Hawaii Tax Form for Renters 2018

What is the Hawaii Tax Form for Renters

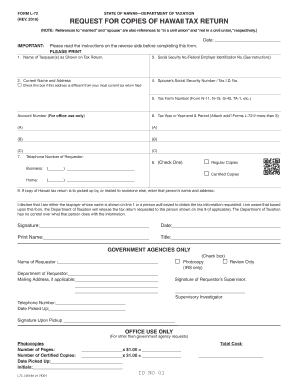

The Hawaii tax form for renters, commonly referred to as the Hawaii L-72 form, is designed to assist individuals who rent residential properties in Hawaii. This form allows renters to report their rental payments and claim any applicable tax credits or deductions. It is essential for ensuring compliance with state tax laws and for potentially reducing the overall tax burden for renters. Understanding the specifics of this form is crucial for anyone renting in the state.

How to Obtain the Hawaii Tax Form for Renters

Renters can obtain the Hawaii L-72 form through several channels. The most straightforward method is to visit the official Hawaii Department of Taxation website, where the form is available for download. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure that you have the most current version of the form to avoid any issues during submission.

Steps to Complete the Hawaii Tax Form for Renters

Completing the Hawaii L-72 form involves several key steps:

- Gather necessary documentation, such as rental agreements and payment records.

- Fill out the personal information section, including your name, address, and Social Security number.

- Detail your rental payments, specifying the amount paid and the duration of the rental period.

- Claim any applicable deductions or credits by following the instructions provided on the form.

- Review the completed form for accuracy before submission.

Legal Use of the Hawaii Tax Form for Renters

The Hawaii L-72 form is legally recognized for tax purposes, provided it is completed accurately and submitted on time. Compliance with state tax regulations is essential to avoid penalties. The form must be signed and dated by the renter, affirming that the information provided is truthful and complete. Understanding the legal implications of this form can help ensure that renters fulfill their tax obligations correctly.

Filing Deadlines / Important Dates

It is crucial for renters to be aware of the filing deadlines associated with the Hawaii L-72 form. Typically, the form must be submitted by the end of the tax filing season, which aligns with federal tax deadlines. Keeping track of these dates can help prevent late submissions and potential penalties. Additionally, renters should consider any extensions that may be available if they need more time to complete their filing.

Required Documents

When completing the Hawaii L-72 form, certain documents are necessary to support your claims. These may include:

- Rental agreements that outline the terms of your lease.

- Receipts or statements showing rental payments made during the tax year.

- Any documentation related to deductions or credits claimed on the form.

Having these documents readily available can streamline the completion process and ensure accuracy in your submission.

Quick guide on how to complete hawaii tax form for renters

Manage Hawaii Tax Form For Renters effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Hawaii Tax Form For Renters on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Hawaii Tax Form For Renters with ease

- Find Hawaii Tax Form For Renters and click on Get Form to begin.

- Use the tools we offer to fill in your document.

- Highlight important parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Modify and eSign Hawaii Tax Form For Renters and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii tax form for renters

Create this form in 5 minutes!

How to create an eSignature for the hawaii tax form for renters

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Hawaii L 72 and how does it integrate with airSlate SignNow?

Hawaii L 72 is a vital component of the airSlate SignNow platform that allows for seamless electronic signatures on documents. By utilizing this feature, users can easily manage workflows and ensure compliance while signing documents from anywhere in Hawaii. It's designed to streamline the signing process, making it an essential tool for businesses.

-

What are the pricing options for using airSlate SignNow with Hawaii L 72?

AirSlate SignNow offers competitive pricing plans that cater to different business needs, including options that specifically include Hawaii L 72 features. You can choose from monthly or yearly subscriptions, allowing you to pick a plan that fits your budget. The transparent pricing model ensures that you know exactly what you’re paying for.

-

What are the key features of Hawaii L 72 in airSlate SignNow?

Hawaii L 72 encompasses robust features such as customizable templates, advanced eSigning capabilities, and document tracking. These features not only enhance efficiency but also create a secure environment for document management. This makes Hawaii L 72 a powerful solution for businesses looking to simplify their signing processes.

-

How can Hawaii L 72 benefit my business?

Utilizing Hawaii L 72 within airSlate SignNow can signNowly reduce turnaround time on document signing, improving overall productivity. By ensuring your documents are signed electronically, you save on printing and mailing costs while increasing reliability and security. These benefits ultimately lead to a more streamlined operation.

-

Can I integrate Hawaii L 72 with other applications?

Yes, Hawaii L 72 offers extensive integration capabilities with various third-party applications such as CRM systems and cloud storage services. This flexibility allows businesses to connect their workflows seamlessly, ensuring that document signing fits into their existing processes. Users can easily streamline operations with these integrations.

-

Is Hawaii L 72 secure for handling sensitive documents?

Absolutely! Hawaii L 72 prioritizes security with advanced encryption and compliance measures such as GDPR and HIPAA. This ensures that your sensitive documents are protected from unauthorized access during the signing process. Trust in Hawaii L 72 allows businesses to handle important documents confidently.

-

How easy is it to use Hawaii L 72 for new users?

Hawaii L 72 is designed with user-friendliness in mind, making it accessible even for those who are not tech-savvy. The platform provides intuitive navigation and detailed instructions to help new users get started quickly. Training resources are also available to maximize your use of airSlate SignNow.

Get more for Hawaii Tax Form For Renters

Find out other Hawaii Tax Form For Renters

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word