Michigan 2705 2016-2026

What is the Michigan 2705

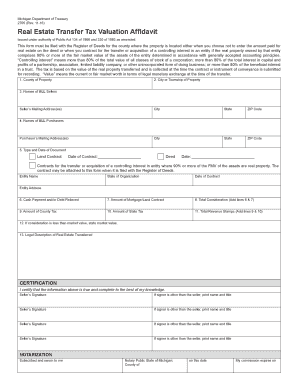

The Michigan 2705, also known as the real estate transfer tax valuation affidavit, is a crucial document required during the transfer of property ownership in Michigan. This form serves to establish the value of the property being transferred, which is essential for calculating the applicable real estate transfer tax. By accurately reporting the property's valuation, the Michigan 2705 ensures compliance with state tax regulations and helps facilitate a smooth transaction between buyers and sellers.

How to use the Michigan 2705

Using the Michigan 2705 involves several steps to ensure proper completion and submission. First, the seller or transferor must fill out the form, providing detailed information about the property, including its address, sale price, and any relevant exemptions. Once completed, the form must be signed and dated by the seller. It is important to submit the Michigan 2705 to the appropriate local government office, typically the county clerk or treasurer, at the time of the property transfer. This ensures that the transfer tax is calculated correctly and that the transaction is recorded officially.

Steps to complete the Michigan 2705

Completing the Michigan 2705 requires attention to detail. Follow these steps:

- Gather necessary information about the property, including its legal description and sale price.

- Obtain the Michigan 2705 form, which can be downloaded or requested from local government offices.

- Fill out the form accurately, ensuring all sections are completed, including any exemptions that may apply.

- Sign and date the form where indicated.

- Submit the completed form to the appropriate local office, typically along with any required fees.

Key elements of the Michigan 2705

The Michigan 2705 includes several key elements that must be accurately reported. These elements typically consist of:

- The property’s address and legal description.

- The sale price or consideration for the property.

- Information about the seller and buyer, including their names and contact details.

- Any exemptions or deductions that may apply, such as transfers between family members.

Legal use of the Michigan 2705

The Michigan 2705 is legally binding when completed accurately and submitted in accordance with state regulations. It serves as a formal declaration of the property's value, which is essential for tax assessment purposes. Failure to submit the form can result in penalties, including fines or additional taxes owed. Therefore, it is critical for all parties involved in a property transfer to understand the legal implications and ensure compliance with the requirements set forth by the Michigan Department of Treasury.

Form Submission Methods

The Michigan 2705 can be submitted through various methods, depending on local regulations. Common submission methods include:

- In-person submission at the local county clerk or treasurer’s office.

- Mailing the completed form to the appropriate office, ensuring it is sent before any deadlines.

- Some jurisdictions may offer online submission options, allowing for electronic filing of the form.

Quick guide on how to complete michigan 2705

Effortlessly Prepare Michigan 2705 on Any Device

The management of documents online has gained traction among both companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can locate the right form and securely store it online. airSlate SignNow offers all the necessary tools for you to create, modify, and eSign your documents swiftly without delays. Manage Michigan 2705 on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and eSign Michigan 2705 with Ease

- Locate Michigan 2705 and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or cover sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a traditional physical signature.

- Review the information, then click the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or errors that require new document copies to be printed. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Edit and eSign Michigan 2705 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan 2705

Create this form in 5 minutes!

How to create an eSignature for the michigan 2705

How to make an eSignature for your PDF in the online mode

How to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 4258 and how is it used?

The form 4258 is a critical document used for various business processes. It facilitates the electronic signing and management of documents, helping businesses streamline their workflows. Using airSlate SignNow, you can easily create, send, and eSign form 4258, ensuring efficient communication and compliance.

-

How does airSlate SignNow simplify the completion of form 4258?

airSlate SignNow simplifies the completion of form 4258 by offering an intuitive interface that allows users to fill out and sign documents electronically. With advanced features such as customizable templates, businesses can tailor the form 4258 to meet their specific needs. This saves time and reduces errors compared to traditional paper-based processes.

-

Is airSlate SignNow affordable for small businesses needing form 4258?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses needing form 4258. The pricing is structured to be cost-effective, allowing businesses of any size to leverage the benefits of electronic signing without breaking the bank. You can choose from different plans based on your usage requirements.

-

What are the key features of airSlate SignNow for managing form 4258?

Key features of airSlate SignNow for managing form 4258 include customizable templates, secure cloud storage, and real-time document tracking. Additionally, users can integrate with other applications to enhance functionality and streamline the signing process. These features ensure that businesses can manage their documents efficiently and securely.

-

Can I integrate form 4258 with other software using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration of form 4258 with various third-party applications. This integration enables businesses to enhance their efficiency by linking document signing processes with their existing workflows. Compatible software includes popular CRM and project management tools, making it easier to manage documents.

-

What are the benefits of using airSlate SignNow for form 4258?

The benefits of using airSlate SignNow for form 4258 include faster turnaround times, reduced paperwork, and enhanced security. The electronic signing process minimizes delays associated with physical document handling. Moreover, the platform ensures all documents are stored securely in compliance with industry regulations.

-

How does airSlate SignNow ensure the security of my form 4258?

airSlate SignNow prioritizes the security of your form 4258 with end-to-end encryption and advanced authentication measures. This guarantees that your sensitive information remains protected during the signing process. Additionally, the platform complies with industry standards to ensure that all your documents are handled securely.

Get more for Michigan 2705

- Pfa portal form

- Prospect worksheet institutional funders foundationcenter form

- Amazon disclosure and background authorization form

- Proof of service example form

- Fillable arkansas order to seal form

- 319 exit ampamp emergency lighting certificate of fitness form

- Voluntary self identification of disability form cc 305 votran

- Adva 31 attendant affidavit form

Find out other Michigan 2705

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile