Rcg 1 E Form

What is the Rcg 1 E?

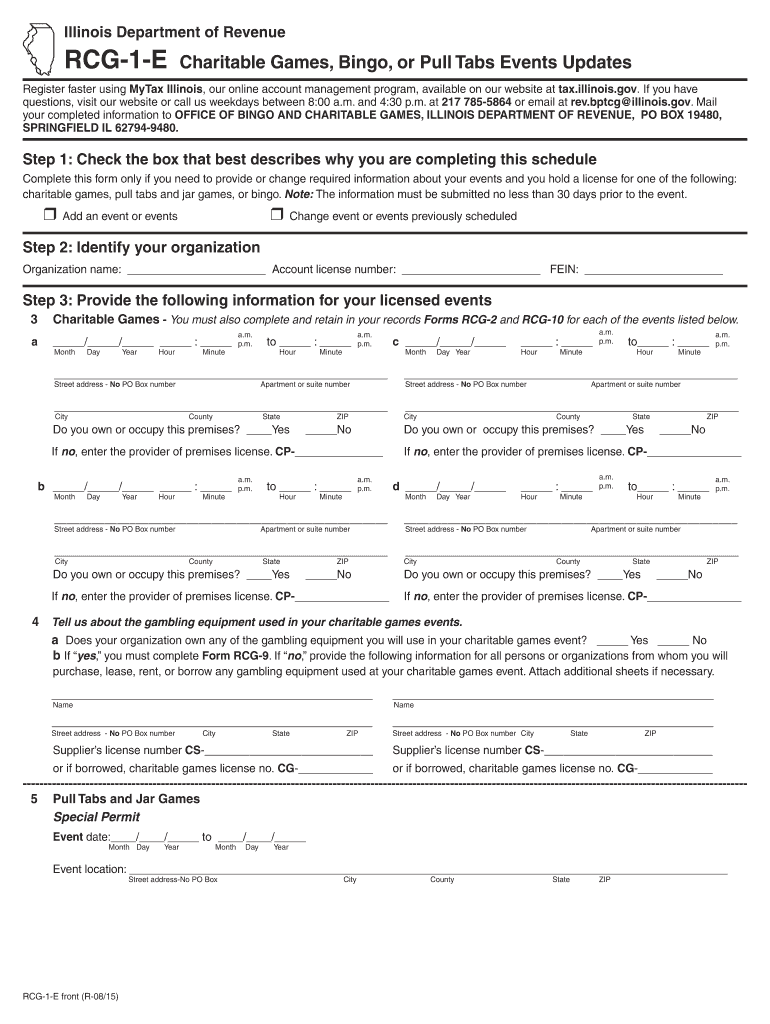

The Rcg 1 E is a specific form used in Illinois for charitable organizations to report and document their activities. This form is essential for ensuring compliance with state regulations governing charitable contributions and fundraising efforts. It captures vital information regarding the organization’s financial activities, including income, expenses, and the specific purposes for which funds are raised. Understanding the Rcg 1 E is crucial for organizations to maintain transparency and uphold public trust.

How to use the Rcg 1 E

Using the Rcg 1 E involves several steps to ensure accurate completion and submission. Organizations must first gather all necessary financial documents and records related to their charitable activities. Once the relevant information is compiled, the form can be filled out electronically or by hand. It is important to review the completed form for accuracy before submission. After filling out the Rcg 1 E, organizations must submit it to the appropriate state agency to fulfill their reporting obligations.

Steps to complete the Rcg 1 E

Completing the Rcg 1 E requires careful attention to detail to ensure compliance with state regulations. Here are the steps to follow:

- Gather financial records, including income statements and expense reports.

- Access the Rcg 1 E form online or obtain a physical copy.

- Fill in the required sections, including organization details, financial data, and purpose of funds.

- Review the form for completeness and accuracy.

- Submit the form electronically or via mail to the designated state agency.

