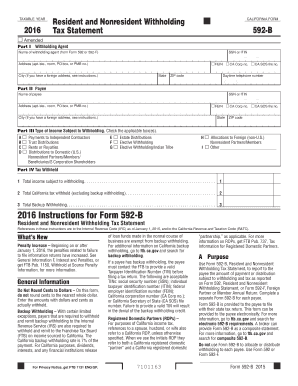

592 B Form 2020

What is the 592 B Form

The 592 B Form is a tax document used in the United States, specifically for reporting California source income paid to non-residents. This form is essential for businesses and individuals who make payments to non-residents and need to comply with California tax regulations. The information collected on this form helps the California Franchise Tax Board (FTB) track income and ensure proper tax withholding.

How to use the 592 B Form

To use the 592 B Form, payers must complete it when they make payments to non-residents for services performed in California. This includes payments for independent contractor work, rents, royalties, and other types of income. The form must be filled out accurately to reflect the amount paid and the recipient's information. Once completed, it should be submitted to the California FTB along with any required tax payments.

Steps to complete the 592 B Form

Completing the 592 B Form involves several key steps:

- Gather the necessary information about the non-resident payee, including their name, address, and taxpayer identification number (TIN).

- Indicate the type of income being reported and the total amount paid during the tax year.

- Ensure that the form is signed and dated by the payer to validate the information provided.

- Submit the completed form to the California FTB by the required deadline.

Legal use of the 592 B Form

The 592 B Form is legally binding when filled out correctly and submitted on time. It must comply with California tax laws, which include accurate reporting of payments to non-residents. Failure to use the form properly can result in penalties and interest on unpaid taxes. It is crucial to understand the legal implications of the information reported on this form to avoid any compliance issues.

Filing Deadlines / Important Dates

Filing deadlines for the 592 B Form are typically aligned with the end of the tax year. The form must be submitted to the California FTB by January 31 of the year following the payment year. It is important to be aware of these dates to ensure timely submission and avoid penalties. Keeping track of these deadlines can help maintain compliance with California tax regulations.

Required Documents

When completing the 592 B Form, certain documents may be required to support the information provided. These may include:

- Payment records showing the amounts paid to the non-resident.

- W-9 forms or other tax identification documentation from the payee.

- Any correspondence with the California FTB regarding the payments made.

Form Submission Methods (Online / Mail / In-Person)

The 592 B Form can be submitted through various methods. Payers may choose to file online through the California FTB's e-file system, which offers a convenient way to submit forms electronically. Alternatively, the form can be mailed to the appropriate address provided by the FTB. In-person submissions may also be possible at designated FTB offices, although this option may vary based on location and current regulations.

Quick guide on how to complete 2016 592 b form

Complete 592 B Form effortlessly on any device

Managing documents online has surged in popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the relevant form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 592 B Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign 592 B Form without any hassle

- Locate 592 B Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant parts of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 592 B Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 592 b form

Create this form in 5 minutes!

How to create an eSignature for the 2016 592 b form

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 592 B Form used for?

The 592 B Form is primarily used for reporting certain types of payments to the California Franchise Tax Board. It assists businesses in complying with state tax regulations by accurately reporting income paid to foreign entities.

-

How can airSlate SignNow help with the 592 B Form?

airSlate SignNow simplifies the process of completing and eSigning the 592 B Form. With its intuitive interface, you can efficiently fill out the form, obtain necessary signatures, and securely store completed documents all in one place.

-

Is there a cost associated with using airSlate SignNow for the 592 B Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides features that facilitate the smooth processing of documents, including the 592 B Form, at a cost-effective rate.

-

What features does airSlate SignNow offer for managing the 592 B Form?

airSlate SignNow provides features such as customizable templates, secure document storage, and advanced tracking capabilities for the 592 B Form. These features enable businesses to streamline their document management processes and ensure compliance.

-

Can I integrate airSlate SignNow with other software for handling the 592 B Form?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, enhancing your ability to manage the 592 B Form alongside other business applications. This interoperability helps maintain workflow continuity across systems.

-

How does eSigning the 592 B Form with airSlate SignNow ensure security?

When you use airSlate SignNow for eSigning the 592 B Form, your documents are protected with advanced encryption, ensuring that sensitive information remains confidential. This high level of security is vital for maintaining compliance with relevant regulations.

-

What benefits can businesses expect when using airSlate SignNow for the 592 B Form?

Businesses can expect increased efficiency and reduced processing times when using airSlate SignNow for the 592 B Form. The platform's easy-to-use features help eliminate paperwork hassles and improve overall productivity in managing tax-related documents.

Get more for 592 B Form

Find out other 592 B Form

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now