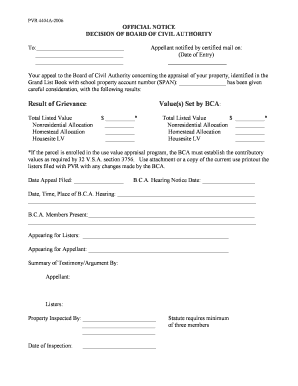

DECISION of BOARD of CIVIL AUTHORITY Tax Vermont 2006

What is the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

The DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont is a formal document issued by local governing bodies in Vermont that outlines decisions regarding property tax assessments. This form is essential for property owners who wish to appeal their property tax assessments or seek adjustments based on various factors, including property value disputes or changes in property status. The board's decision is critical as it can significantly impact the tax obligations of property owners within the jurisdiction.

Steps to complete the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

Completing the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including property tax assessments and any supporting evidence for your appeal. Next, fill out the form with the required information, ensuring all details are accurate and complete. After completing the form, submit it to the appropriate local authority, either electronically or via mail, depending on the submission methods available in your area. Keep a copy of the submitted form for your records.

Legal use of the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

The legal use of the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont is governed by state laws and regulations that dictate how property tax assessments can be challenged. This form serves as a formal record of the board's decision and is recognized in legal contexts as a valid document for property tax appeals. It is important for property owners to understand their rights and the legal implications of the decisions made by the board, as these can affect future tax liabilities and property rights.

How to obtain the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

To obtain the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont, property owners should contact their local town or city clerk's office. Many municipalities provide access to this form online, allowing individuals to download and print it directly. If the form is not available online, it can typically be requested in person or via phone. Additionally, local government websites often provide guidance on the process for appealing property tax assessments, including links to the necessary forms and instructions.

State-specific rules for the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

Each municipality in Vermont may have specific rules and procedures regarding the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont. These rules can dictate the timeline for submitting appeals, the format of required documentation, and the criteria used by the board to evaluate appeals. Property owners should familiarize themselves with their local regulations to ensure compliance and maximize their chances of a successful appeal.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont can result in various penalties. Property owners who do not adhere to submission deadlines or who provide inaccurate information may face increased tax liabilities or denial of their appeals. In some cases, non-compliance can lead to legal repercussions, making it crucial for individuals to understand and follow the guidelines set forth by their local authorities.

Quick guide on how to complete decision of board of civil authority tax vermont

Complete DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont easily on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any holdups. Manage DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont across any platform using airSlate SignNow's Android or iOS applications and streamline any document-focused tasks today.

The easiest way to edit and eSign DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont effortlessly

- Locate DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choosing. Edit and eSign DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct decision of board of civil authority tax vermont

Create this form in 5 minutes!

How to create an eSignature for the decision of board of civil authority tax vermont

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont?

The DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont refers to the determinations made by the local board regarding property tax assessments and appeals. This process gives residents the opportunity to contest their property values and seek fair tax assessments. Understanding this decision is crucial for accurate filing and tax obligations.

-

How can airSlate SignNow assist with the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont?

airSlate SignNow provides an efficient platform to manage all the documentation related to the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont. You can easily create, send, and eSign documents necessary for tax appeals, ensuring that you meet all legal requirements quickly and efficiently. This simplifies the paperwork often involved in these important decisions.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, all aimed at facilitating processes like handling the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont. Whether you are a small business or a large enterprise, there is a plan to fit your needs, allowing you to manage documents at an affordable rate without compromising on features.

-

What features does airSlate SignNow provide for tax-related documents?

airSlate SignNow offers a range of features suited for tax-related documents, including customizable templates for the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont. You can track changes, set reminders for deadlines, and manage all communications within one secure platform. These features help ensure that crucial documents are handled efficiently and effectively.

-

How does airSlate SignNow enhance collaboration during tax filings?

With airSlate SignNow, collaboration on tax filings related to the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont is made seamless. You can invite team members to review, sign, and provide feedback in real-time, facilitating a smoother working process. This feature minimizes errors and speeds up document turnaround times, which is vital during tax season.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including those related to the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont, are protected with advanced encryption methods. The platform adheres to the highest security standards, allowing you to handle sensitive information with confidence while reducing the risk of data bsignNowes.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various applications to enhance your workflow, especially for managing documents related to the DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont. Whether you use CRM systems or accounting software, these integrations help consolidate your processes and ensure that everything is interconnected, thus streamlining operations.

Get more for DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

Find out other DECISION OF BOARD OF CIVIL AUTHORITY Tax Vermont

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document