 State St, Montpelier, VT 05602, US?

Yes, airSlate SignNow seamlessly integrates with various software applications commonly used by the Tax Department, 133 State St, Montpelier, VT 05602, US. This includes popular tools like Google Drive, Salesforce, and Microsoft Office. These integrations enhance productivity by allowing users to manage documents and workflows from a single platform.

-

What benefits does airSlate SignNow provide for the Tax Department, 133 State St, Montpelier, VT 05602, US?

The primary benefits of using airSlate SignNow for the Tax Department, 133 State St, Montpelier, VT 05602, US, include increased efficiency, reduced turnaround times, and improved document management. By digitizing the signing process, your team can focus on more critical tasks while ensuring compliance and accuracy in document handling.

-

How user-friendly is airSlate SignNow for the Tax Department, 133 State St, Montpelier, VT 05602, US?

airSlate SignNow is designed with user experience in mind, making it highly user-friendly for the Tax Department, 133 State St, Montpelier, VT 05602, US. The intuitive interface allows users to navigate easily through the platform, even if they have limited technical skills. Comprehensive support resources are also available to assist users as needed.

-

Is there customer support available for airSlate SignNow users from the Tax Department, 133 State St, Montpelier, VT 05602, US?

Absolutely! airSlate SignNow offers dedicated customer support for users from the Tax Department, 133 State St, Montpelier, VT 05602, US. Support is available through various channels, including email, live chat, and phone, ensuring that you receive timely assistance whenever you need it.

Get more for Tax Department, 133 State St, Montpelier, VT 05602, US

- Services contract independent form

- Catering services contract form

- Child care or day care services contract self employed form

- Cleaning contract form

- Staff contractor form

- Computer services contract form

- Data entry employment contract self employed independent contractor form

- Shoring services contract self employed form

Find out other Tax Department, 133 State St, Montpelier, VT 05602, US

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT