540x Form 2016

What is the 540x Form

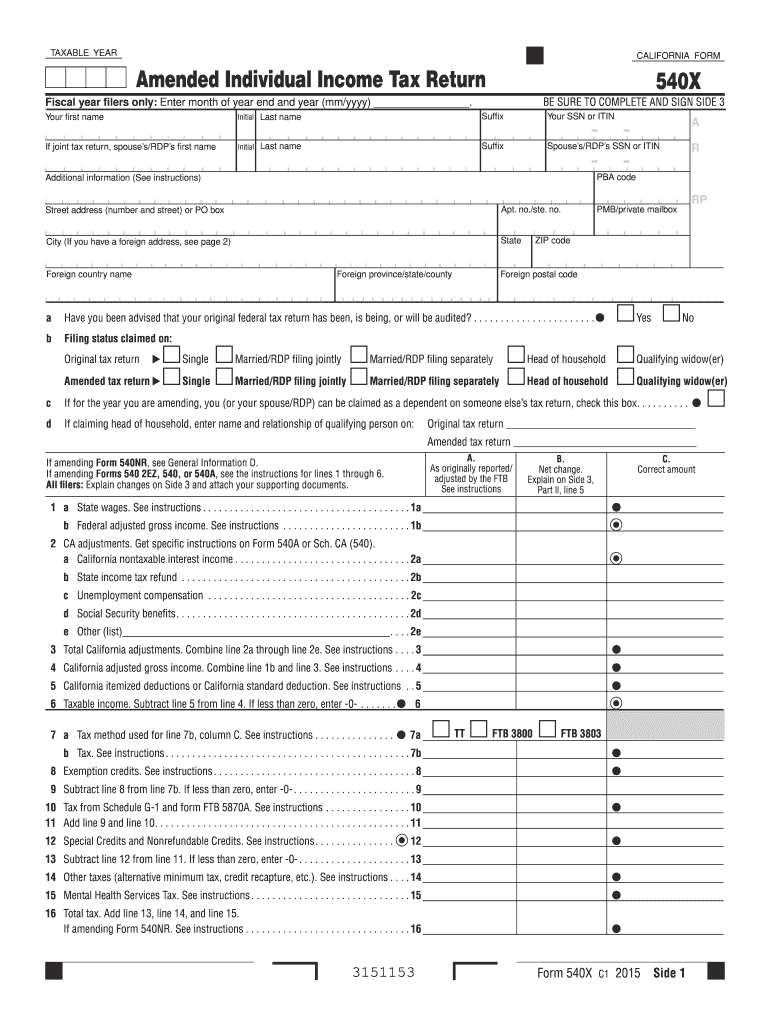

The 540x Form is a California state tax form used to amend previously filed individual income tax returns. If a taxpayer discovers an error or needs to make changes to their original 540 Form, they can use the 540x Form to correct the information. This form allows individuals to report additional income, claim deductions or credits that were missed, or make any necessary adjustments to their tax liability. It is essential for ensuring that tax records are accurate and up-to-date.

Steps to complete the 540x Form

Completing the 540x Form involves several key steps to ensure accuracy and compliance with California tax regulations. First, gather all relevant documentation, including the original 540 Form and any supporting documents related to the changes. Next, clearly indicate the reasons for the amendments in the appropriate sections of the form. It is crucial to provide detailed explanations for any changes made. After filling out the form, review it thoroughly to ensure all information is correct before submitting it. Finally, file the amended return with the California Franchise Tax Board either electronically or by mail, depending on your preference.

Legal use of the 540x Form

The 540x Form is legally recognized as a valid means to amend a previously filed California tax return. To ensure its legal standing, it must be completed accurately and submitted within the designated timeframe. Compliance with California tax laws is essential when using this form, as any discrepancies may lead to penalties or delays in processing. The form must be signed and dated by the taxpayer, and if applicable, any additional documentation supporting the amendments should be included to substantiate the changes being made.

Filing Deadlines / Important Dates

When using the 540x Form, it is important to be aware of specific filing deadlines. Generally, amended returns must be filed within six months of the original return's due date. For individuals who filed their returns on time, this means that the deadline for submitting the 540x Form is typically October 15 of the following year. However, if additional taxes are owed as a result of the amendments, it is advisable to file and pay as soon as possible to avoid interest and penalties.

Examples of using the 540x Form

There are several scenarios in which a taxpayer might need to use the 540x Form. For instance, if an individual discovers they neglected to claim a tax credit, such as the California Earned Income Tax Credit, they can file an amended return to claim that credit. Another example includes correcting income reported on the original return due to receiving a corrected W-2 or 1099 form. Each of these situations highlights the importance of the 540x Form in ensuring accurate tax reporting and compliance.

Form Submission Methods (Online / Mail / In-Person)

The 540x Form can be submitted through various methods to accommodate taxpayer preferences. For those who prefer convenience, electronic filing is available through the California Franchise Tax Board's online portal. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided by the Franchise Tax Board. In-person submissions are also an option at designated tax offices, although this method may require an appointment. Each submission method has its own processing times, so it is beneficial to choose the one that best fits individual needs.

Required Documents

When filing the 540x Form, certain documents are required to support the amendments being made. Taxpayers should include a copy of the original 540 Form, any relevant schedules, and documentation that justifies the changes, such as corrected W-2s or 1099s. Additionally, if claiming new deductions or credits, supporting documentation must be provided to verify eligibility. Ensuring that all necessary documents are included can help expedite the processing of the amended return.

Quick guide on how to complete 2015 540x form

Easily prepare 540x Form on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage 540x Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and electronically sign 540x Form effortlessly

- Locate 540x Form and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow has specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 540x Form and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 540x form

Create this form in 5 minutes!

How to create an eSignature for the 2015 540x form

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 540x Form?

The 540x Form is used to amend a previously submitted California income tax return. With airSlate SignNow, you can easily eSign and send this form securely, streamlining your tax amendment process.

-

How does airSlate SignNow help with the 540x Form?

airSlate SignNow offers an intuitive platform for sending and eSigning the 540x Form. Our easy-to-use features ensure that your amendments are completed accurately and submitted promptly, minimizing the hassle of manual paperwork.

-

Is airSlate SignNow cost-effective for filing the 540x Form?

Yes, airSlate SignNow provides a cost-effective solution for handling the 540x Form. Our pricing plans are designed to fit various business needs, allowing you to manage your document signing without breaking the bank.

-

What features does airSlate SignNow offer for handling the 540x Form?

With airSlate SignNow, you get features like eSignature integration, document storage, and real-time tracking for the 540x Form. These tools help ensure that your tax amendments are accurate and submitted on time.

-

Can I integrate airSlate SignNow with other applications for the 540x Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it easy to manage the 540x Form alongside your other business tools. This integration helps streamline the workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the 540x Form?

Using airSlate SignNow for the 540x Form comes with several benefits, including speed, security, and user-friendliness. You can complete and send your tax amendments swiftly, knowing your sensitive information is protected.

-

How secure is airSlate SignNow when handling the 540x Form?

Security is a top priority for airSlate SignNow. When working with the 540x Form, all documents are encrypted, ensuring that your personal and financial information remains confidential during the signing process.

Get more for 540x Form

Find out other 540x Form

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free