Legal use of the Rcg 1 E

The legal use of the Rcg 1 E is governed by Illinois state law, which mandates that charitable organizations submit this form to report their financial activities. Compliance with these regulations is crucial, as failure to submit the form or providing false information can lead to penalties or loss of charitable status. Organizations must ensure that their submissions are accurate and timely to maintain their legal standing and fulfill their obligations to donors and the public.

Key elements of the Rcg 1 E

Several key elements must be included in the Rcg 1 E to ensure it meets legal requirements. These elements typically include:

- Organization name and contact information.

- Details of fundraising activities conducted during the reporting period.

- Complete financial statements, including income and expenditures.

- Information on how funds raised were utilized, including specific charitable purposes.

Required Documents

To complete the Rcg 1 E, organizations need to prepare several documents. These typically include:

- Financial statements, such as balance sheets and income statements.

- Receipts or documentation for all fundraising activities.

- Records of donations received and how they were allocated.

- Any correspondence with donors or regulatory agencies.

Quick guide on how to complete rcg 1 e

Complete Rcg 1 E effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Rcg 1 E on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Rcg 1 E with ease

- Obtain Rcg 1 E and click on Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Rcg 1 E and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rcg 1 e

How to generate an eSignature for your PDF document online

How to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is RCG charitable print and how does it work?

RCG charitable print is a specialized printing service that allows organizations to create high-quality printed materials for charitable campaigns. This service utilizes advanced printing technology to ensure vibrant colors and crisp images that attract attention. It's designed to streamline the promotional efforts of nonprofits and charities, making it easier for them to raise awareness and funds.

-

What are the pricing options for RCG charitable print?

Pricing for RCG charitable print varies based on the type of materials, sizes, and quantities ordered. Typically, you can choose from several packages that cater to different budgets and needs. It's best to contact us directly for a personalized quote that meets your specific charitable printing requirements.

-

What features does RCG charitable print offer?

RCG charitable print offers a range of features including customizable designs, various paper types, and multiple finishing options. Additionally, it supports eco-friendly printing practices to align with sustainability goals. This ensures that your printed materials not only look great but also reflect your organization's values.

-

How can RCG charitable print benefit my organization?

Utilizing RCG charitable print can signNowly enhance your organization's outsignNow efforts by providing professional and visually appealing materials. These printed items can attract potential donors and volunteers, thereby increasing engagement with your cause. Moreover, having high-quality prints can enhance your organization's credibility and professionalism.

-

Can RCG charitable print materials be integrated with other marketing tools?

Yes, RCG charitable print materials can be easily integrated with various marketing tools. This includes online platforms where you can promote your printed materials, as well as social media campaigns. The seamless integration helps ensure a unified approach to your marketing strategy, maximizing visibility for your charitable initiatives.

-

Is there a minimum order requirement for RCG charitable print?

Yes, RCG charitable print has a minimum order requirement, which ensures efficiency in production and delivery. This policy helps us maintain quality and manage costs effectively. Be sure to inquire about specific minimums for different types of print materials when you signNow out for a quote.

-

What types of charitable events can benefit from RCG charitable print?

RCG charitable print can be utilized for a wide range of events such as fundraising galas, community awareness events, and promotional campaigns. Creating flyers, banners, and brochures can enhance the visibility of your events. This tailored printing service ensures that your charitable efforts stand out and make a lasting impact.

Get more for Rcg 1 E

Find out other Rcg 1 E

- Share eSignature PDF Simple

- Share eSignature Presentation Free

- Share eSignature Presentation Secure

- Share eSignature Form iPad

- How To Share eSignature Form

- Edit eSignature PDF Simple

- Edit eSignature PDF Android

- Edit eSignature Document Online

- Edit eSignature Word Free

- Edit eSignature Document Free

- Edit eSignature Form Android

- Submit eSignature Word Mobile

- Submit eSignature Document Fast

- Submit eSignature Document Simple

- Submit eSignature Document Easy

- How To Submit eSignature Form

- Convert eSignature PDF Online

- Convert eSignature PDF Free

- Convert eSignature Word Online

- Convert eSignature Document Online