Form Rural Tax 2015-2026

What is the Form Rural Tax

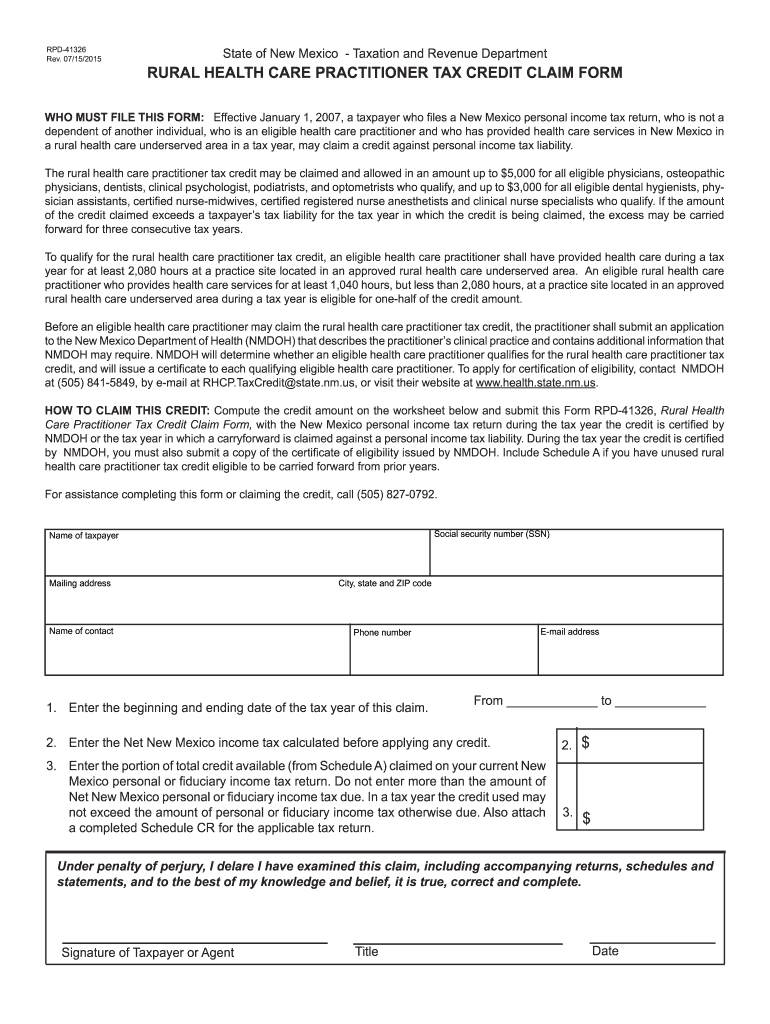

The Form Rural Tax is a specific tax document used in New Mexico to claim the rural tax credit. This credit is designed to support individuals and businesses located in rural areas, providing financial relief and promoting economic growth. It is essential for eligible taxpayers to understand the purpose and benefits of this form, as it can significantly reduce their tax liability.

Eligibility Criteria

To qualify for the rural tax credit in New Mexico, applicants must meet specific eligibility criteria. Generally, this includes being a resident of a rural area as defined by state guidelines. Taxpayers must also demonstrate that they are engaged in qualified activities that contribute to the local economy. Additionally, income limits may apply, so it is important to review the latest state regulations to ensure compliance.

Steps to Complete the Form Rural Tax

Completing the Form Rural Tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and any relevant financial records. Next, fill out the form carefully, providing all required information, such as personal details and income sources. It is crucial to double-check the form for errors before submission, as inaccuracies can lead to delays or denials of the credit.

Required Documents

When applying for the rural tax credit, certain documents are required to support your application. These typically include proof of residency in a rural area, income statements, and any additional documentation that demonstrates eligibility for the credit. Collecting these documents in advance can streamline the application process and ensure that you meet all necessary requirements.

Form Submission Methods

The Form Rural Tax can be submitted through various methods, including online, by mail, or in person. Online submission is often the most convenient option, allowing for faster processing times. If submitting by mail, ensure that you send the form to the correct address and consider using a trackable mailing option. In-person submissions may be available at designated state offices, providing an opportunity to ask questions and receive assistance with the application.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for successfully claiming the rural tax credit. Typically, forms must be submitted by a specific date each year, often coinciding with the general tax filing deadline. It is advisable to check the New Mexico taxation website or consult with a tax professional for the most current deadlines and any potential extensions that may apply.

IRS Guidelines

While the Form Rural Tax is specific to New Mexico, it is important to consider IRS guidelines that may affect your overall tax situation. Understanding how the rural tax credit interacts with federal tax obligations can help ensure compliance and optimize your tax benefits. Consulting IRS resources or a tax advisor can provide clarity on how to navigate these regulations effectively.

Quick guide on how to complete form rural tax

Handle Form Rural Tax seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage Form Rural Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Form Rural Tax effortlessly

- Find Form Rural Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced paperwork, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form Rural Tax and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rural tax

Create this form in 5 minutes!

How to create an eSignature for the form rural tax

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the nm rural tax credit?

The nm rural tax credit is a financial incentive provided by the state of New Mexico to encourage investment in rural areas. It is designed to promote economic development and support businesses in qualifying communities, helping them reduce their tax liability.

-

How can airSlate SignNow assist with the nm rural tax credit application process?

airSlate SignNow simplifies the document signing process required for the nm rural tax credit application. Our platform allows users to easily send, sign, and organize necessary forms, ensuring compliance and a smooth application process.

-

What features does airSlate SignNow offer to support nm rural tax credit claims?

airSlate SignNow offers features such as template creation, document tracking, and secure cloud storage, all of which are beneficial for managing nm rural tax credit claims. These tools help businesses streamline their documentation efforts, ensuring all necessary paperwork is timely and efficiently completed.

-

Is airSlate SignNow affordable for small businesses applying for the nm rural tax credit?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With competitive pricing plans, it provides small businesses applying for the nm rural tax credit an accessible way to manage their document signing needs without breaking the bank.

-

What benefits does electronic signing offer for nm rural tax credit-related documents?

Using electronic signatures for nm rural tax credit documents enhances security and speeds up the process. airSlate SignNow's electronic signing features ensure that all parties can sign documents quickly and securely, reducing delays in submitting important information to authorities.

-

Can airSlate SignNow integrate with other tools for handling nm rural tax credit applications?

Yes, airSlate SignNow offers integrations with various business applications that can assist in managing nm rural tax credit applications. Whether you're using accounting software or CRM systems, our platform connects smoothly with your existing workflows.

-

How does airSlate SignNow ensure compliance with nm rural tax credit regulations?

airSlate SignNow is committed to compliance with industry standards and regulations, including those related to the nm rural tax credit. Our platform regularly updates to align with legal requirements, helping businesses meet compliance obligations easily.

Get more for Form Rural Tax

- Miller and levine biology workbook answers pdf form

- Newburgh academy cross country tick sheet form

- Dartmouth coop questionnaire pdf form

- Wage statement template form

- Nurse practitioner job application form

- Background check kings recruit form

- St aloysius catholic church youth ministry permission form saintaloysiuschurch

- Code of conduct form

Find out other Form Rural Tax

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy